Chevron 2005 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2005 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2005 was a year

of unprecedented

accomplishment

and challenge for

our company.

We reported record earnings and completed the acquisi-

tion and integration of Unocal. We made major new

discoveries of crude oil and natural gas and took sig-

nifi cant steps to expand our global natural gas business.

Although our employees and facilities sustained damage

from back-to-back hurricanes in the U.S. Gulf Coast, we

are recovering with remarkable resilience and effi ciency.

Our fi nancial performance refl ects the capital discipline

that is necessary to create sustained value and growth.

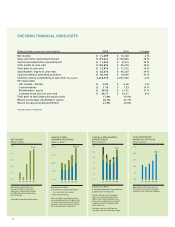

Net income in 2005 was $14.1 billion on sales and other

operating revenues of $194 billion – representing record

levels in both categories. Return on capital employed for

the year was a strong 21.9 percent. We increased our divi-

dend in 2005 for the 18th consecutive year, completed the

purchase of $5 billion of the company’s shares in the open

market under a program started in 2004 and initiated a

new program to acquire up to an additional $5 billion of

shares over a period of up to three years. A critical mea-

sure of our performance, total stockholder return (TSR),

was 11.3 percent for 2005. From 2001 through 2005,

TSR averaged 9.7 percent, among the highest of our larger

peer companies.

MAINTAINING MOMENTUM We executed strongly

against our key business strategies in 2005, enhancing

our foundation for current and future growth. The suc-

cessful integration of Unocal’s operations strengthened

our competitive profi le in key markets, par ticularly in

Southeast Asia, where we are in the top tier of natural

gas producers. Unocal’s world-class assets in Asia, the Cas-

pian and the U.S. Gulf of Mexico are a superb strate gic

fi t with Chevron’s portfolio and capabilities. In addition,

Unocal provided us with a deep source of talent and lead-

ing-edge technology, particularly with the drill bit, that

we are integrating throughout our enterprise.

We enhanced our position in the deep water with dis-

coveries at Big Foot and Knotty Head in the U.S. Gulf of

Mexico and at Manatee offshore Trinidad and Tobago,

among others. Our combination of experience and applied

technology resulted in a total of 31 successful exploration

wells in 2005 and an exploration success rate of 58 percent,

one of the best in the industry.

We reached key milestones in our queue of major

capital projects, most notably the Benguela Belize-Lobito

Tomboco deepwater project in Angola, which is the fi rst

of our “Big 5” projects to begin production. We began

construction of production facilities for the Tahiti (U.S.)

and Agbami (Nigeria) deepwater projects, as well as the

Escravos gas-to-liquids plant in Nigeria. Our global gas

business reached key agreements with Japanese utility

companies for future sales of liquefi ed natural gas (LNG)

from the Gorgon project in Australia into Japan, the

world’s largest LNG market.

Refi ning and marketing operations benefi ted from

strong margins in Asian and U.S. markets, and we moved

forward with expansion plans at our largest U.S. refi n-

eries. In Asia, we approved a major upgrade of the Yeosu

Refi nery in South Korea, the world’s fourth-largest refi n-

ery, to enable heavy oil processing.

Our planned capital and exploratory spending pro-

gram for 2006 is $14.8 billion, a 34 percent increase over

2005. This level of investment is aligned with our strong

queue of growth projects and our commitment to bring

new energy supplies to market.

COMPETITIVE ADVANTAGE The operating environ-

ment for the energy industry continues to be challenging.

With a sustained increase in global demand, tight supplies

and a dynamic geopolitical situation, we continue to

believe our industry is dealing with a fundamentally new

energy equation. To some extent, risk in our industry has

shifted from below ground – where Chevron has proved

ex treme ly effective at fi nding and producing hydrocarbons

– to above ground, where challenges include access to

re sources, barriers to the free fl ow of capital investment

to produce those resources and the economic develop-

ment of infrastructure needed to connect energy supplies

to markets.

In this environment, the competitive advantage will go

to companies that demonstrate sustained performance and

operating excellence, apply new technology in ways that

2

TO OUR STOCKHOLDERS