Chevron 2005 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2005 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CHEVRON CORPORATION 2005 ANNUAL REPORT 33

sales and the effect of higher prices on cost-recovery and

variable-royalty provisions of certain contracts, oil-equivalent

production in 2005 was essentially the same as 2004 and 2003.

The net liquids component of oil-equivalent production

was 1.4 million barrels per day in 2005, unchanged from

2004 and 2003. Excluding the effects of Unocal production,

property sales and the effect of higher prices on cost-recovery

and variable-royalty volumes, 2005 net liquids production

was essentially the same as 2004 and decreased 1 percent

from 2003.

Net natural gas production of 2.6 billion cubic feet per

day in 2005 was up 25 percent and 26 percent from 2004

and 2003, respectively. Excluding the effect of production

from the Unocal properties, production increased 2 percent

and 3 percent from 2004 and 2003, respectively.

Refer to the “Selected Operating Data” table, on page

36, for the three-year comparative of international produc-

tion volumes.

No special items were recorded in 2005. Special-item

gains in 2004 included $585 million from the sale of produc-

ing properties in western Canada and $266 million from

the sale of other nonstrategic assets, including the company’s

operations in the Democratic Republic of the Congo and

a Canadian natural-gas processing business. In 2003, net

special-item gains of $98 million included benefi ts of $150

million related to income taxes and property sales, partially

offset by asset impairments and charges for employee termi-

nation costs.

U.S. Downstream – Refining, Marketing and Transportation

Millions of dollars 2005 2004 2003

Income* $ 980 $ 1,261 $ 482

*Includes Special-Item Gains (Charges):

Asset Dispositions $ – $ – $ 37

Environmental Remediation Provisions – – (132)

Restructuring and Reorganizations – – (28)

Total $ – $ – $ (123)

U.S. downstream earnings of nearly $1 billion in 2005

decreased about $300 million from 2004 and were up $500

million from 2003. Results in 2003 included net special-

item charges (discussed below) of $123 million. Average

refi ned-product margins in 2005 were higher than in 2004,

and margins in 2004 were signifi cantly higher than in 2003.

However, the effects of increased downtime at refi neries and

other facilities and higher fuel costs dampened earnings in

2005. A portion of the downtime in 2005 was associated

with hurricanes in the Gulf of Mexico. As a result of the

storms, the company’s refi nery in Pascagoula, Mississippi,

was shut down for more than a month, and the company’s

marketing and pipeline operations along the Gulf Coast were

also disrupted for an extended period.

Sales volumes of refi ned products in 2005 were approxi-

mately 1.5 million barrels per day, or about 2 percent lower

than in 2004. Branded gasoline sales volumes of approxi-

mately 600,000 barrels per day increased about 4 percent

from the 2004 period. In 2004, refi ned-product sales volumes

increased about 5 percent from 2003, primarily due to higher

sales of gasoline, diesel fuel and fuel oil. Refer to the “Selected

Operating Data” table, on page 36, for the three-year com-

parative refi ned-product sales volumes in the United States.

In 2003, net special-item charges of $123 million

included $132 million for environmental remediation and

$28 million for employee severance costs associated with the

global downstream restructuring and reorganization. These

charges were partially offset by net gains of $37 million from

asset sales.

International Downstream – Refining, Marketing and Transportation

Millions of dollars 2005 2004 2003

Income1,2 $ 1,786 $ 1,989 $ 685

1 Includes Foreign Currency Effects: $ (24) $ 7 $ (141)

2 Includes Special-Item Charges:

Asset Dispositions $ – $ – $ (24)

Asset Impairments/Write-offs – – (123)

Restructuring and Reorganizations – – (42)

Total $ – $ – $ (189)

The international downstream includes the company’s

consolidated refi ning and marketing businesses, non-U.S. ship-

ping operations, non-U.S. supply and trading activities, and

equity earnings of affi liates, primarily in the Asia-Pacifi c region.

