Chevron 2005 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2005 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

76 CHEVRON CORPORATION 2005 ANNUAL REPORT

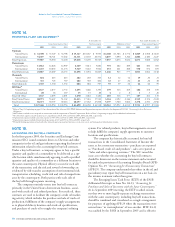

NOTE 21. EMPLOYEE BENEFIT PLANS – Continued

Notes to the Consolidated Financial Statements

Millions of dollars, except per-share amounts

The accumulated benefi t obligations for all U.S. and

international pension plans were $7,931 and $3,080, respec-

tively, at December 31, 2005, and $6,117 and $2,734,

respectively, at December 31, 2004.

The components of net periodic benefi t cost for 2005, 2004 and 2003 were:

Pension Benefi ts

2005 2004 2003 Other Benefi ts

U.S. Int’l. U.S. Int’l. U.S. Int’l. 2005 2004 2003

Service cost $ 208 $ 84 $ 170 $ 70 $ 144 $ 54 $ 30 $ 26 $ 28

Interest cost 395 199 326 180 334 151 164 164 191

Expected return on plan assets (449) (208) (358) (169) (224) (132) – – –

Amortization of transitional assets – 2 – 1 – (3) – – –

Amortization of prior-service costs 45 16 42 16 45 14 (91) (47) (3)

Recognized actuarial losses 177 51 114 69 133 42 93 54 12

Settlement losses 86 – 96 4 132 1 – – –

Curtailment losses – – – 2 – 6 – – –

Special termination benefi ts

recognition – – – 1 – – – – –

Net periodic benefi t cost $ 462 $ 144 $ 390 $ 174 $ 564 $ 133 $ 196 $ 197 $ 228

Assumptions The following weighted-average assumptions were used to determine benefi t obligations and net period benefi t costs

for years ended December 31:

Pension Benefi ts

2005 2004 2003 Other Benefi ts

U.S. Int’l. U.S. Int’l. U.S. Int’l. 2005 2004 2003

Assumptions used to determine

benefi t obligations

Discount rate

5.5% 5.9% 5.8% 6.4% 6.0% 6.8% 5.6% 5.8% 6.1%

Rate of compensation increase 4.0% 5.1% 4.0% 4.9% 4.0% 4.9% 4.0% 4.1% 4.1%

Assumptions used to determine

net periodic benefi t cost

Discount rate1,2 5.5% 6.4% 5.9% 6.8% 6.3% 7.1% 5.8% 6.1% 6.8%

Expected return on plan assets1,2 7.8% 7.9% 7.8% 8.3% 7.8% 8.3% N/A N/A N/A

Rate of compensation increase2 4.0% 5.0% 4.0% 4.9% 4.0% 5.1% 4.0% 4.1% 4.1%

1 Discount rate and expected rate of return on plan assets were reviewed and updated as needed on a quarterly basis for the main U.S. pension plan.

2 The 2005 discount rate, expected return on plan assets and rate of compensation increase refl ect the remeasurement of the Unocal benefi t plans at July 31, 2005, due to the acquisition of Unocal.

Information for U.S. and international pension plans

with an accumulated benefi t obligation in excess of plan

assets at December 31, 2005 and 2004, was:

At December 31

2005 2004

Projected benefi t obligations $ 2,950 $ 1,449

Accumulated benefi t obligations 2,625 1,360

Fair value of plan assets 1,359 282

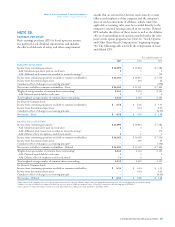

Expected Return on Plan Assets The company employs a rig-

orous process to determine estimates of the long-term rate

of return on pension assets. These estimates are primarily

driven by actual historical asset-class returns, an assessment

of expected future performance, advice from external actu-

arial fi rms and the incorporation of specifi c asset-class risk

factors. Asset allocations are periodically updated using pen-

sion plan asset/liability studies, and the determination of the

company’s estimates of long-term rates of return are consis-

tent with these studies.

There have been no changes in the expected long-term

rate of return on plan assets since 2002 for U.S. plans, which

account for 72 percent of the company’s pension plan assets.

At December 31, 2005, the estimated long-term rate of

return on U.S. pension plan assets was 7.8 percent.

The market-related value of assets of the major U.S. pen-

sion plan used in the determination of pension expense was

based on the market values in the three months preceding

the year-end measurement date, as opposed to the maximum

allowable period of fi ve years under U.S. accounting rules.

Management considers the three-month time period long

enough to minimize the effects of distortions from day-to-day

market volatility and still be contemporaneous to the end of the

year. For other plans, market value of assets as of the measure-

ment date is used in calculating the pension expense.

Discount Rate The discount rate assumptions used to deter-

mine U.S. and international pension and postretirement

benefi t plan obligations and expense refl ect the prevailing

rates available on high-quality fi xed-income debt instru-

ments. At December 31, 2005, the company selected a