Chevron 2005 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2005 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

46 CHEVRON CORPORATION 2005 ANNUAL REPORT

future to: prevent, control, reduce or eliminate releases of

hazardous materials into the environment; comply with exist-

ing and new environmental laws or regulations; or remediate

and restore areas damaged by prior releases of hazardous

materials. Although these costs may be signifi cant to the

results of operations in any single period, the company does

not expect them to have a material effect on the company’s

liquidity or fi nancial position.

CRITICAL ACCOUNTING ESTIMATES AND ASSUMPTIONS

Management makes many estimates and assumptions in

the application of generally accepted accounting principles

(GAAP) that may have a material impact on the company’s

consolidated fi nancial statements and related disclosures

and on the comparability of such information over different

reporting periods. All such estimates and assumptions affect

reported amounts of assets, liabilities, revenues and expenses,

as well as disclosures of contingent assets and liabilities.

Estimates and assumptions are based on management’s expe-

rience and other information available prior to the issuance

of the fi nancial statements. Materially different results can

occur as circumstances change and additional information

becomes known.

The discussion in this section of “critical” accounting

estimates or assumptions is according to the disclosure guide-

lines of the Securities and Exchange Commission (SEC),

wherein:

1. the nature of the estimates or assumptions is material

due to the levels of subjectivity and judgment neces-

sary to account for highly uncertain matters, or the

susceptibility of such matters to change;

2. the impact of the estimates and assumptions on the

company’s fi nancial condition or operating perfor-

mance is material.

Besides those meeting these “critical” criteria, the

company makes many other accounting estimates and

assumptions in preparing its fi nancial statements and related

disclosures. Although not associated with “highly uncertain

matters,” these estimates and assumptions are also subject to

revision as circumstances warrant, and materially different

results may sometimes occur.

For example, the recording of deferred tax assets

requires an assessment under the accounting rules that the

future realization of the associated tax benefi ts be “more

likely than not.” Another example is the estimation of oil

and gas reserves under SEC rules that require “...geological

and engineering data (that) demonstrate with reasonable

certainty (reserves) to be recoverable in future years from

known reservoirs under existing economic and operating

conditions, i.e., prices and costs as of the date the estimate

is made.” Refer to Table V, “Reserve Quantity Information,”

beginning on page 94, for the changes in these estimates

for the three years ending December 31, 2005, and to Table

VII, “Changes in the Standardized Measure of Discounted

Future Net Cash Flows From Proved Reserves” on page 102

for estimates of proved-reserve values for each of the three

years ending December 31, 2003 through 2005, which were

based on year-end prices at the time. Note 1 to the Consoli-

dated Financial Statements, beginning on page 58, includes a

description of the “successful efforts” method of accounting

for oil and gas exploration and production activities. The

estimates of crude oil and natural gas reserves are important

to the timing of expense recognition for costs incurred.

The discussion of the critical accounting policy for

“Impairment of Property, Plant and Equipment and Invest-

ments in Affi liates,” on page 47, includes reference to

conditions under which downward revisions of proved

reserve quantities could result in impairments of oil and gas

properties. This commentary should be read in conjunc-

tion with disclosures elsewhere in this discussion and in the

Notes to the Consolidated Financial Statements related to

estimates, uncertainties, contingencies and new accounting

standards. Signifi cant accounting policies are discussed in

Note 1 to the Consolidated Financial Statements, beginning

on page 58. The development and selection of accounting

estimates and assumptions, including those deemed “criti-

cal,” and the associated disclosures in this discussion have

been discussed by management with the audit committee of

the Board of Directors.

The areas of accounting and the associated “critical” esti-

mates and assumptions made by the company are as follows:

Pension and Other Postretirement Benefi t Plans The

determination of pension plan expense is based on a num-

ber of actuarial assumptions. Two critical assumptions are

the expected long-term rate of return on plan assets and

the discount rate applied to pension plan obligations. For

other postretirement employee benefi t (OPEB) plans, which

provide for certain health care and life insurance benefi ts

for qualifying retired employees and which are not funded,

critical assumptions in determining OPEB expense are the

discount rate applied to benefi t obligations and the assumed

health care cost-trend rates used in the calculation of benefi t

obligations.

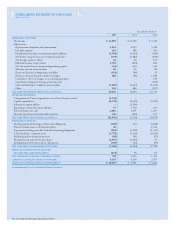

Note 21, beginning on page 74, includes information for

the three years ending December 31, 2005, on the compo-

nents of pension and OPEB expense and on the underlying

assumptions as well as on the funded status for the compa-

ny’s pension plans at the end of 2005 and 2004.

To estimate the long-term rate of return on pension

assets, the company employs a rigorous process that incorpo-

rates actual historical asset-class returns and an assessment

of expected future performance and takes into consider-

ation external actuarial advice and asset-class factors. Asset

allocations are periodically updated using pension plan asset/

liability studies, and the determination of the company’s esti-

mates of long-term rates of return are consistent with these