Chevron 2005 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2005 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CHEVRON CORPORATION 2005 ANNUAL REPORT 73

NOTE 17. SHORT-TERM DEBT – Continued

At December 31, 2005 and 2004, the company clas-

sifi ed $4,850 and $ 4,735, respectively, of short-term debt as

long-term. Settlement of these obligations is not expected to

require the use of working capital in 2006, as the company

has both the intent and the ability to refi nance this debt on

a long-term basis.

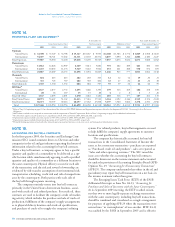

NOTE 18.

LONG-TERM DEBT

Chevron has three “shelf” registration statements on fi le

with the SEC that together would permit the issuance of

$3,800 of debt securities pursuant to Rule 415 of the Secu-

rities Act of 1933. Total long-term debt, excluding capital

leases, at December 31, 2005, was $11,807, which included

$1,861 assumed in connection with the acquisition of

Unocal. The company’s long-term debt outstanding at

year-end 2005 and 2004 was as follows:

At December 31

2005 2004

3.5% notes due 2007 $ 1,992 $ 1,995

3.375% notes due 2008 736 754

7.5% debentures due 20291 475 –

5.05% debentures due 20121 412 –

5.5% notes due 2009 406 422

7.35% debentures due 20091 347 –

7% debentures due 20281 259 –

9.75% debentures due 2020 250 250

7.327% amortizing notes due 20142 247 360

Fixed interest rate notes, maturing from

2006 to 2015 (8.1%)1,3 241 –

8.625% debentures due 2031 199 199

8.625% debentures due 2032 199 199

7.5% debentures due 2043 198 198

Fixed and fl oating interest rate loans due

2007 to 2009 (4.4%)1,3 194 –

9.125% debentures due 20061 167 –

8.625% debentures due 2010 150 150

8.875% debentures due 2021 150 150

8% debentures due 2032 148 148

7.09% notes due 2007 144 144

8.25% debentures due 2006 129 129

Medium-term notes, maturing from

2017 to 2043 (7.5%)3 210 210

Other foreign currency obligations (3.2%)3 30 39

5.7% notes due 2008 – 206

Other long-term debt (6.4%)3 141 262

Total including debt due within one year 7,424 5,815

Debt due within one year (467) (333)

Reclassifi ed from short-term debt 4,850 4,735

Total long-term debt $ 11,807 $ 10,217

1 Debt assumed with acquisition of Unocal in 2005.

2 Guarantee of ESOP debt.

3

Less than $100 individually; weighted-average interest rate at December 31, 2005.

Consolidated long-term debt maturing after Dec ember 31,

2005, is as follows: 2006 – $467; 2007 – $2,287; 2008 – $856;

2009 – $782; and 2010 – $176; after 2010 – $2,856.

In October 2005, the company fully redeemed Pure

Resources 7.125 percent Senior Notes due 2011 for $395.

The company’s $150 of Texaco Brasil zero coupon notes were

paid at maturity in November 2005. In December 2005, the

company exercised a par call redemption of $200 for Texaco

Capital Inc. 5.7 percent Notes due 2008.

In January 2005, the company contributed $98 to permit

the ESOP to make a principal payment of $113.

NOTE 19.

NEW ACCOUNTING STANDARDS

FASB Statement No. 151, “Inventory Costs, an Amendment of

ARB No. 43, Chapter 4” (FAS 151) In November 2004, the

FASB issued FAS 151, which became effective for the com-

pany on January 1, 2006. The standard amends the guidance

in Accounting Research Bulletin (ARB) No. 43, Chapter 4,

“Inventory Pricing,” to clarify the accounting for abnormal

amounts of idle facility expense, freight, handling costs and

spoilage. In addition, the standard requires that allocation of

fi xed production overheads to the costs of conversion be based

on the normal capacity of the production facilities. The adop-

tion of this standard will not have an impact on the company’s

results of operations, fi nancial position or liquidity.

EITF Issue No. 04-6, “Accounting for Stripping Costs Incurred

During Production in the Mining Industry” (Issue 04-6) In

March 2005, the FASB ratifi ed the earlier EITF consensus on

Issue 04-6, which became effective for the company on January 1,

2006. Stripping costs are costs of removing overburden and

other waste materials to access mineral deposits. The consen-

sus calls for stripping costs incurred once a mine goes into

production to be treated as variable production costs that

should be considered a component of mineral inventory cost

subject to ARB No. 43, “Restatement and Revision of Account-

ing Research Bulletins.” Adoption of this accounting for its

coal, oil sands and other mining operations will not have

a signifi cant effect on the company’s results of operations,

fi nancial position or liquidity.

NOTE 20.

ACCOUNTING FOR SUSPENDED EXPLORATORY WELLS

Refer to Note 1, beginning on page 58, in the section “Proper-

ties, Plant and Equipment” for a discussion of the company’s

accounting policy for the cost of exploratory wells. The

company’s suspended wells are reviewed in this context on a

quarterly basis.

In April 2005, the FASB issued FASB Staff Position

(FSP) FAS 19-1, “Accounting for Suspended Well Costs,” which

amended FAS 19, “Financial Accounting and Reporting by Oil

and Gas Producing Companies.” The company elected early

application of this guidance with the fi rst quarter 2005 fi nan-

cial statements.

Under the provisions of FSP FAS 19-1, exploratory

well costs continue to be capitalized after the completion of

drilling when (a) the well has found a suffi cient quantity of

reserves to justify completion as a producing well and (b) the

enterprise is making suffi cient progress assessing the reserves

and the economic and operating viability of the project.