Chevron 2005 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2005 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CHEVRON CORPORATION 2005 ANNUAL REPORT 81

Energy Inc. (formerly Caltex Corporation), Unocal Corpora-

tion (Unocal) and Texaco Inc. (Texaco). California franchise

tax liabilities have been settled through 1991 for Chevron,

1998 for Unocal and through 1987 for Texaco. Settlement of

open tax years, as well as tax issues in other countries where

the company conducts its businesses, is not expected to have

a material effect on the consolidated fi nancial position or

liquidity of the company, and in the opinion of management,

adequate provision has been made for income and franchise

taxes for all years under examination or subject to future

examination.

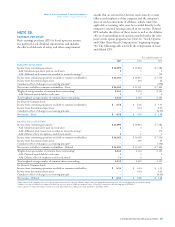

Guarantees At December 31, 2005, the company and its

subsidiaries provided, either directly or indirectly, guarantees

of $985 for notes and other contractual obligations of affi li-

ated companies and $294 for third parties, as described by

major category below. There are no material amounts being

carried as liabilities for the company’s obligations under these

guarantees.

Of the $985 guarantees provided to affi liates, $806

related to borrowings for capital projects or general corporate

purposes. These guarantees were undertaken to achieve lower

interest rates and generally cover the construction periods of

the capital projects. Included in these amounts are Unocal-

related guarantees of approximately $230 associated with a

construction completion guarantee for the debt fi nancing of

Unocal’s equity interest in the Baku-Tbilisi-Ceyhan (BTC)

crude oil pipeline project. Approximately 95 percent of the

$806 guaranteed will expire between 2006 and 2010, with

the remaining guarantees expiring by the end of 2015. Under

the terms of the guarantees, the company would be required

to fulfi ll the guarantee should an affi liate be in default of its

loan terms, generally for the full amounts disclosed. There

are no recourse provisions, and no assets are held as collateral

for these guarantees. The other guarantees of $179 represent

obligations in connection with pricing of power-purchase

agreements for certain of the company’s cogeneration affi li-

ates. Under the terms of these guarantees, the company may

be required to make payments under certain conditions if the

affi liates do not perform under the agreements. There are no

provisions for recourse to third parties, and no assets are held

as collateral for these pricing guarantees.

Of the $294 in guarantees provided to third par-

ties, approximately $150 related to construction loans to

host governments of certain of the company’s international

upstream operations. The remaining guarantees of $144 were

provided principally as conditions of sale of the company’s

interest in certain operations, to provide a source of liquidity

to the guaranteed parties and in connection with company

marketing programs. No amounts of the company’s obliga-

tions under these guarantees are recorded as liabilities. About

85 percent of the $294 in guarantees expire by 2010, with

the remainder expiring after 2010. The company would be

required to perform under the terms of the guarantees should

an entity be in default of its loan or contract terms, generally

for the full amounts disclosed. Approximately $85 of the guar-

antees have recourse provisions, which enable the company to

recover any payments made under the terms of the guarantees

from securities held over the guaranteed parties’ assets.

At December 31, 2005, Chevron also had outstanding

guarantees for about $190 of Equilon debt and leases. Follow-

ing the February 2002 disposition of its interest in Equilon,

the company received an indemnifi cation from Shell Oil

Company (Shell) for any claims arising from the guarantees.

The company has not recorded a liability for these guarantees.

Approximately 50 percent of the amounts guaranteed will

expire within the 2006 through 2010 period, with the guaran-

tees of the remaining amounts expiring by 2019.

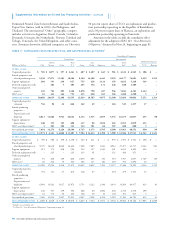

Indemnifi cations The company provided certain indemni-

ties of contingent liabilities of Equilon and Motiva to Shell

and Saudi Refi ning, Inc., in connection with the February

2002 sale of the company’s interests in those investments.

The company would be required to perform if the indemni-

fi ed liabilities become actual losses. Were that to occur, the

company could be required to make future payments up to

$300. Through the end of 2005, the company paid approxi-

mately $38 under these indemnities. The company expects to

receive additional requests for indemnifi cation payments in

the future.

The company has also provided indemnities relating to

contingent environmental liabilities related to assets origi-

nally contributed by Texaco to the Equilon and Motiva joint

ventures and environmental conditions that existed prior to

the formation of Equilon and Motiva or that occurred dur-

ing the periods of Texaco’s ownership interest in the joint

ventures. In general, the environmental conditions or events

that are subject to these indemnities must have arisen prior

to December 2001. Claims relating to Equilon indemnities

must be asserted either as early as February 2007, or no later

than February 2009, and claims relating to Motiva must be

asserted no later than February 2012. Under the terms of the

indemnities, there is no maximum limit on the amount of

potential future payments. The company has not recorded

any liabilities for possible claims under these indemnities.

The company posts no assets as collateral and has made no

payments under the indemnities.

The amounts payable for the indemnities described

above are to be net of amounts recovered from insurance

carriers and others and net of liabilities recorded by Equilon

or Motiva prior to September 30, 2001, for any applicable

incident.

In the acquisition of Unocal, the company assumed certain

indemnities relating to contingent environmental liabilities

associated with assets of Unocal’s 76 Products Company busi-

ness that existed prior to its sale in 1997. Under the terms of

these indemnities, there is no maximum limit on the amount

of potential future payments by the company; however, the

purchaser shares certain costs under this indemnity up to an

aggregate cap of $200. Claims relating to these indemnities

must be asserted by April 2022. Through the end of 2005,

NOTE 23. OTHER CONTINGENCIES AND

COMMITMENTS – Continued