Foot Locker 2008 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2008 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

39

In December 2008, the FASB issued FASB Staff Position (“FSP”) FAS No. 132(R)-1, “Employers’ Disclosures about

Postretirement Benefit Plan Assets” (“FSP FAS No. 132(R)-1”), which amends SFAS No. 132(R) “Employers’ Disclosures

about Pensions and Other Postretirement Benefits – an Amendment of FASB Statements No. 87, 88, and 106” (“SFAS No.

132(R)”). FSP FAS No. 132(R)-1 requires more detailed disclosures about the assets of a defined benefit pension or other

postretirement plan and is effective for fiscal years ending after December 15, 2009. The Company is in the process

of evaluating FSP FAS No. 132(R)-1 and does not expect it will have a significant impact on its Consolidated Financial

Statements.

2. Immaterial Revision of Previously Issued Financial Statements

The 2007 results as presented in this Annual Report have been corrected to reflect an immaterial revision to its

fourth quarter and full year 2007 results in accordance with Staff Accounting Bulletin 108, “Considering the Effects

of Prior Year Misstatements when Quantifying Misstatements in Current Year Financial Statements.” The income tax

benefit of $99 million related to continuing operations, as reported for the full year of 2007 within the Form 10-K,

was overstated by $6 million. This overstatement comprises primarily five items. First, the Company understated its

income taxes payable by $9 million due to incorrectly accounting for foreign dividend withholding taxes. Second,

the Company noted that certain foreign currency fluctuations related to the tax assets and liabilities, totaling $5

million, should have been reflected as part of the foreign currency translation adjustment within accumulated other

comprehensive loss. The Company had incorrectly reflected these foreign exchange movements within the income

tax provision, thereby increasing the income tax provision erroneously. Third, the Company overstated the value

of a portion of its Canadian deferred tax assets by $3 million as a result of using incorrect tax rates. Fourth, the

Company understated a deferred tax liability of $2 million related to goodwill. Finally, various state and international

depreciation corrections totaling $3 million were overstated in the income tax provision.

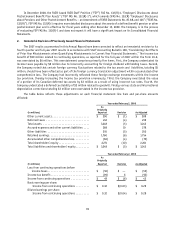

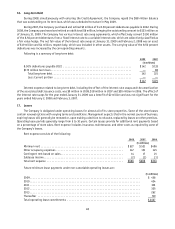

The table below reflects these adjustments on each financial statement line item and per-share amounts

affected:

Year ended February 2, 2008

(in millions)

As

Originally

Reported Revision As Adjusted

Other current assets ........................ $ 290 $ (1) $ 289

Deferred taxes ............................ 243 (4) 239

Total assets .............................. 3,248 (5) 3,243

Accrued expenses and other current liabilities .... 268 10 278

Other liabilities ........................... 255 (5) 250

Retained earnings .......................... 1,760 (6) 1,754

Accumulated other comprehensive loss .......... (66) (4) (70)

Total shareholders’ equity .................... 2,271 (10) 2,261

Total liabilities and shareholders’ equity ......... $ 3,248 $ (5) $ 3,243

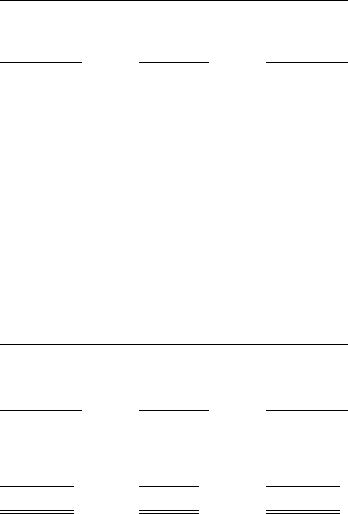

Year ended February 2, 2008

As

Originally

(in millions) Reported Revision As Adjusted

Loss from continuing operations before

income taxes ........................... $ (50) $ — $ (50)

Income tax benefit ......................... (99) 6 (93)

Income from continuing operations ............ $ 49 $ (6) $ 43

Basic earnings per share:

Income from continuing operations ......... $ 0.32 $(0.03) $ 0.29

Diluted earnings per share:

Income from continuing operations ......... $ 0.32 $(0.04) $ 0.28