Chevron 2005 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2005 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

74 CHEVRON CORPORATION 2005 ANNUAL REPORT

Notes to the Consolidated Financial Statements

Millions of dollars, except per-share amounts

If either condition is not met, or if an enterprise obtains

information that raises substantial doubt about the eco-

nomic or operational viability of the project, the exploratory

well would be assumed to be impaired, and its costs, net of

any salvage value, would be charged to expense. The FSP

provides a number of indicators that can assist an entity to

demonstrate suffi cient progress is being made in assessing the

reserves and economic viability of the project.

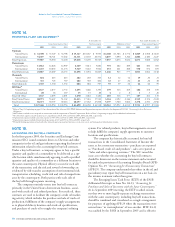

The following table indicates the changes to the com-

pany’s suspended exploratory-well costs for the three years

ended December 31, 2005. No capitalized exploratory well

costs were charged to expense upon the adoption of FSP FAS

19-1. Amounts may differ from those previously disclosed

due to the requirements of FSP FAS 19-1 to exclude costs

suspended and expensed in the same annual period.

Year ended December 31

2005 2004 2003

Beginning balance at January 1 $ 671 $ 549 $ 478

Additions associated with the

acquisition of Unocal 317 – –

Additions to capitalized exploratory

well costs pending the

determination of proved reserves 290 252 344

Reclassifi cations to wells, facilities

and equipment based on the

determination of proved reserves (140) (64) (145)

Capitalized exploratory well costs

charged to expense (6) (66) (126)

Other reductions* (23) – (2)

Ending balance at December 31 $ 1,109 $ 671 $ 549

*Represent property sales and an exchange.

