Chevron 2005 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2005 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

90 CHEVRON CORPORATION 2005 ANNUAL REPORT

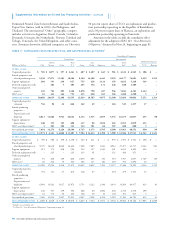

Supplemental Information on Oil and Gas Producing Activities – Continued

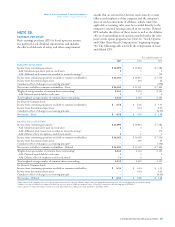

TABLE II – CAPITALIZED COSTS RELATED TO OIL AND GAS PRODUCING ACTIVITIES1

Consolidated Companies

United States

International

Gulf of Total Asia- Total Affi liated Companies

Millions of dollars Calif. Mexico Other U.S.

Africa Pacifi c Indonesia Other Int’l. Total TCO Hamaca

AT DEC. 31, 2005

Unproved properties $ 769 $ 1,077 $ 397 $ 2,243 $ 407 $ 2,287 $ 645 $ 983 $ 4,322 $ 6,565 $ 108 $ –

Proved properties and

related producing assets 9,530 17,871 11,103 38,504 8,169 14,308 4,441 9,259 36,177 74,681 2,259 1,212

Support equipment 204 193 230 627 715 426 3,124 356 4,621 5,248 549 –

Deferred exploratory wells – 284 5 289 245 154 173 248 820 1,109 – –

Other uncompleted

projects 149 782 209 1,140 2,878 790 427 946 5,041 6,181 2,332 –

ARO asset2 16 412 364 792 235 620 265 368 1,488 2,280 5 1

GROSS CAP. COSTS 10,668 20,619 12,308 43,595 12,649 18,585 9,075 12,160 52,469 96,064 5,253 1,213

Unproved properties

valuation 736 90 22 848 162 69 – 318 549 1,397 17 –

Proved producing

properties –

Depreciation and

depletion 6,813 13,866 5,943 26,622 4,132 3,915 2,895 5,533 16,475 43,097 455 90

Support equipment

depreciation 140 119 149 408 317 88 1,824 222 2,451 2,859 213 –

ARO asset depreciation2 5 201 106 312 134 101 66 187 488 800 5 –

Accumulated provisions 7,694 14,276 6,220 28,190 4,745 4,173 4,785 6,260 19,963 48,153 690 90

NET CAPITALIZED COSTS $ 2,974 $ 6,343 $ 6,088 $ 15,405 $ 7,904 $ 14,412 $ 4,290 $ 5,900 $ 32,506 $ 47,911 $ 4,563 $ 1,123

AT DEC. 31, 2004

Unproved properties $ 769 $ 380 $ 109 $ 1,258 $ 322 $ 211 $ – $ 970 $ 1,503 $ 2,761 $ 108 $ –

Proved properties and

related producing assets 9,170 16,610 8,660 34,440 7,188 7,485 3,643 8,961 27,277 61,717 2,163 963

Support equipment 211 175 208 594 513 127 3,030 361 4,031 4,625 496 –

Deferred exploratory wells – 225 – 225 213 81 – 152 446 671 – –

Other uncompleted

projects 91 400 169 660 2,050 605 351 391 3,397 4,057 1,749 149

ARO asset2 28 204 70 302 206 113 181 292 792 1,094 20 –

GROSS CAP. COSTS 10,269 17,994 9,216 37,479 10,492 8,622 7,205 11,127 37,446 74,925 4,536 1,112

Unproved properties

valuation 734 111 27 872 118 67 – 294 479 1,351 15 –

Proved producing

properties –

Depreciation and

depletion 6,694 13,562 5,617 25,873 3,753 3,122 2,396 4,933 14,204 40,077 423 43

Support equipment

depreciation 148 107 139 394 268 60 1,802 206 2,336 2,730 190 –

ARO asset depreciation2 24 174 64 262 128 49 36 148 361 623 5 –

Accumulated provisions 7,600 13,954 5,847 27,401 4,267 3,298 4,234 5,581 17,380 44,781 633 43

NET CAPITALIZED COSTS $ 2,669 $ 4,040 $ 3,369 $ 10,078 $ 6,225 $ 5,324 $ 2,971 $ 5,546 $ 20,066 $ 30,144 $ 3,903 $ 1,069

1 Includes assets held for sale.

2 See Note 24, “Asset Retirement Obligations,” beginning on page 83.

Partitioned Neutral Zone between Kuwait and Saudi Arabia,

Papua New Guinea (sold in 2003), the Philippines, and

Thailand. The international “Other” geographic category

includes activities in Argentina, Brazil, Canada, Colombia,

Denmark, Germany, the Netherlands, Norway, Trinidad and

Tobago, Venezuela, the United Kingdom, and other coun-

tries. Amounts shown for affi liated companies are Chevron’s

50 percent equity share of TCO, an exploration and produc-

tion partnership operating in the Republic of Kazakhstan,

and a 30 percent equity share of Hamaca, an exploration and

production partnership operating in Venezuela.

Amounts in the tables exclude the cumulative effect

adjustment for the adoption of FAS 143, “Asset Retirement

Obligations,” discussed in Note 24, beginning on page 83.