Chevron 2005 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2005 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CHEVRON CORPORATION 2005 ANNUAL REPORT 99

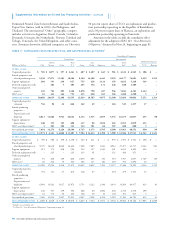

TABLE V – RESERVE QUANTITY INFORMATION – Continued

increase in Africa related to properties in Nigeria, for which

changes were associated with well performance reviews,

development drilling and lease fuel calculations. The 236

BCF addition in the Asia-Pacifi c region was related primarily

to reservoir analysis for a single fi eld. Most of the 325 BCF

in the “Other” international area is related to a new gas sales

contract in Trinidad and Tobago. In the United States, the

net 391 BCF downward revision in the Gulf of Mexico was

related to well-performance reviews and technical analyses

in several fi elds. Most of the net 316 BCF negative revision

in the “Other” U.S. area related to two coal bed methane

fi elds in the Mid-Continent region and their associated wells’

performance. The 963 BCF increase for TCO was connected

with updated analyses of reservoir performance and process-

ing plant yields.

In 2005, reserves were revised downward by 14 BCF for

consolidated companies and 498 BCF for equity affi liates.

For consolidated companies, negative revisions were 428 BCF

in the Asia-Pacifi c region. Most of the decrease was attribut-

able to one fi eld in Kazakhstan, due mainly to the effects of

higher year-end prices on variable-royalty provisions of the

production-sharing contract. Reserves additions for consoli-

dated companies totaled 211 BCF and 243 BCF in Africa

and “Other,” respectively. The majority of the African region

changes were in Angola, due to a revised forecast of fuel gas

usage, and in Nigeria from improved reservoir performance.

The availability of third-party compression in Colombia

accounted for most of the increase in the “Other” region.

Revisions in the United States decreased reserves by 9 BCF, as

nominal increases in the San Joaquin Valley were more than

offset by decreases in the Gulf of Mexico and “Other” region.

For the TCO affi liate in Kazakhstan, a reduction of 547 BCF

refl ects the updated forecast of future royalties payable and

year-end price effects, partially offset by volumes added as a

result of an updated assessment of reservoir performance.

Extensions and Discoveries In 2003, extensions and

discoveries accounted for an increase of 526 BCF for con-

solidated companies, refl ecting a 388 BCF increase in the

United States, with 270 BCF added in the Gulf of Mexico

and 118 BCF in the “Other” region. The Gulf of Mexico

increase includes discoveries in several offshore Louisiana

fi elds, with a large number of fi elds in Texas, Louisiana and

other states accounting for the increase in “Other.”

In 2004, extensions and discoveries accounted for an

increase of 214 BCF, refl ecting an increase in the United

States of 144 BCF, with 89 BCF added in the “Other” region

and 54 BCF added in the Gulf of Mexico through drilling

activities in a large number of fi elds.

In 2005, consolidated companies increased reserves

by 370 BCF, including 167 BCF in the United States and

118 BCF in the Asia-Pacifi c region. In the United States,

99 BCF was added in the “Other” region and 68 BCF in the

Gulf of Mexico, primarily due to drilling activities. The addi-

tion in Asia-Pacifi c resulted primarily from increased drilling

in Kazakhstan.

Purchases In 2005, all except 7 BCF of the 5,656 BCF

total purchases were associated with the Unocal acquisition.

International reserve acquisitions were 4,488 BCF, with

Thailand accounting for about half the volumes. Other sig-

nifi cant volumes were added in Bangladesh and Myanmar.

Sales In 2004, sales for consolidated companies totaled

547 BCF. Of this total, 436 BCF was in the United States

and 111 BCF in the “Other” international region. In the

United States, “Other” region sales accounted for 289 BCF,

refl ecting the disposal of a large number of smaller proper-

ties, including a coal bed methane fi eld. Gulf of Mexico sales

of 147 BCF refl ected the sale of Shelf properties, with four

fi elds accounting for more than one-third of the total sales.

Sales in the “Other” international region refl ected the dis-

position of the properties in western Canada and the United

Kingdom.

In 2005, sales of 248 BCF in the “Other” international

region related to the disposition of former-Unocal’s onshore

properties in Canada.