Foot Locker 2008 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2008 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.53

transactions, the significant characteristics and expected terms of a forecasted transaction must be specifically

identified, and it must be probable that each forecasted transaction would occur. If it were deemed probable that the

forecasted transaction would not occur, the gain or loss would be recognized in earnings immediately. No such gains

or losses were recognized in earnings during 2008. Derivative financial instruments qualifying for hedge accounting

must maintain a specified level of effectiveness between the hedging instrument and the item being hedged, both at

inception and throughout the hedged period, which management evaluates periodically.

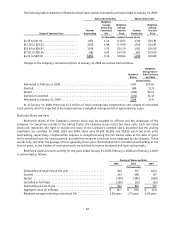

The primary currencies to which the Company is exposed are the euro, the British Pound, and the Canadian Dollar.

For option and forward foreign exchange contracts designated as cash flow hedges of the purchase of inventory, the

effective portion of gains and losses is deferred as a component of accumulated other comprehensive loss and is

recognized as a component of cost of sales when the related inventory is sold. The amount classified to cost of sales

related to such contracts was not significant in 2008. The ineffective portion of gains and losses related to cash flow

hedges recorded to earnings in 2008 was not significant. When using a forward contract as a hedging instrument,

the Company excludes the time value from the assessment of effectiveness. At each year-end, the Company had not

hedged forecasted transactions for more than the next twelve months, and the Company expects all derivative-related

amounts reported in accumulated other comprehensive loss to be reclassified to earnings within twelve months.

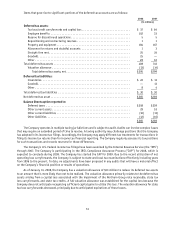

The Company has numerous investments in foreign subsidiaries, and the net assets of those subsidiaries are

exposed to foreign exchange-rate volatility. In 2005, the Company hedged a portion of its net investment in its

European subsidiaries. The Company entered into a 10-year cross currency swap, effectively creating a €100 million

long-term liability and a $122 million long-term asset. During the third quarter of 2008, the Company entered into

an offset to its European net investment hedge, fixing the amount recorded within the foreign currency translation

adjustment at $24 million, or $15 million after-tax. During the term of the amended transaction, the Company will remit

to its counterparty interest payments based on one-month U.S. LIBOR rates. In 2006, the Company hedged a portion

of its net investment in its Canadian subsidiaries. The Company entered into a 10-year cross currency swap, creating a

CAD $40 million liability and a $35 million long-term asset. During the fourth quarter of 2008, the Company terminated

this hedge and received approximately $3 million.

The Company had designated these hedging instruments as hedges of the net investments in foreign subsidiaries,

and used the spot rate method of accounting to value changes of the hedging instrument attributable to currency

rate fluctuations. As such, adjustments in the fair market value of the hedging instrument due to changes in the

spot rate were recorded in other comprehensive income and offset changes in the euro-denominated net investment.

Amounts recorded to foreign currency translation within accumulated other comprehensive loss will remain there until

the net investment is disposed of. The amount recorded within the foreign currency translation adjustment included

in accumulated other comprehensive loss on the Consolidated Balance Sheet decreased shareholders’ equity by $15

million, $20 million and $5 million net of tax at January 31, 2009, February 2, 2008 and February 3, 2007, respectively.

The effect on the Consolidated Statements of Operations related to the net investments hedges was $3 million of

expense for 2008, $1 million of income for 2007, and $3 million of income for 2006.

Derivative Holdings Designated as Non-Hedges

The Company mitigates the effect of fluctuating foreign exchange rates on the reporting of foreign currency

denominated earnings by entering into a variety of derivative instruments including option currency contracts.

Changes in the fair value of these foreign currency option contracts, which are designated as non-hedges, are recorded

in earnings immediately. The realized gains, premiums paid and changes in the fair market value recorded in the

Consolidated Statements of Operations was $4 million of income for the year ended January 31, 2009 and was not

significant for the years ended February 2, 2008 and February 3, 2007.

The Company also enters into forward foreign exchange contracts to hedge foreign-currency denominated

merchandise purchases and intercompany transactions. Net changes in the fair value of foreign exchange derivative

financial instruments designated as non-hedges were substantially offset by the changes in value of the underlying

transactions, which were recorded in selling, general and administrative expenses. The amount recorded for all the

periods presented was not significant.