Chevron 2005 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2005 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

70 CHEVRON CORPORATION 2005 ANNUAL REPORT

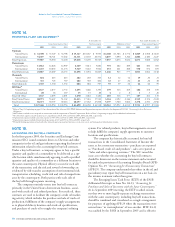

NOTE 14.

PROPERTIES, PLANT AND EQUIPMENT1,2

At December 31 Year ended December 31

Gross Investment at Cost Net Investment Additions at Cost3 Depreciation Expense4,5

2005 2004 2003 2005 2004 2003 2005 2004 2003 2005 2004 2003

Upstream

United States $ 43,390 $ 37,329 $ 34,798 $ 15,327 $ 10,047 $ 9,953 $ 2,160 $ 1,584 $ 1,776 $ 1,869 $ 1,508 $ 1,815

International 54,497 38,721 37,402 34,311 21,192 20,572 4,897 3,090 3,246 2,804 2,180 2,227

Total Upstream 97,887 76,050 72,200 49,638 31,239 30,525 7,057 4,674 5,022 4,673 3,688 4,042

Downstream

United States 13,832 12,826 12,959 6,169 5,611 5,881 793 482 389 461 490 493

International 11,235 10,843 11,174 5,529 5,443 5,944 453 441 388 550 572 655

Tot al Downstrea m 25,067 23,669 24,133 11,698 11,054 11,825 1,246 923 777 1,011 1,062 1,148

Chemicals

United States 624 615 613 282 292 303 12 12 12 19 20 21

International 721 725 719 402 392 404 43 27 24 23 26 38

Total Chemicals 1,345 1,340 1,332 684 684 707 55 39 36 42 46 59

All Other6

United States 3,127 2,877 2,772 1,655 1,466 1,393 199 314 169 186 158 109

International 20 18 119 15 15 88 4 2 8 1 3 26

Total All Other 3,147 2,895 2,891 1,670 1,481 1,481 203 316 177 187 161 135

Total United States 60,973 53,647 51,142 23,433 17,416 17,530 3,164 2,392 2,346 2,535 2,176 2,438

Total International 66,473 50,307 49,414 40,257 27,042 27,008 5,397 3,560 3,666 3,378 2,781 2,946

Total $ 127,446 $ 103,954 $ 100,556 $ 63,690 $ 44,458 $ 44,538 $ 8,561 $ 5,952 $ 6,012 $ 5,913 $ 4,957 $ 5,384

1 Refer to Note 24, beginning on page 83, for a discussion of the effect on 2003 PP&E balances and depreciation expenses related to the adoption of FAS 143, “Accounting for Asset Retirement

Obligations.”

2 2005 balances include assets acquired in connection with the acquisition of Unocal Corporation. Refer to Note 2, beginning on page 60, for additional information.

3 Net of dry hole expense related to prior years’ expenditures of $28, $58 and $124 in 2005, 2004 and 2003, respectively.

4 Depreciation expense includes accretion expense of $187, $93 and $132 in 2005, 2004 and 2003, respectively.

5 Depreciation expense includes discontinued operations of $22 and $58 in 2004 and 2003, respectively.

6 Primarily mining operations of coal and other minerals, power generation businesses, real estate assets and management information systems.

NOTE 15.

ACCOUNTING FOR BUY/SELL CONTRACTS

In the fi rst quarter 2005, the Securities and Exchange Com-

mission (SEC) issued comment letters to Chevron and other

companies in the oil and gas industry requesting disclosure of

information related to the accounting for buy/sell contracts.

Under a buy/sell contract, a company agrees to buy a specifi c

quantity and quality of a commodity to be delivered at a spe-

cifi c location while simultaneously agreeing to sell a specifi ed

quantity and quality of a commodity at a different location to

the same counterparty. Physical delivery occurs for each side

of the transaction, and the risk and reward of ownership are

evidenced by title transfer, assumption of environmental risk,

transportation scheduling, credit risk and risk of nonperform-

ance by the counterparty. Both parties settle each side of

the buy/sell through separate invoicing.

The company routinely enters into buy/sell contracts,

primarily in the United States downstream business, associ-

ated with crude oil and refi ned products. For crude oil, these

contracts are used to facilitate the company’s crude oil market-

ing activity, which includes the purchase and sale of crude oil

production, fulfi llment of the company’s supply arrangements

as to physical delivery location and crude oil specifi cations,

and purchase of crude oil to supply the company’s refi ning

Notes to the Consolidated Financial Statements

Millions of dollars, except per-share amounts

system. For refi ned products, buy/sell arrangements are used

to help fulfi ll the company’s supply agreements to customer

locations and specifi cations.

The company has historically accounted for buy/sell

transactions in the Consolidated Statement of Income the

same as for a monetary transaction – purchases are reported

as “Purchased crude oil and products”; sales are reported as

“Sales and other operating revenues.” The SEC raised the

issue as to whether the accounting for buy/sell contracts

should be shown net on the income statement and accounted

for under the provisions of Accounting Principles Board (APB)

Opinion No. 29, “Accounting for Nonmonetary Transactions”

(APB 29). The company understands that others in the oil and

gas industry may report buy/sell transactions on a net basis in

the income statement rather than gross.

The Emerging Issues Task Force (EITF) of the FASB

deliberated this topic as Issue No. 04-13, “Accounting for

Purchases and Sales of Inventory with the Same Counterparty.”

At its September 2005 meeting, the EITF reached consen-

sus that two or more legally separate exchange transactions

with the same counterparty, including buy/sell transactions,

should be combined and considered as a single arrangement

for purposes of applying APB 29 when the transactions were

entered into “in contemplation” of one another. EITF 04-13

was ratifi ed by the FASB in September 2005 and is effective