Foot Locker 2008 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2008 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64

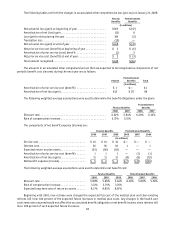

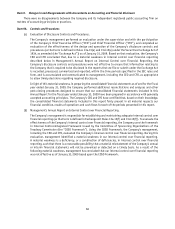

29. Quarterly Results (Unaudited)

1st Q2

nd Q3

rd Q4

th Q(a) Year(a)

(in millions, except per share amounts)

Sales

2008 ..................................... $1,309 1,302 1,309 1,317 5,237

2007...................................... 1,316 1,283 1,356 1,482 5,437

Gross margin(b)

2008 ..................................... $ 366 361 355 378 1,460

2007...................................... 360 302 381 377 1,420

Operating profit (loss)(c)

2008 ..................................... $ 16 28 33 (180)

(d) (103)

2007...................................... 27 (28) (58) 9 (d) (50)

Income (loss) from continuing operations

2008 ..................................... $ 3 18 24 (124) (79)

2007...................................... 17 (18) (34) 78

(e) 43

Net income (loss)

2008 ..................................... $ 3 18 24 (125) (80)

2007...................................... 17 (18) (33) 79 45

Basic earnings (loss) per share:

2008

Income (loss) from continuing operations ....... $ 0.02 0.11 0.16 (0.81) (0.52)

Income from discontinued operations .......... — — — — —

Net income (loss) ......................... 0.02 0.11 0.16 (0.81) (0.52)

2007

Income (loss) from continuing operations ....... $ 0.11 (0.12) (0.22) 0.51 0.29

Income from discontinued operations .......... — — — 0.01 0.01

Net income (loss) ......................... 0.11 (0.12) (0.22) 0.52 0.30

Diluted earnings (loss) per share:

2008

Income (loss) from continuing operations ....... $ 0.02 0.11 0.16 (0.81) (0.52)

Income from discontinued operations .......... — — — — —

Net income (loss) ......................... 0.02 0.11 0.16 (0.81) (0.52)

2007

Income (loss) from continuing operations ....... $ 0.11 (0.12) (0.22) 0.50 0.28

Income from discontinued operations .......... — — — 0.01 0.01

Net income (loss) ......................... 0.11 (0.12) (0.22) 0.51 0.29

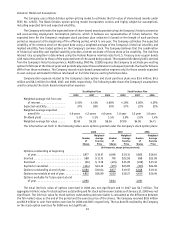

(a) The 2007 results have been corrected to reflect an immaterial revision to its fourth quarter and full year 2007 results in accordance

with Staff Accounting Bulletin 108, “Considering the Effects of Prior Year Misstatements when Quantifying Misstatements in Current Year

Financial Statements.” See note 2.

(b) Gross margin represents sales less cost of sales.

(c) Operating profit (loss) represents income (loss) from continuing operations before income taxes, interest expense, net and non-operating income.

(d) During the fourth quarter of 2008, the Company recorded $236 million in impairment charges representing $67 million of store long-

lived assets and $169 million of goodwill and other intangibles. During the fourth quarter of 2007, the Company recognized an additional

impairment charge of $22 million reflecting the continued downturn of the U.S. formats. The projected cash flows used in the third quarter

impairment analysis were significantly reduced reflecting the poor performance during the fourth quarter and the expected continued

difficult retail environment.

(e) Net income includes an income tax benefit of $62 million representing a reduction of a Canadian income tax valuation allowance primarily

related to income tax deductions that the Company now expects will be utilized.