Chevron 2005 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2005 Chevron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

66 CHEVRON CORPORATION 2005 ANNUAL REPORT

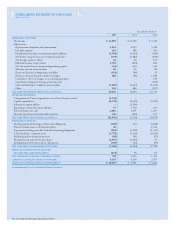

NOTE 8. OPERATING SEGMENTS AND

GEOGRAPHIC DATA – Continued

Year ended December 31

2005 2004 2003

Upstream – Exploration and

Production

United States $ 16,044 $ 8,242 $ 6,842

Intersegment 8,651 8,121 6,295

Total United States 24,695 16,363 13,137

International 10,190 7,246 7,013

Intersegment 13,652 10,184 8,142

Total International 23,842 17,430 15,155

Total Upstream 48,537 33,793 28,292

Downstream – Refi ning,

Marketing and Transportation

United States 73,721 57,723 44,701

Excise taxes 4,521 4,147 3,744

Intersegment 535 179 225

Total United States 78,777 62,049 48,670

International 83,223 67,944 52,486

Excise taxes 4,184 3,810 3,342

Intersegment 14 87 46

Total International 87,421 71,841 55,874

Total Downstream 166,198 133,890 104,544

Chemicals

United States 343 347 323

Intersegment 241 188 129

Total United States 584 535 452

International 760 747 677

Excise taxes 14 11 9

Intersegment 131 107 83

Total International 905 865 769

Total Chemicals 1,489 1,400 1,221

All Other

United States 597 551 338

Intersegment 514 431 121

Total United States 1,111 982 459

International 44 97 100

Intersegment 26 16 4

Total International 70 113 104

Total All Other 1,181 1,095 563

Segment Sales and Other

Operating Revenues

United States 105,167 79,929 62,718

International 112,238 90,249 71,902

Total Segment Sales and Other

Operating Revenues 217,405 170,178 134,620

Elimination of intersegment sales (23,764) (19,313) (15,045)

Total Sales and Other

Operating Revenues* $ 193,641 $ 150,865 $ 119,575

* Includes buy/sell contracts of $23,822 in 2005, $18,650 in 2004 and $14,246 in 2003.

Substantially all of the amounts in each period relates to the downstream segment. Refer to

Note 15, beginning on page 70, for a discussion of the company’s accounting for buy/sell

contracts.

Segment Income Taxes Segment income tax expenses for the

years 2005, 2004 and 2003 are as follows:

Year ended December 31

2005 2004 20031

Upstream – Exploration and

Production

United States $ 2,330 $ 2,308 $ 1,853

International 8,440 5,041 3,831

Total Upstream 10,770 7,349 5,684

Downstream – Refi ning,

Marketing and Transportation

United States 575 739 300

International 576 442 275

Total Downstream 1,151 1,181 575

Chemicals

United States 99 47 (25)

International 25 17 6

Total Chemicals 124 64 (19)

All Other (947) (1,077) (946)

Income Tax Expense From

Continuing Operations2 $ 11,098 $ 7,517 $ 5,294

1 See Note 24, beginning on page 83, for information concerning the cumulative effect of

changes in accounting principles due to the adoption of FAS 143, “Accounting for Asset

Retirement Obligations.”

2 Income tax expense of $100 and $50 related to discontinued operations for 2004 and

2003, respectively, is not included.

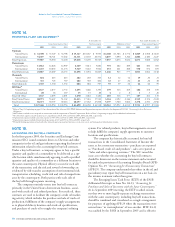

Other Segment Information Additional information for

the segmentation of major equity affiliates is contained in

Note 13, beginning on page 68. Information related to proper-

ties, plant and equipment by segment is contained in Note 14,

on page 70.

NOTE 9.

LITIGATION

Chevron and many other companies in the petroleum industry

have used methyl tertiary butyl ether (MTBE) as a gasoline

additive. Chevron is a party to more than 70 lawsuits and

claims, the majority of which involve numerous other petro-

leum marketers and refi ners, related to the use of MTBE in

certain oxygenated gasolines and the alleged seepage of MTBE

into groundwater. Resolution of these actions may ultimately

require the company to correct or ameliorate the alleged effects

on the environment of prior release of MTBE by the company

or other parties. Additional lawsuits and claims related to the

use of MTBE, including personal-injury claims, may be fi led in

the future.

The company’s ultimate exposure related to these lawsuits

and claims is not currently determinable, but could be material

to net income in any one period. The company does not use

MTBE in the manufacture of gasoline in the United States.

NOTE 10.

LEASE COMMITMENTS

Certain noncancelable leases are classifi ed as capital leases,

and the leased assets are included as part of “Properties, plant

and equipment, at cost.” Such leasing arrangements involve

tanker charters, crude oil production and processing equip-

ment, service stations, and other facilities. Other leases are

classifi ed as operating leases and are not capitalized. The pay-

Notes to the Consolidated Financial Statements

Millions of dollars, except per-share amounts