Chevron 2005 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2005 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CHEVRON CORPORATION 2005 ANNUAL REPORT 85

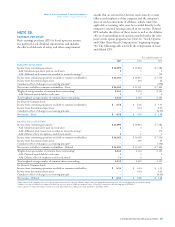

NOTE 25.

EARNINGS PER SHARE

Basic earnings per share (EPS) is based upon net income

less preferred stock dividend requirements and includes

the effects of deferrals of salary and other compensation

Year ended December 31

2005 2004 2003

BASIC EPS CALCULATION

Income from continuing operations $ 14,099 $ 13,034 $ 7,382

Add: Dividend equivalents paid on stock units 2 3 2

Add: Affi liated stock transaction recorded to retained earnings1 – – 170

Income from continuing operations available to common stockholders $ 14,101 $ 13,037 $ 7,554

Income from discontinued operations – 294 44

Cumulative effect of changes in accounting principle2 – – (196)

Net income available to common stockholders – Basic $ 14,101 $ 13,331 $ 7,402

Weighted-average number of common shares outstanding3 2,143 2,114 2,123

Add: Deferred awards held as stock units 1 2 2

Total weighted-average number of common shares outstanding 2,144 2,116 2,125

Per-Share of Common Stock

Income from continuing operations available to common stockholders $ 6.58 $ 6.16 $ 3.55

Income from discontinued operations – 0.14 0.02

Cumulative effect of changes in accounting principle – – (0.09)

Net income – Basic $ 6.58 $ 6.30 $ 3.48

DILUTED EPS CALCULATION

Income from continuing operations $ 14,099 $ 13,034 $ 7,382

Add: Dividend equivalents paid on stock units 2 3 2

Add: Affi liated stock transaction recorded to retained earnings1 – – 170

Add: Dilutive effects of employee stock-based awards 2 1 2

Income from continuing operations available to common stockholders $ 14,103 $ 13,038 $ 7,556

Income from discontinued operations – 294 44

Cumulative effect of changes in accounting principle2 – – (196)

Net income available to common stockholders – Diluted $ 14,103 $ 13,332 $ 7,404

Weighted-average number of common shares outstanding3 2,143 2,114 2,123

Add: Deferred awards held as stock units 1 2 2

Add: Dilutive effect of employee stock-based awards 11 6 2

Total weighted-average number of common shares outstanding 2,155 2,122 2,127

Per-Share of Common Stock

Income from continuing operations available to common stockholders $ 6.54 $ 6.14 $ 3.55

Income from discontinued operations – 0.14 0.02

Cumulative effect of changes in accounting principle – – (0.09)

Net income – Diluted $ 6.54 $ 6.28 $ 3.48

1 2003 amount is the company’s share of a capital stock transaction of its Dynegy affi liate, which, under the applicable accounting rules, was recorded directly to retained earnings.

2 Includes a net loss of $200 for the adoption of FAS 143 and a net gain of $4 for the company’s share of Dynegy’s cumulative effect of adoption of EITF 02-3.

3 Share amounts in all periods refl ect a two-for-one stock split effected as a 100 percent stock dividend in September 2004.

awards that are invested in Chevron stock units by certain

offi cers and employees of the company and the company’s

share of stock transactions of affi liates, which, under the

applicable accounting rules, may be recorded directly to the

company’s retained earnings instead of net income. Diluted

EPS includes the effects of these items as well as the dilutive

effects of outstanding stock options awarded under the com-

pany’s stock option programs (see Note 22, “Stock Options

and Other Share-Based Compensation” beginning on page

78). The following table sets forth the computation of basic

and diluted EPS:

Notes to the Consolidated Financial Statements

Millions of dollars, except per-share amounts