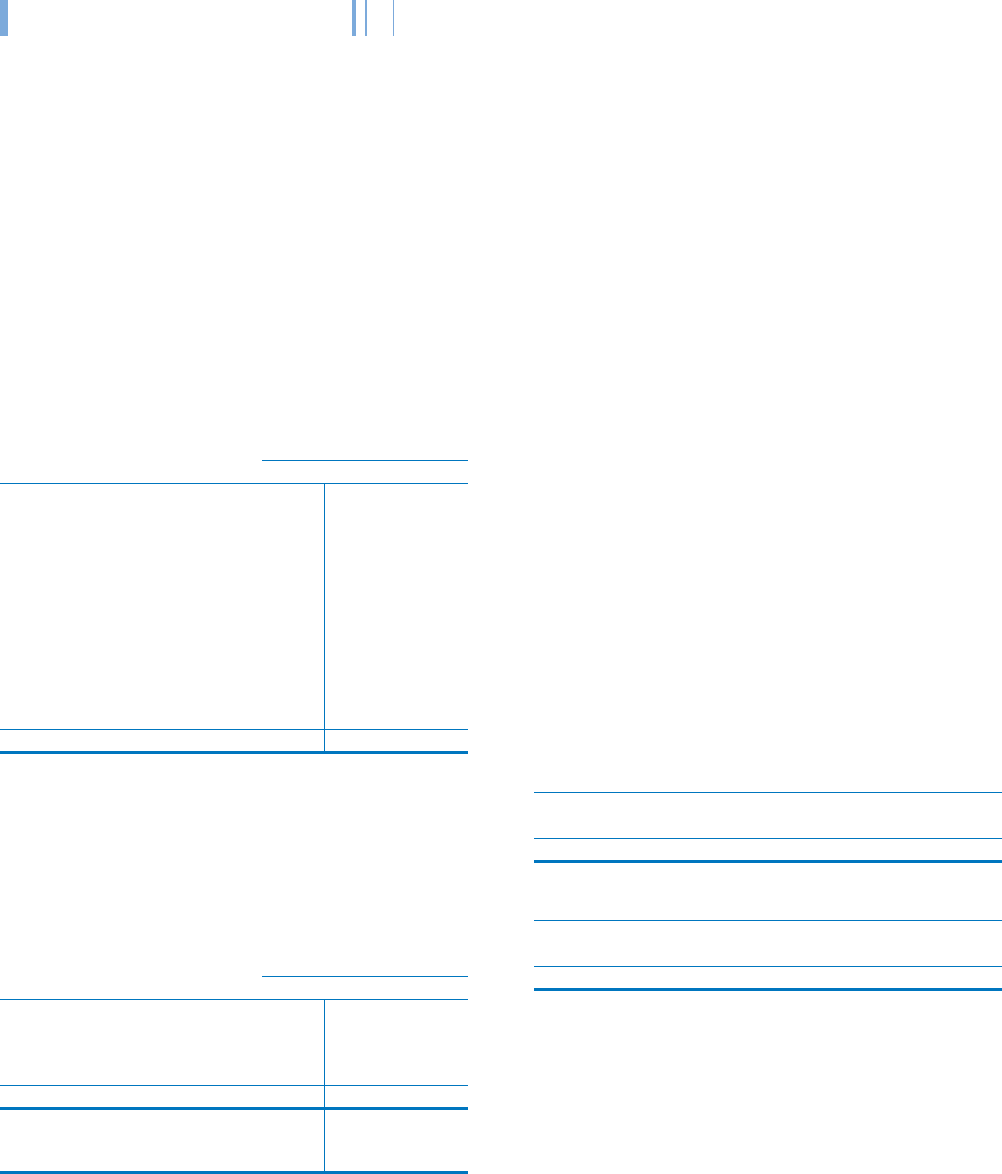

The following table provides an aging of capitalized well

costs and the number of projects for which exploratory well

costs have been capitalized for a period greater than one year

since the completion of drilling. The aging of the former

Unocal wells is based on the date the drilling was completed,

rather than Chevron’s August 2005 acquisition of Unocal.

Year ended December 31

2005 2004 2003

Exploratory well costs capitalized

for a period of one year or less $ 259 $ 222 $ 181

Exploratory well costs capitalized

for a period greater than one year 850 449 368

Balance at December 31 $ 1,109 $ 671 $ 549

Number of projects with exploratory

well costs that have been capitalized

for a period greater than one year* 40 22 22

* Certain projects have multiple wells or fi elds or both.

Of the $850 of exploratory well costs capitalized for a

period greater than one year at December 31, 2005, approxi-

mately $313 (20 projects) related to projects that had drilling

activities under way or fi rmly planned for the near future.

An additional $63 (four projects) had drilling activity dur-

ing 2005. The $474 balance related to 16 projects in areas

requiring a major capital expenditure before production

could begin and for which additional drilling efforts were not

under way or fi rmly planned for the near future. Additional

drilling was not deemed necessary because the presence of

hydrocarbons had already been established, and other activi-

ties were in process to enable a future decision on project

development.

The projects for the $474 referenced above had the fol-

lowing activities associated with assessing the reserves and

the projects’ economic viability: (a) $141 – additional seismic

interpretation planned, with front-end engineering and design

(FEED) expected to commence in 2007 (two projects); (b) $82

– evaluation of drilling results and pre-FEED studies ongoing

with FEED expected to commence in 2006 (one project);

(c) $74 – fi nalization of pre-unit agreement with operator

of adjacent fi eld and the progression of joint subsurface and

joint concept selection studies, with FEED expected to begin

in 2006 (one project); (d) $63 – FEED contracts executed in

2005 and continued marketing of equity natural gas (two proj-

ects); (e) $114 – miscellaneous activities for 10 projects with

smaller amounts suspended. While progress was being made

on all the projects in this category, the decision on the recog-

nition of proved reserves under SEC rules in some cases may

not occur for several years because of the complexity, scale and

negotiations connected with the projects. The majority of these

decisions are expected to occur in the next three years.

The $850 of suspended well costs capitalized for a period

greater than one year as of December 31, 2005, represents

105 exploratory wells in 40 projects. The tables below contain

the aging of these costs on a well and project basis:

Exploratory wells costs greater than one year:

Number

Aging based on drilling completion date of individual wells: Amount of wells

1994–2000 $ 147 28

2001–2004 703 77

Total $ 850 105

Number

Aging based on drilling completion date of last well in project: Amount of projects

1998–2000 $ 91 4

2001–2005 759 36

Total $ 850 40

NOTE 21.

EMPLOYEE BENEFIT PLANS

The company has defi ned-benefi t pension plans for many

employees. The company typically pre-funds defi ned-benefi t

plans as required by local regulations or in certain situa-

tions where pre-funding provides economic advantages. In

the United States, all qualifi ed tax-exempt plans are subject

to the Employee Retirement Income Security Act (ERISA)

minimum funding standard. The company does not typically

fund domestic nonqualifi ed tax-exempt pension plans that

are not subject to funding requirements under laws and regu-

lations because contributions to these pension plans may be

NOTE 20. ACCOUNTING FOR SUSPENDED

EXPLORATORY WELLS – Continued