Foot Locker 2008 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2008 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

47

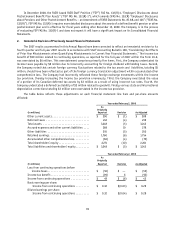

14. Accrued and Other Liabilities

2008 2007

(in millions)

Pension and postretirement benefits ......................................... $ 4 $ 4

Incentive bonuses ....................................................... 23 5

Other payroll and payroll related costs, excluding taxes ........................... 50 52

Taxes other than income taxes .............................................. 36 44

Property and equipment ................................................... 13 23

Customer deposits(1) ...................................................... 32 34

Income taxes payable ..................................................... 4 17

Current deferred tax liabilities .............................................. 10 13

Sales return reserve ...................................................... 4 4

Current portion of reserve for discontinued operations ............................ 2 14

Other operating costs ..................................................... 53 68

$231 $278

(1) Customer deposits include unredeemed gift cards and certificates, merchandise credits and, deferred revenue related to undelivered

merchandise, including layaway sales.

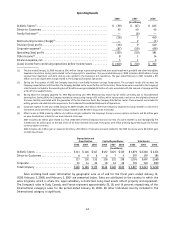

15. Revolving Credit Facility

On May 16, 2008, the Company entered into an amended credit agreement with its banks, providing for a

$175 million revolving credit facility and extending the maturity date to May 16, 2011 (the “Credit Agreement”).

The Credit Agreement also provides an incremental facility of up to $100 million under certain circumstances. The

Credit Agreement provides that the Company comply with certain financial covenants, including (i) a fixed charge

coverage ratio of 1.25:1 for the 2008 fiscal year, 1.50:1 for the 2009 fiscal year, and 1.75:1 for each year thereafter

and (ii) a minimum liquidity/excess cash flow covenant, as defined in the Credit Agreement, which provides that if at

the end of any fiscal quarter minimum liquidity is less than $350 million, the excess cash flow for the four consecutive

fiscal quarters ended on such date must be at least $25 million. The amount permitted to be paid by the Company as

dividends in any fiscal year is $105 million under the terms of the Credit Agreement. With regard to stock purchases, the

Credit Agreement provides that not more than $50 million in the aggregate may be expended unless the fixed charge

coverage ratio is at least 2.0:1 for the period of four consecutive fiscal quarters most recently ended prior to any stock

repurchase. Additionally, the Credit Agreement provides for a security interest in certain of the Company’s intellectual

property and certain other non-inventory assets.

At January 31, 2009, the Company had unused domestic lines of credit of $166 million, pursuant to its $175 million

revolving credit agreement. $9 million of the line of credit was committed to support standby letters of credit. These

letters of credit are primarily used for insurance programs.

Deferred financing fees are amortized over the life of the facility on a straight-line basis, which is comparable to

the interest method. The unamortized balance at January 31, 2009 is approximately $2.6 million. Interest is determined

at the time of borrowing based on variable rates and the Company’s fixed charge coverage ratio, as defined in the

agreement. The rates range from LIBOR plus 1.50 percent to LIBOR plus 2.50 percent. The quarterly facility fees paid

on the unused portion, which are also based in the Company’s fixed charge coverage ratio, ranged from 0.1250 percent

to 0.8750 and ranged from 0.175 percent to 0.500 percent for 2008 and 2007 respectively. There were no short-term

borrowings during 2008 or 2007. Interest expense, including facility fees, related to the revolving credit facility was

$2 million in 2008, 2007, and 2006.

On March 20, 2009, the Company entered into a new credit agreement with its banks, providing for a $200 million

revolving credit facility maturing on March 20, 2013 (the “New Credit Agreement”), which replaces the existing Credit

Agreement. The New Credit Agreement also provides an incremental facility of up to $100 million under certain

circumstances. The New Credit Agreement provides for a security interest in certain of the Company’s domestic assets,

including certain inventory assets. However, no material covenants or payment restrictions exist until the Company is

borrowing under the agreement and, in that event, the restrictions may vary depending upon the level of borrowings.