Foot Locker 2008 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2008 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56

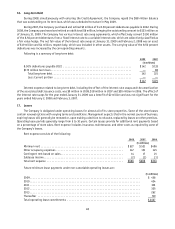

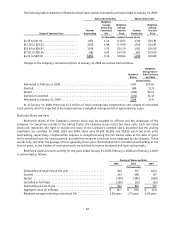

The following table provides a summary of the recognized assets and liabilities that are measured at fair value on

a recurring basis as of January 31, 2009:

(in millions) Level 1 Level 2 Level 3

Assets

Cash equivalents ........................... $307 $— $—

Short-term investment ...................... — — 23

Auction rate security ....................... — 2 —

Forward foreign exchange contracts ............ — 5 —

Interest rate swaps ......................... — 19 —

Total Assets .............................. $307 $26 $23

Liabilities

Forward foreign exchange contracts ............ $ — $ 1 $—

European net investment hedge ............... — 24 —

Total Liabilities ............................ $ — $25 $—

As of January 31, 2009, the Company had $385 million of cash and cash equivalents. Cash equivalents, excluding

amounts due from third-party credit card processors, total $307 million and their carrying values approximates their

fair value due to their short-term nature. At January 31, 2009, the Company’s auction rate security was classified as

available-for-sale, and accordingly is reported at fair value. The fair value of the security is determined by review of the

underlying security at each reporting period. The Company’s derivative financial instruments are valued using market-

based inputs to valuation models. These valuation models require a variety of inputs, including contractual terms,

market prices, yield curves, and measures of volatility.

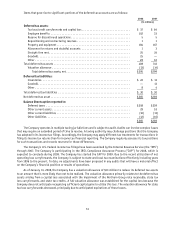

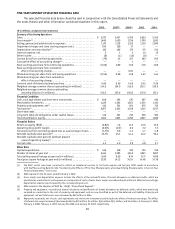

The following table is a reconciliation of financial assets and liabilities measured at fair value on a recurring basis

classified as Level 3, for the year ended January 31, 2009:

(in millions) Level 3

Balance at February 3, 2008........................................ $ 15

Total balance of Reserve International Liquidity Fund reclassified

from Level 1 to Level 3, net of redemptions received ................ 26

Total impairment charges included in the statements of operations ........ (18)

Balance at January 31, 2009 ....................................... $ 23

The Company has determined that its note receivable from the Northern Group should be classified within Level

3 of the fair value hierarchy. During the first quarter of 2008, the Company determined that the value of the Northern

Group note receivable was impaired; accordingly, a charge of $15 million was recorded reducing the fair value to zero.

This assessment was based upon management’s review of Northern Group’s financial condition.

Additionally, the Company’s Level 3 assets include an investment in a money market fund, which is classified in

short-term investments. The Company assessed the fair value of its investment in the Reserve International Liquidity

Fund, Ltd. (the “Fund”) and their underlying securities. Based on this assessment, the Company recorded an impairment

charge of $3 million, incorporating the valuation at zero for debt securities of Lehman Brothers. The Company has

reclassified its investment in shares of the Fund from Level 1 to Level 3 of the fair value hierarchy due to the inherent

subjectivity and significant judgment related to the fair value of the shares of the Fund and their underlying securities.

Changes in market conditions and the method and timing of the liquidation process of the Fund could result in further

adjustments to the fair value and classifications of this investment.