Chevron 2005 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2005 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

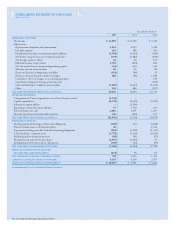

62 CHEVRON CORPORATION 2005 ANNUAL REPORT

FAS 123R, “Share-Based Payment.” This amount was offset

by an equal amount in “Net purchases of treasury shares.”

Refer to Note 22, beginning on page 78, for additional infor-

mation related to the company’s adoption of FAS 123R.

The “Net (purchases) sales of treasury shares” in 2005

and 2004 included purchases of $3,029 and $2,122, respec-

tively, related to the company’s common stock repurchase

programs and share-based compensation plans, which were

partially offset by the issuance of shares for the exercise of

stock options.

The 2003 “Net cash provided by operating activities”

in cluded an $890 “Decrease in other deferred charges” and

a decrease of the same amount in “Other” related to balance

sheet netting of certain pension-related asset and liability

accounts, in accordance with the requirements of Financial

Accounting Standards Board (FASB) Statement No. 87,

“Employers’ Accounting for Pensions.”

The “cash portion of Unocal acquisition, net of Unocal

cash received” represents the purchase price, net of $1,600

of cash received. The aggregate purchase price of Unocal was

$17,300. Refer to Note 2 starting on page 60 for additional

discussion of the Unocal acquisition.

The major components of “Capital expenditures” and

the reconciliation of this amount to the reported capital and

exploratory expenditures, including equity affiliates, presented

in Management’s Discussion and Analysis, beginning on

page 38, are presented in the following table:

Year ended December 31

2005 2004 2003

Additions to properties, plant

and equipment1 $ 8,154 $ 5,798 $ 4,953

Additions to investments 459 303 687

Current-year dry hole expenditures 198 228 132

Payments for other liabilities

and assets, net (110) (19) (147)

Capital expenditures 8,701 6,310 5,625

Expensed exploration expenditures 517 412 315

Assets acquired through capital

lease obligations and other

fi nancing obligations 164 31 2862

Capital and exploratory expenditures,

excluding equity affi liates 9,382 6,753 6,226

Equity in affi liates’ expenditures 1,681 1,562 1,137

Capital and exploratory expenditures,

including equity affi liates $ 11,063 $ 8,315 $ 7,363

1

Net of noncash additions of $435 in 2005, $212 in 2004 and $1,183 in 2003.

2

Includes deferred payment of $210 related to the 1993 acquisition of the company’s inter-

est in the Tengiz chevroil joint venture.

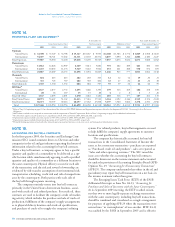

NOTE 4.

SUMMARIZED FINANCIAL DATA – CHEVRON U.S.A. INC.

Chevron U.S.A. Inc. (CUSA) is a major subsidiary of

Chevron Corporation. CUSA and its subsidiaries manage

and operate most of Chevron’s U.S. businesses. Assets include

those related to the exploration and production of crude oil,

natural gas and natural gas liquids and those associated with

the refi ning, marketing, supply and distribution of products

derived from petroleum, other than natural gas liquids, exclud-

ing most of the regulated pipeline operations of Chevron.

CUSA also holds Chevron’s investments in the Chevron Phil-

lips Chemical Company LLC (CPChem) joint venture and

Dynegy Inc. (Dynegy), which are accounted for using the

equity method.

During 2003, Chevron implemented legal reorganiza-

tions in which certain Chevron subsidiaries transferred

assets to or under CUSA and other Chevron companies were

merged with and into CUSA. The summarized fi nancial

information for CUSA and its consolidated subsidiaries pre-

sented in the following table gives retroactive effect to the

reorganizations, with all periods presented as if the compa-

nies had always been combined and the reorganizations had

occurred on January 1, 2003. However, the fi nancial informa-

tion included in this table may not refl ect the fi nancial

position and operating results in the future or the historical

results in the periods presented had the reorganizations actu-

ally occurred on January 1, 2003.

Year ended December 31

2005 2004 2003

Sales and other operating

revenues $ 138,296 $ 108,351 $ 82,760

Total costs and other deductions 132,180 102,180 78,399

Net income* 4,693 4,773 3,083

* 2003 net income includes a charge of $323 for the cumulative effect of changes in

accounting principles.

At December 31

2005 2004

Current assets $ 27,878 $ 23,147

Other assets 20,611 19,961

Current liabilities 20,286 17,044

Other liabilities 12,897 12,533

Net equity 15,306 13,531

Memo: Total debt $ 8,353 $ 8,349

NOTE 5.

SUMMARIZED FINANCIAL DATA – CHEVRON TRANSPORT

CORPORATION LTD.

Chevron Transport Corporation Ltd. (CTC), incorporated in

Bermuda, is an indirect, wholly owned subsidiary of Chevron

Corporation. CTC is the principal operator of Chevron’s

international tanker fl eet and is engaged in the marine

transportation of crude oil and refi ned petroleum products.

Most of CTC’s shipping revenue is derived from providing

transportation services to other Chevron companies. Chevron

Corporation has guaranteed this subsidiary’s obligations in

connection with certain debt securities issued by a third party.

Summarized fi nancial information for CTC and its consoli-

dated subsidiaries is presented in the following table:

Notes to the Consolidated Financial Statements

Millions of dollars, except per-share amounts

NOTE 3. INFORMATION RELATING TO THE CONSOLIDATED

STATEMENT OF CASH FLOWS– Continued