Foot Locker 2008 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2008 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

12

• Merchandise inventories at January 31, 2009 were $1,120 million, which represents a reduction of $161 million.

Excluding the effect of foreign currency fluctuations and the additional inventory associated with our recent

acquisition, inventories declined by approximately 10 percent.

• Repaid the remaining $88 million of our outstanding balance on the 5-year term loan.

• Purchased and retired $6 million of the $200 million 8.50 percent debentures payable in 2022, bringing the

outstanding amount to $123 million as of January 31, 2009.

• Dividends totaling $93 million were declared and paid.

Looking ahead to 2009, we are focused on ensuring our balance sheet and cash position remain strong; continuing

to manage our cost structure and inventory levels aggressively; strengthening and enhancing our brands to ensure they

are relevant; and positioning our Company for long-term success.

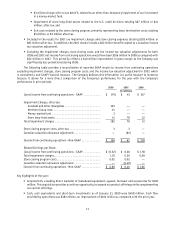

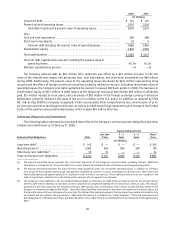

The following table represents a summary of sales and operating results, reconciled to (loss) income from

continuing operations before income taxes.

2008 2007 2006

(in millions)

Sales

Athletic Stores ............................................ $4,847 $5,071 $5,370

Direct-to-Customers ........................................ 390 364 380

Family Footwear ........................................... — 2 —

$ 5,237 $ 5,437 $ 5,750

Operating Results

Athletic Stores(1) ........................................... $ (59) $ (27) $ 405

Direct-to-Customers ........................................ 43 40 45

Family Footwear(2) .......................................... — (6) —

Division (loss) profit ........................................ (16) 7 450

Restructuring income (charge)(3) ............................... — 2 (1)

Total division (loss) profit ................................. (16) 9 449

Corporate expense ......................................... (87) (59) (68)

Total operating (loss) profit .................................. (103) (50) 381

Other income ............................................. 8 1 14

Interest expense, net ....................................... 5 1 3

(Loss) income from continuing operations before income taxes ....... $(100) $ (50) $ 392

(1) The year ended January 31, 2009 includes a $241 million charge representing long-lived store asset impairment, goodwill and other

intangibles impairment and store closing costs related to the Company’s U.S. operations. The year ended February 2, 2008 includes a $128

million charge representing impairment and store closing costs related to the Company’s U.S. operations. The year ended February 3, 2007

included a $17 million non-cash impairment charge related to the Company’s European operations.

(2) During the first quarter of 2007, the Company launched a new family footwear concept, Footquarters. The concept’s results did not meet

the Company’s expectations and, therefore, the Company decided not to invest further in this business. These stores were converted to the

Company’s other formats. Included in the operating loss of $6 million was approximately $2 million of costs associated with the removal of

signage and the write-off of unusable fixtures.

(3) During 2007, the Company adjusted its 1993 Repositioning and 1991 Restructuring reserve by $2 million primarily due to favorable lease

terminations. During 2006, the Company recorded a restructuring charge of $1 million, which represented a revision to the original estimate

of the lease liability associated with the guarantee of The San Francisco Music Box Company distribution center. These amounts are included

in selling, general and administrative expenses in the Consolidated Statements of Operations.

Sales

All references to comparable-store sales for a given period relate to sales from stores that are open at the period-

end, that have been open for more than one year, and exclude the effect of foreign currency fluctuations. Accordingly,

stores opened and closed during the period are not included. Sales from the Direct-to-Customer segment, excluding

CCS sales, are included in the calculation of comparable-store sales for all periods presented. Sales from acquired

businesses that include the purchase of inventory are included in the computation of comparable-store sales after

15 months of operations. Accordingly, CCS sales have been excluded in the computation of comparable-store sales.