Foot Locker 2008 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2008 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42

Impairment of Assets and Store Closing Program

In connection with the review of goodwill and other intangibles, the Company performed a store long-lived

impairment test pursuant to SFAS No. 144 for its Foot Locker, Kids Foot Locker, and Footaction divisions. Additionally,

in accordance with the Company’s store long-lived assets policy, the Company determined that triggering events

had occurred during the fourth quarter of 2008 at its Lady Foot Locker and Champs Sports divisions. Accordingly,

the Company evaluated the long-lived assets of those operations for impairment and recorded non-cash impairment

charges of $67 million primarily to write-down long-lived assets such as store fixtures and leasehold improvements for

868 stores at the Company’s U.S. store operations.

During the year ended January 31, 2009, the Company closed 21 unproductive stores as part of the store closing

program announced in 2007. Exit costs of $5 million for the year ended January 31, 2009, comprising primarily lease

termination costs, were recognized in accordance with SFAS No. 146, “Accounting for Costs Associated with Exit or

Disposal Activities.”

During 2007, the Company concluded that triggering events had occurred at its U.S. retail store divisions,

comprising Foot Locker, Lady Foot Locker, Kids Foot Locker, Footaction, and Champs Sports. Accordingly, the Company

evaluated the long-lived assets of those operations for impairment and recorded non-cash impairment charges of

$117 million primarily to write-down long-lived assets such as store fixtures and leasehold improvements for 1,395

stores at the Company’s U.S. store operations pursuant to SFAS No. 144. The Company recorded an additional non-cash

impairment charge of $7 million in 2007 as a result of the decision to close 66 unproductive stores as part of a store

closing program. Exit costs related to 33 stores, which closed during 2007, comprising primarily lease termination costs

of $4 million, were recognized in accordance with SFAS No. 146.

Under SFAS No. 144, store closings may constitute discontinued operations if migration of customers and cash

flows are not expected. The Company has concluded that no store closings have met the criteria for discontinued

operations treatment.

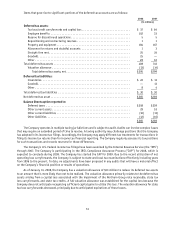

5. Segment Information

The Company has determined that its reportable segments are those that are based on its method of internal

reporting. As of January 31, 2009, the Company has two reportable segments, Athletic Stores and Direct-to-Customers.

The Company acquired CCS during the fourth quarter of 2008, the operations are presented within the Direct-to-

Customers segment. The Company also operated the Family Footwear segment, which included the retail format under

the Footquarters brand name through the second quarter of 2007. During the third quarter, the Company converted the

Footquarters stores, which were the only stores reported under the Family Footwear segment, to Foot Locker and Champs

Sports outlet stores. The Company has concluded that the Footquarters store closings are not discontinued operations

pursuant to SFAS No. 144.

The accounting policies of both segments are the same as those described in the “Summary of Significant

Accounting Policies.” The Company evaluates performance based on several factors, of which the primary financial

measure is division results. Division (loss) profit reflects (loss) income from continuing operations before income taxes,

corporate expense, non-operating income, and net interest expense.

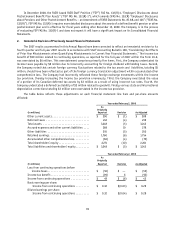

Sales

2008 2007 2006

(in millions)

Athletic Stores.............................................. $4,847 $5,071 $5,370

Direct-to-Customers ......................................... 390 364 380

Family Footwear............................................. — 2 —

Total sales .............................................. $5,237 $5,437 $5,750