Foot Locker 2008 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2008 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

63

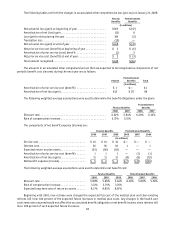

The weighted average grant-date fair value per share was $11.79, $22.95, and $24.08 for 2008, 2007, and 2006,

respectively. The total value of awards for which restrictions lapsed during the year-ended January 31, 2009, February

2, 2008, and February 3, 2007 was $2.7 million, $7.3 million and $6.7 million, respectively. As of January 31, 2009, there

was $6.5 million of total unrecognized compensation cost, related to nonvested restricted stock awards. The Company

recorded compensation expense related to restricted shares, net of forfeitures, of $5.0 million in 2008, $5.6 million in

2007 and $4.0 million in 2006.

26. Legal Proceedings

Legal proceedings pending against the Company or its consolidated subsidiaries consist of ordinary, routine

litigation, including administrative proceedings, incidental to the business of the Company, as well as litigation

incidental to the sale and disposition of businesses that have occurred in past years. These legal proceedings include

commercial, intellectual property, customer, and labor-and-employment-related claims. Certain of the Company’s

subsidiaries are defendants in a number of lawsuits filed in state and federal courts containing various class action

allegations under state wage and hour laws, including allegations concerning classification of employees as exempt or

nonexempt, unpaid overtime, meal and rest breaks, and uniforms. Management does not believe that the outcome of

such proceedings would have a material adverse effect on the Company’s consolidated financial position, liquidity, or

results of operations, taken as a whole.

27. Commitments

In connection with the sale of various businesses and assets, the Company may be obligated for certain

lease commitments transferred to third parties and pursuant to certain normal representations, warranties, or

indemnifications entered into with the purchasers of such businesses or assets. Although the maximum potential

amounts for such obligations cannot be readily determined, management believes that the resolution of such

contingencies will not have a material effect on the Company’s consolidated financial position, liquidity, or results

of operations. The Company is also operating certain stores and making rental payments for which lease agreements

are in the process of being negotiated with landlords. Although there is no contractual commitment to make these

payments, it is likely that a lease will be executed.

The Company does not have any off-balance sheet financing, other than operating leases entered into in the

normal course of business and disclosed above, or unconsolidated special purpose entities. The Company does not

participate in transactions that generate relationships with unconsolidated entities or financial partnerships,

including variable interest entities.

28. Shareholder Information and Market Prices (Unaudited)

Foot Locker, Inc. common stock is listed on The New York Stock Exchange as well as on the böerse-stuttgart stock

exchange in Germany and the Elektronische Börse Schweiz (EBS) stock exchange in Switzerland. In addition, the stock

is traded on the Cincinnati stock exchange.

As of January 31, 2009, the Company had 21,749 shareholders of record owning 154,917,700 common shares. During

2008 and 2007, the Company declared quarterly dividends of $0.15 and $0.125 per share during each of the quarters,

respectively.

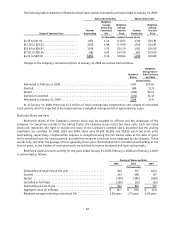

The following table sets forth, for the period indicated, the intra-day high and low sales prices for the Company’s

common stock:

2008 2007

HighLowHighLow

Common Stock

Quarter

1stQ ..................................... $13.90 $10.39 $24.78 $21.28

2ndQ .................................... 15.43 11.40 24.15 17.00

3rdQ ..................................... 18.19 10.12 17.60 13.70

4thQ. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14.79 3.65 15.14 9.05