Chevron 2005 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2005 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

88 CHEVRON CORPORATION 2005 ANNUAL REPORT

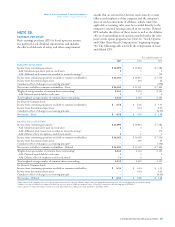

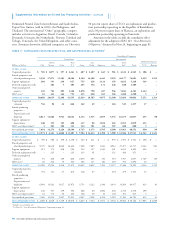

FIVE-YEAR FINANCIAL SUMMARY

Unaudited

Millions of dollars, except per-share amounts 2005 2004 2003 2002 2001

COMBINED STATEMENT OF INCOME DATA

REVENUES AND OTHER INCOME

Total sales and other operating revenues $ 193,641 $ 150,865 $ 119,575 $ 98,340 $ 103,951

Income from equity affi liates and other income 4,559 4,435 1,702 197 1,751

TOTAL REVENUES AND OTHER INCOME 198,200 155,300 121,277 98,537 105,702

TOTAL COSTS AND OTHER DEDUCTIONS 173,003 134,749 108,601 94,437 97,517

INCOME FROM CONTINUING OPERATIONS BEFORE INCOME TAXES 25,197 20,551 12,676 4,100 8,185

INCOME TAX EXPENSE 11,098 7,517 5,294 2,998 4,310

INCOME FROM CONTINUING OPERATIONS 14,099 13,034 7,382 1,102 3,875

INCOME FROM DISCONTINUED OPERATIONS – 294 44 30 56

INCOME BEFORE EXTRAORDINARY ITEM AND

CUMULATIVE EFFECT OF CHANGES IN ACCOUNTING PRINCIPLES 14,099 13,328 7,426 1,132 3,931

Extraordinary loss, net of tax – – – – (643)

Cumulative effect of changes in accounting principles – – (196) – –

NET INCOME $ 14,099 $ 13,328 $ 7,230 $ 1,132 $ 3,288

PER SHARE OF COMMON STOCK1

INCOME FROM CONTINUING OPERATIONS2

– Basic $ 6.58 $ 6.16 $ 3.55 $ 0.52 $ 1.82

– Diluted $ 6.54 $ 6.14 $ 3.55 $ 0.52 $ 1.82

INCOME FROM DISCONTINUED OPERATIONS

– Basic $ – $ 0.14 $ 0.02 $ 0.01 $ 0.03

– Diluted $ – $ 0.14 $ 0.02 $ 0.01 $ 0.03

EXTRAORDINARY ITEM

– Basic $ – $ – $ – $ – $ (0.30)

– Diluted $ – $ – $ – $ – $ (0.30)

CUMULATIVE EFFECT OF CHANGES IN ACCOUNTING PRINCIPLES

– Basic $ – $ – $ (0.09) $ – $ –

– Diluted $ – $ – $ (0.09) $ – $ –

NET INCOME2

– Basic $ 6.58 $ 6.30 $ 3.48 $ 0.53 $ 1.55

– Diluted $ 6.54 $ 6.28 $ 3.48 $ 0.53 $ 1.55

CASH DIVIDENDS PER SHARE $ 1.75 $ 1.53 $ 1.43 $ 1.40 $ 1.33

COMBINED BALANCE SHEET DATA (AT DECEMBER 31)

Current assets $ 34,336 $ 28,503 $ 19,426 $ 17,776 $ 18,327

Noncurrent assets 91,497 64,705 62,044 59,583 59,245

TOTAL ASSETS 125,833 93,208 81,470 77,359 77,572

Short-term debt 739 816 1,703 5,358 8,429

Other current liabilities 24,272 17,979 14,408 14,518 12,225

Long-term debt and capital lease obligations 12,131 10,456 10,894 10,911 8,989

Other noncurrent liabilities 26,015 18,727 18,170 14,968 13,971

TOTAL LIABILITIES 63,157 47,978 45,175 45,755 43,614

STOCKHOLDERS’ EQUITY $ 62,676 $ 45,230 $ 36,295 $ 31,604 $ 33,958

1 Per-share amounts in all periods refl ect a two-for-one stock split effected as a 100 percent stock dividend in September 2004.

2 The amount in 2003 includes a benefi t of $0.08 for the company’s share of a capital stock transaction of its Dynegy Inc. affi liate, which, under the applicable accounting rules, was recorded

directly to retained earnings and not included in net income for the period.