Chevron 2005 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2005 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

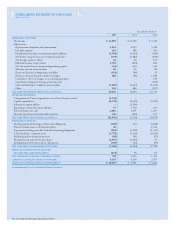

Year ended December 31

2005 2004 2003

REVENUES AND OTHER INCOME

Sales and other operating revenues1,2 $ 193,641 $ 150,865 $ 119,575

Income from equity affiliates 3,731 2,582 1,029

Other income 828 1,853 308

Gain from exchange of Dynegy preferred stock – – 365

TOTAL REVENUES AND OTHER INCOME 198,200 155,300 121,277

COSTS AND OTHER DEDUCTIONS

Purchased crude oil and products2 127,968 94,419 71,310

Operating expenses 12,191 9,832 8,500

Selling, general and administrative expenses 4,828 4,557 4,440

Exploration expenses 743 697 570

Depreciation, depletion and amortization 5,913 4,935 5,326

Taxes other than on income1 20,782 19,818 17,901

Interest and debt expense 482 406 474

Minority interests 96 85 80

TOTAL COSTS AND OTHER DEDUCTIONS 173,003 134,749 108,601

INCOME FROM CONTINUING OPERATIONS BEFORE INCOME TAX EXPENSE 25,197 20,551 12,676

INCOME TAX EXPENSE 11,098 7,517 5,294

INCOME FROM CONTINUING OPERATIONS 14,099 13,034 7,382

INCOME FROM DISCONTINUED OPERATIONS – 294 44

INCOME BEFORE CUMULATIVE EFFECT OF CHANGES IN ACCOUNTING PRINCIPLES $ 14,099 $ 13,328 $ 7,426

Cumulative effect of changes in accounting principles – – (196)

NET INCOME $ 14,099 $ 13,328 $ 7,230

PER-SHARE OF COMMON STOCK3

INCOME FROM CONTINUING OPERATIONS

– BASIC $ 6.58 $ 6.16 $ 3.55

– DILUTED $ 6.54 $ 6.14 $ 3.55

INCOME FROM DISCONTINUED OPERATIONS

– BASIC $ – $ 0.14 $ 0.02

– DILUTED $ – $ 0.14 $ 0.02

CUMULATIVE EFFECT OF CHANGES IN ACCOUNTING PRINCIPLES

– BASIC $ – $ – $ (0.09)

– DILUTED $ – $ – $ (0.09)

NET INCOME

– BASIC $ 6.58 $ 6.30 $ 3.48

– DILUTED $ 6.54 $ 6.28 $ 3.48

1

Includes consumer excise taxes: $ 8,719 $ 7,968 $ 7,095

2 Includes amounts in revenues for buy/sell contracts associated costs are in “Purchased crude oil and products.”

See Note 15, on page 70: $ 23,822 $ 18,650 $ 14,246

3

All periods refl ect a two-for-one stock split effected as a 100 percent stock dividend in September 2004.

See accompanying Notes to the Consolidated Financial Statements.

CONSOLIDATED STATEMENT OF INCOME

Millions of dollars, except per-share amounts

CHEVRON CORPORATION 2005 ANNUAL REPORT 53