Chevron 2005 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2005 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

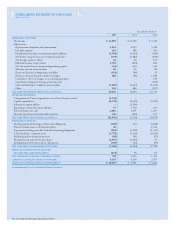

2005 2004 2003

Shares Amount Shares Amount Shares Amount

PREFERRED STOCK – $ – – $ – – $ –

COMMON STOCK1

Balance at January 1 2,274,032 $ 1,706 2,274,042 $ 1,706 2,274,042 $ 1,706

Shares issued for Unocal acquisition 168,645 126 – –

Conversion of Texaco Inc. acquisition – – (10) – – –

BALANCE AT DECEMBER 31 2,442,677 $ 1,832 2,274,032 $ 1,706 2,274,042 $ 1,706

CAPITAL IN EXCESS OF PAR1

Balance at January 1 $ 4,160 $ 4,002 $ 3,980

Shares issued for Unocal acquisition 9,585 – –

Stock options and restricted stock units 67 – –

Treasury stock transactions 82 158 22

BALANCE AT DECEMBER 31 $ 13,894 $ 4,160 $ 4,002

RETAINED EARNINGS

Balance at January 1 $ 45,414 $ 35,315 $ 30,942

Net income 14,099 13,328 7,230

Cash dividends on common stock (3,778) (3,236) (3,033)

Tax benefi t from dividends paid on

unallocated ESOP shares and other 3 7 6

Exchange of Dynegy securities – – 170

BALANCE AT DECEMBER 31 $ 55,738 $ 45,414 $ 35,315

NOTES RECEIVABLE – KEY EMPLOYEES $ (3) $ – $ –

ACCUMULATED OTHER COMPREHENSIVE LOSS

Currency translation adjustment

Balance at January 1 $ (140) $ (176) $ (208)

Change during year

2 (5) 36 32

Balance at December 31 $ (145) $ (140) $ (176)

Minimum pension liability adjustment

Balance at January 1 $ (402) $ (874) $ (876)

Change during year 58 472 2

Balance at December 31 $ (344) $ (402) $ (874)

Unrealized net holding gain on securities

Balance at January 1 $ 120 $ 129 $ 49

Change during year (32) (9) 80

Balance at December 31 $ 88 $ 120 $ 129

Net derivatives gain (loss) on hedge transactions

Balance at January 1 $ 103 $ 112 $ 37

Change during year

2 (131) (9) 75

Balance at December 31 $ (28) $ 103 $ 112

BALANCE AT DECEMBER 31 $ (429) $ (319) $ (809)

DEFERRED COMPENSATION AND BENEFIT PLAN TRUST

DEFERRED COMPENSATION

Balance at January 1 $ (367) $ (362) $ (412)

Net reduction of ESOP debt and other 121 (5) 50

BALANCE AT DECEMBER 31 (246) (367) (362)

BENEFIT PLAN TRUST (COMMON STOCK)1 14,168 (240) 14,168 (240) 14,168 (240)

BALANCE AT DECEMBER 31 14,168 $ (486) 14,168 $ (607) 14,168 $ (602)

TREASURY STOCK AT COST1

Balance at January 1 166,912 $ (5,124) 135,747 $ (3,317) 137,769 $ (3,374)

Purchases 52,013 (3,029) 42,607 (2,122) 81 (3)

Issuances – mainly employee benefit plans (8,935) 283 (11,442) 315 (2,103) 60

BALANCE AT DECEMBER 31 209,990 $ (7,870) 166,912 $ (5,124) 135,747 $ (3,317)

TOTAL STOCKHOLDERS’ EQUITY AT DECEMBER 31 $ 62,676 $ 45,230 $ 36,295

1 2003 restated to refl ect a two-for-one stock split effected as a 100 percent stock dividend in September 2004.

2 Includes Unocal balances at December 31, 2005.

See accompanying Notes to the Consolidated Financial Statements.

CONSOLIDATED STATEMENT OF STOCKHOLDERS’ EQUITY

Shares in thousands; amounts in millions of dollars

CHEVRON CORPORATION 2005 ANNUAL REPORT 57