Foot Locker 2008 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2008 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

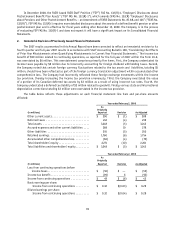

44

Sales

2008 2007 2006

(in millions)

United States ............................................... $3,768 $3,991 $4,356

International ............................................... 1,469 1,446 1,394

Total sales ................................................. $5,237 $5,437 $5,750

Long-Lived Assets

2008 2007 2006

(in millions)

United States ............................................... $ 311 $ 368 $ 504

International ............................................... 121 153 150

Total long-lived assets ........................................ $ 432 $ 521 $ 654

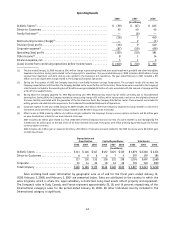

6. Other Income

Other income was $8 million, $1 million and $14 million for 2008, 2007 and 2006, respectively. Included in other

income are non-operating items, such as the effect of foreign currency option contracts, sales of lease interests and

insurance proceeds. Other income in 2008 primarily reflects a $4 million net gain related to the Company’s foreign

currency options contracts and a $3 million gain on lease terminations related to two lease interests in Europe.

In 2007, other income includes a $1 million gain related to a final settlement with the Company’s insurance carriers

of a claim related to a store damaged by fire in 2006. Additionally, the Company sold two of its lease interests in Europe

for a gain of $1 million. These gains were offset primarily by premiums paid for foreign currency option contracts.

In 2006, other income includes a gain of $8 million related to a final settlement with the Company’s insurance

carriers of claims related to Hurricane Katrina, income of $2 million related to the purchase and retirement of debt and

lease termination income of $4 million. The Company purchased and retired $38 million of its $200 million 8.50 percent

debentures payable in 2022, at a $2 million discount from face value. During 2006, the Company terminated two of its

leases and recorded a net gain of $4 million.

7. Short-Term Investments

2008 2007

(in millions)

Money market investment ............................................ $ 23 $ —

Auction rate security ............................................... — 5

$23 $ 5

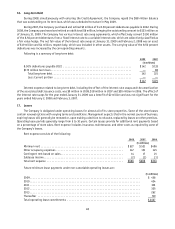

The Company has classified its remaining investment in the Reserve International Liquidity Fund as a short-

term investment as of January 31, 2009. The determination to classify the investment as short-term was based upon

a review of the underlying assets and maturities of the Fund. With the liquidity issues experienced in the global

credit and capital markets, the Company’s preferred stock auction rate security, having a face value of $7 million, has

experienced failed auctions. For the years ended January 31, 2009 and February 2, 2008, the Company determined that

a temporary impairment occurred and recorded charges of $3 million and $2 million, respectively, with no tax benefit,

to accumulated other comprehensive loss. In the second quarter of 2008, the Company determined that due to the

illiquid nature of this investment it should be classified as a non-current asset. Accordingly, the fair value of $2 million

is recorded within other assets as of January 31, 2009.

Based on the relatively small size of these investments and its ability to access cash and other short-term

investments, and expected operating cash flows, the Company does not anticipate the lack of liquidity on these

investments will affect its ability to operate its business as usual.