Chevron 2005 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2005 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CHEVRON CORPORATION 2005 ANNUAL REPORT 79

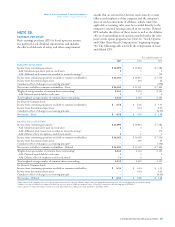

Cash paid to settle performance units and stock appre-

ciation rights was $110, $23 and $11 for 2005, 2004 and

2003, respectively. Cash paid in 2005 included $73 million for

Unocal awards paid under change-in-control plan provisions.

At adoption of FAS 123R, the impact of measuring

stock appreciation rights at fair value instead of intrinsic

value resulted in an insignifi cant charge against income in

the third quarter 2005. For restricted stock units, FAS 123R

required that unrecognized compensation amounts presented

in “Deferred compensation and benefi t plan trust” on the

Consolidated Balance Sheet be reclassifi ed against the appropri-

ate equity accounts. This resulted in a reclassifi cation of $7 to

“Capital in excess of par value.”

Prior to the adoption of FAS 123R, the company pre-

sented all tax benefi ts of deductions resulting from the exercise

of stock options as operating cash fl ows in the Consolidated

Statement of Cash Flows. FAS 123R requires the cash fl ow

resulting from the tax deductions in excess of the compensa-

tion cost recognized for those options (excess tax benefi ts) to be

classifi ed as fi nancing cash fl ows. Refer to Note 3, beginning on

page 61, for information on excess tax benefi ts.

In November 2005, the FASB issued a Staff Position FAS

123R-3 (FSP FAS 123R-3), “Transition Election Related to

Accounting for the Tax Effects of Share-Based Payment Awards,”

which provides a one-time transition election for companies

to follow in calculating the beginning balance of the pool of

excess tax benefi ts related to employee compensation and a

simplifi ed method to determine the subsequent impact on the

pool of employee awards that are fully vested and outstanding

upon the adoption of FAS 123R. Under the FSP, the com-

pany must decide by November 2006 whether to make this

one-time transition election, which may provide some adminis-

trative relief in calculating the future tax effects of stock option

issuances. Whether or not the one-time election is made, the

company anticipates no signifi cant difference in the amount of

tax expense recorded in future periods.

In the discussion below, the references to share price

and number of shares have been adjusted for the two-for-one

stock split in September 2004.

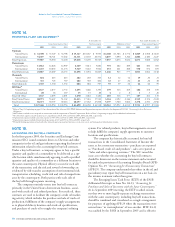

Chevron Long-Term Incentive Plan (LTIP) Awards under

the LTIP may take the form of, but are not limited to, stock

options, restricted stock, restricted stock units, stock appre-

ciation rights, performance units and non-stock grants. For

a 10-year period after April 2004, no more than 160 mil-

lion shares may be issued under the LTIP, and no more than

64 million of those shares may be in a form other than a stock

option, stock appreciation right or award requiring full payment

for shares by the award recipient.

Stock options and stock appreciation rights granted

under the LTIP extend for 10 years from grant date. Effective

with options granted in June 2002, one-third of each award

vests on the fi rst, second and third anniversaries of the date

of grant. Prior to this change, options granted by Chevron

vested one year after the date of grant. Performance units

granted under the LTIP extend for 3 years from grant date

and are settled in cash at the end of the period. Settlement

amounts are based on achievement of performance targets

relative to major competitors over the period, and payments are

indexed to the company’s stock price.

Texaco Stock Incentive Plan (Texaco SIP) On the closing

of the acquisition of Texaco in October 2001, outstand-

ing options granted under the Texaco SIP were converted

to Chevron options. These options retained a provision for

being restored, which enables a participant who exercises

a stock option to receive new options equal to the number

of shares exchanged or who has shares withheld to satisfy

tax withholding obligations to receive new options equal to

the number of shares exchanged or withheld. The restored

options are fully exercisable six months after the date of

grant, and the exercise price is the market value of the com-

mon stock on the day the restored option is granted. Apart

from the restored options, no further awards may be granted

under the former Texaco plans.

Unocal Share-Based Plans (Unocal Plans) On the closing of

the acquisition of Unocal in August 2005, outstanding stock

options and stock appreciation rights granted under vari-

ous Unocal Plans were exchanged for fully vested Chevron

options at a conversion ratio of 1.07 Chevron shares for each

Unocal share. These awards retained the same provisions

as the original Unocal Plans. Awards issued prior to 2004

generally may be exercised for up to 3 years after termination

of employment (depending upon the terms of the individual

award agreements), or the original expiration date, whichever

is earlier. Awards issued since 2004 generally remain exercis-

able until the end of the normal option term if termination

of employment occurs prior to August 10, 2007. Other

awards issued under the Unocal Plans, including restricted

stock, stock units, restricted stock units and performance

shares, became vested at the acquisition date, and shares or

cash were issued to recipients in accordance with change-in-

control provisions of the plans.

NOTE 22. STOCK OPTIONS AND OTHER SHARE-BASED

COMPENSATION – Continued