Foot Locker 2008 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2008 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32

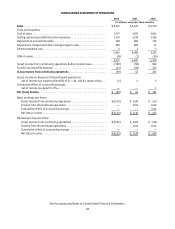

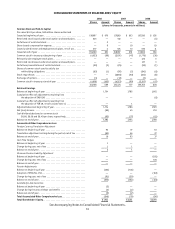

CONSOLIDATED STATEMENTS OF CASH FLOWS

2008 2007 2006

(in millions)

From Operating Activities

Net (loss) income ..................................................... $ (80) $ 45 $ 251

Adjustments to reconcile net (loss) income to net cash provided by

operating activities of continuing operations:

Discontinued operations, net of tax ..................................... (1) (2) (3)

Non-cash impairment charges and store closing program costs ................. 259 124 17

Cumulative effect of accounting change, net of tax ......................... — — (1)

Depreciation and amortization ........................................ 130 166 175

Share-based compensation expense ..................................... 9 10 10

Deferred income taxes ............................................... (44) (129) 21

Change in assets and liabilities:

Merchandise inventories ........................................... 128 55 (38)

Accounts payable and other accruals ................................. (43) (36) (103)

Qualified pension plan contributions ................................. (6) — (68)

Income taxes ................................................... (7) 14 (3)

Other, net ...................................................... 36 36 (69)

Net cash provided by operating activities of continuing operations ............... 383 283 189

From Investing Activities

Business acquisition ................................................... (106) — —

Gain from lease termination ............................................. 3 1 4

Gain from insurance recoveries ........................................... — 1 4

Reclassification of cash equivalents to short-term investments .................. (23) — —

Purchases of short-term investments ...................................... — (1,378) (1,992)

Sales of short-term investments .......................................... — 1,620 2,041

Capital expenditures ................................................... (146) (148) (165)

Proceeds from investment and note ....................................... — 21 —

Net cash (used in) provided by investing activities of continuing operations ........ (272) 117 (108)

From Financing Activities

Reduction in long-term debt ............................................. (94) (7) (86)

Repayment of capital lease .............................................. — (14) (1)

Dividends paid on common stock ......................................... (93) (77) (61)

Issuance of common stock .............................................. 2 9 9

Treasury stock reissued under employee stock plans ........................... — — 3

Purchase of treasury shares .............................................. — (50) (8)

Tax benefit on stock compensation ........................................ — 1 2

Net cash used in financing activities of continuing operations ................... (185) (138) (142)

Net Cash Used In operating activities of Discontinued Operations ............... — — (8)

Effect of Exchange Rate Fluctuations on Cash and Cash Equivalents .............. (29) 5 1

Net Change in Cash and Cash Equivalents ................................... (103) 267 (68)

Cash and Cash Equivalents at Beginning of Year .............................. 488 221 289

Cash and Cash Equivalents at End of Year ................................... $ 385 $ 488 $ 221

Cash Paid During the Year:

Interest .......................................................... $ 11 $ 18 $ 20

Income taxes ...................................................... $ 64 $ 52 $ 133

See Accompanying Notes to Consolidated Financial Statements.