Chevron 2005 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2005 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

72 CHEVRON CORPORATION 2005 ANNUAL REPORT

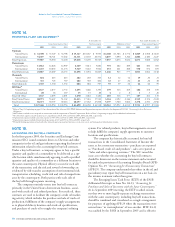

NOTE 16. TAXES – Continued

The overall valuation allowance relates to foreign tax

credit carry forwards, tax loss carryforwards and temporary

differences for which no benefi t is expected to be realized. Tax

loss carry forwards exist in many foreign jurisdictions. Whereas

some of these tax loss carry forwards do not have an expiration

date, others expire at various times from 2006 through 2013.

Foreign tax credit carryforwards of $1,145 will expire in 2015.

At December 31, 2005 and 2004, deferred taxes were

classifi ed in the Consolidated Balance Sheet as follows:

At December 31

2005 2004

Prepaid expenses and other current assets $ (892) $ (1,532)

Deferred charges and other assets (547) (769)

Federal and other taxes on income 1 6

Noncurrent deferred income taxes 11,262 7,268

Total deferred income taxes, net $ 9,824 $ 4,973

It is the company’s policy for subsidiaries that are

included in the U.S. consolidated tax return to record income

tax expense as though they fi le separately, with the parent

recording the adjustment to income tax expense for the effects

of consolidation.

Income taxes are not accrued for unremitted earnings

of international operations that have been or are intended to

be reinvested indefi nitely. Undistributed earnings of inter-

national consolidated subsidiaries and affiliates for which

no deferred income tax provision has been made for possible

future remittances totaled $14,317 at December 31, 2005.

A signifi cant majority of this amount represents earnings

reinvested as part of the company’s ongoing international

business. It is not practicable to estimate the amount of taxes

that might be payable on the eventual remittance of such

earnings. The company does not anticipate incurring signifi -

cant additional taxes on remittances of earnings that are not

indefi nitely reinvested.

American Jobs Creation Act of 2004 In October 2004, the

Amer ican Jobs Creation Act of 2004 was passed into law.

The Act provides a deduction for income from qualifi ed

domestic refi ning and upstream production activities, which

will be phased in from 2005 through 2010. For that income,

the company expects the net effect of this provision of the

Act to result in a decrease in the federal effective tax rate for

2006 to approximately 34 percent, based on current earnings

levels. In the long term, the company expects that the new

deduction will result in a decrease of the annual effective tax

rate to about 32 percent for that category of income, based

on current earnings levels.

Notes to the Consolidated Financial Statements

Millions of dollars, except per-share amounts Taxes other than on income were as follows:

Year ended December 31

2005 2004 2003

United States

Excise taxes on products

and merchandise $ 4,521 $ 4,147 $ 3,744

Import duties and other levies 8 5 11

Property and other

miscellaneous taxes 392 359 309

Payroll taxes 149 137 138

Taxes on production 323 257 244

Total United States 5,393 4,905 4,446

International

Excise taxes on products

and merchandise 4,198 3,821 3,351

Import duties and other levies 10,466 10,542 9,652

Property and other

miscellaneous taxes 535 415 320

Payroll taxes 52 52 54

Taxes on production 138 86 83

Total International 15,389 14,916 13,460

Total taxes other than on income* $ 20,782 $ 19,821 $ 17,906

* Includes taxes on discontinued operations of $3 and $5 in 2004 and 2003, respectively.

NOTE 17.

SHORT-TERM DEBT

At December 31

2005 2004

Commercial paper* $ 4,098 $ 4,068

Notes payable to banks and others with

originating terms of one year or less 170 310

Current maturities of long-term debt 467 333

Current maturities of long-term

capital leases 70 55

Redeemable long-term obligations

Long-term debt 487 487

Capital leases 297 298

Subtotal 5,589 5,551

Reclassifi ed to long-term debt (4,850) (4,735)

Total short-term debt $ 739 $ 816

* Weighted-average interest rates at December 31, 2005 and 2004, were 4.18 percent and

1.98 percent, respectively.

Redeemable long-term obligations consist primarily of

tax-exempt variable-rate put bonds that are included as cur-

rent liabilities because they become redeemable at the option

of the bondholders during the year following the balance

sheet date.

The company periodically enters into interest rate swaps

on a portion of its short-term debt. See Note 7, beginning on

page 63, for information concerning the company’s debt-

related derivative activities.

At December 31, 2005, the company had $4,850 of com-

mitted credit facilities with banks worldwide, which permit

the company to refi nance short-term obligations on a long-

term basis. The facilities support the company’s commercial

paper borrowings. Interest on borrowings under the terms of

specifi c agreements may be based on the London Interbank

Offered Rate or bank prime rate. No amounts were outstand-

ing under these credit agreements during 2005 or at year-end.