Income of nearly $1.8 billion in 2005 decreased 10

percent from $2 billion in 2004 but was up about $1.1 bil-

lion from 2003. The decrease from the 2004 period was

due mainly to lower sales volumes, higher costs for fuel and

transportation, expenses associated with an explosion and fi re

at a 40 percent-owned, nonoperated terminal in the United

Kingdom, and tax adjustments in various countries. These

items more than offset an improvement in average refi ned-

product margins between periods. The $1.3 billion increase

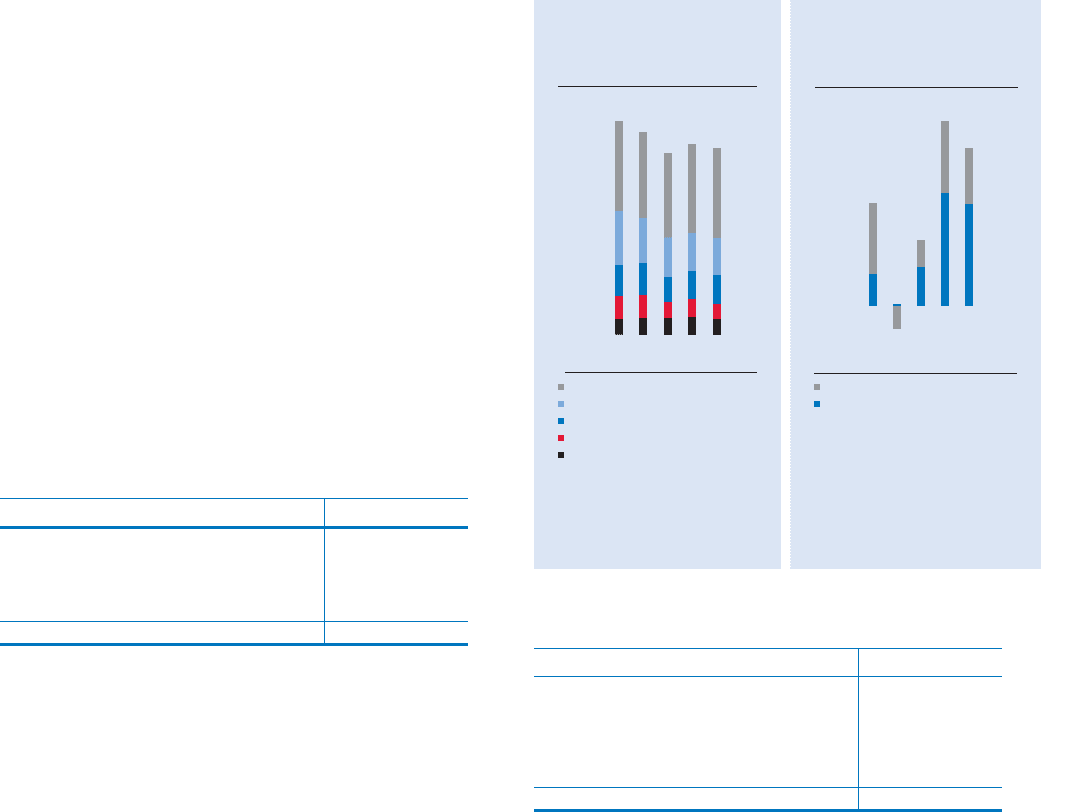

0

1800

1500

1200

900

600

300

1,473

U.S. GASOLINE &

OTHER REFINED

PRODUCTS SALES*

Thousands of barrels per day

Gasoline

Jet Fuel

Gas Oils & Kerosene

Residual Fuel Oil

Other

Refined products sales volumes

declined about 2 percent from

2004, with lower sales of fuel

oils and other products.

*Includes equity in affiliates

0201 03 04 05

-0.5

3.5

3.0

2.5

0.0

0.5

2.0

1.0

1.5

0201 03 04 05

$2.8

WORLDWIDE REFINING,

MARKETING &

TRANSPORTATION EARNINGS

Billions of dollars

Downstream earnings declined

due to lower international margins

for refined products and U.S.

refinery downtime.

United States

International