Foot Locker 2008 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2008 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

15

Income Taxes

The effective tax rate for 2008 was a benefit of 20.8 percent as compared with a benefit of 187.0 percent in the

prior year. The effective income tax rate changed primarily due to the effect of goodwill impairment, a portion of

which is not deductible for tax purposes, the prior year valuation allowance adjustment, and to a lesser extent, the mix

of U.S. and international profits.

The effective tax rate for 2007 was a benefit of 187.0 percent as compared with expense of 36.9 percent in the

prior year. The change in the rate is primarily due to the $62 million valuation allowance adjustment (net of deferred

costs) relating to Canadian tax depreciation and tax loss carryforwards, the change in the mix of U.S. and international

profits, and the impairment charges relating to the Company’s U.S. operations.

Segment Information

The Company has seven reporting units, as defined under SFAS No. 142, “Goodwill and Other Intangible Assets.”

A reporting unit is defined as an operating segment or one level below an operating segment. Although we have seven

reporting units, they have been aggregated into two operating segments for segment reporting purposes, in accordance

with SFAS No. 131, “Disclosures about Segments of an Enterprise and Related Information.”

The Company evaluates performance based on several factors, the primary financial measure of which is division

profit. Division (loss) profit reflects (loss) income from continuing operations before income taxes, corporate expense,

non-operating income, and net interest expense.

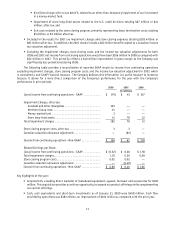

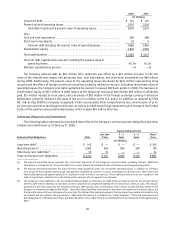

Athletic Stores

2008 2007 2006

(in millions)

Sales ............................................... $4,847 $5,071 $5,370

Division (loss) profit ................................... $ (59) $ (27) $ 405

Division (loss) profit margin ............................. (1.2)% (0.5)% 7.5%

Number of stores at year end ............................. 3,641 3,785 3,942

Selling square footage (in millions) ........................ 8.09 8.50 8.74

Gross square footage (in millions) ......................... 13.50 14.12 14.55

2008 compared with 2007

Athletic Stores sales of $4,847 million decreased 4.4 percent in 2008, as compared with $5,071 million in 2007.

Excluding the effect of foreign currency fluctuations, primarily related to the euro, sales from athletic store formats

decreased by 4.8 percent in 2008. Comparable-store sales for the Athletic Stores segment declined 3.6 percent as

compared with prior year. The decline in sales for the year ended January 31, 2009 was primarily related to the domestic

operations as the result of a decline in mall traffic and consumer spending in general. Excluding the effect of foreign

currency fluctuations, sales in Europe decreased low single digits in 2008 as compared with 2007. The sales of low

profile styles negatively affected the first three quarters of 2008. However, during the fourth quarter of 2008 sales

of higher-priced marquee footwear and apparel increased, which more than offset the sales decline related to the low

profile footwear styles.

Athletic Stores reported a loss of $59 million in 2008 as compared with a loss of $27 million in 2007 which was

primarily attributable to the U.S. operations. Included in the results for 2008 and 2007 are impairment charges and

store closing costs totaling $241 million and $128 million, respectively. Athletic Stores division loss for 2008 includes

a $167 million goodwill impairment charge, a $67 million write-down of long-lived assets such as store fixtures and

leasehold improvements for 868 stores at the Company’s U.S. store operations pursuant to SFAS No. 144, $5 million

of exit costs related to the closure of underperforming stores comprising primarily lease terminations in accordance

with SFAS No. 146, and $2 million in other intangible impairment charges related to its tradenames. The Company

performs its annual impairment test as of the beginning of each year, however due to the macroeconomic conditions

affecting retail and the significant decline in the Company’s common stock and market capitalization, plus a reasonable

control premium, in relation to the book value, the Company determined that a triggering event had occurred and,

therefore, performed an interim impairment test. The fair value of the four reporting units containing goodwill was

determined under step 1 of the goodwill impairment test based on a weighting of a discounted cash flow analysis