Zynga 2014 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2014 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

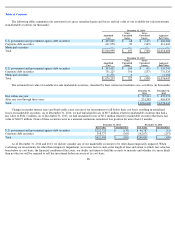

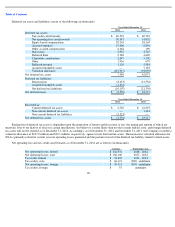

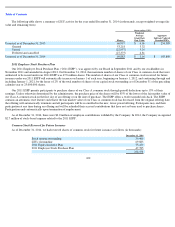

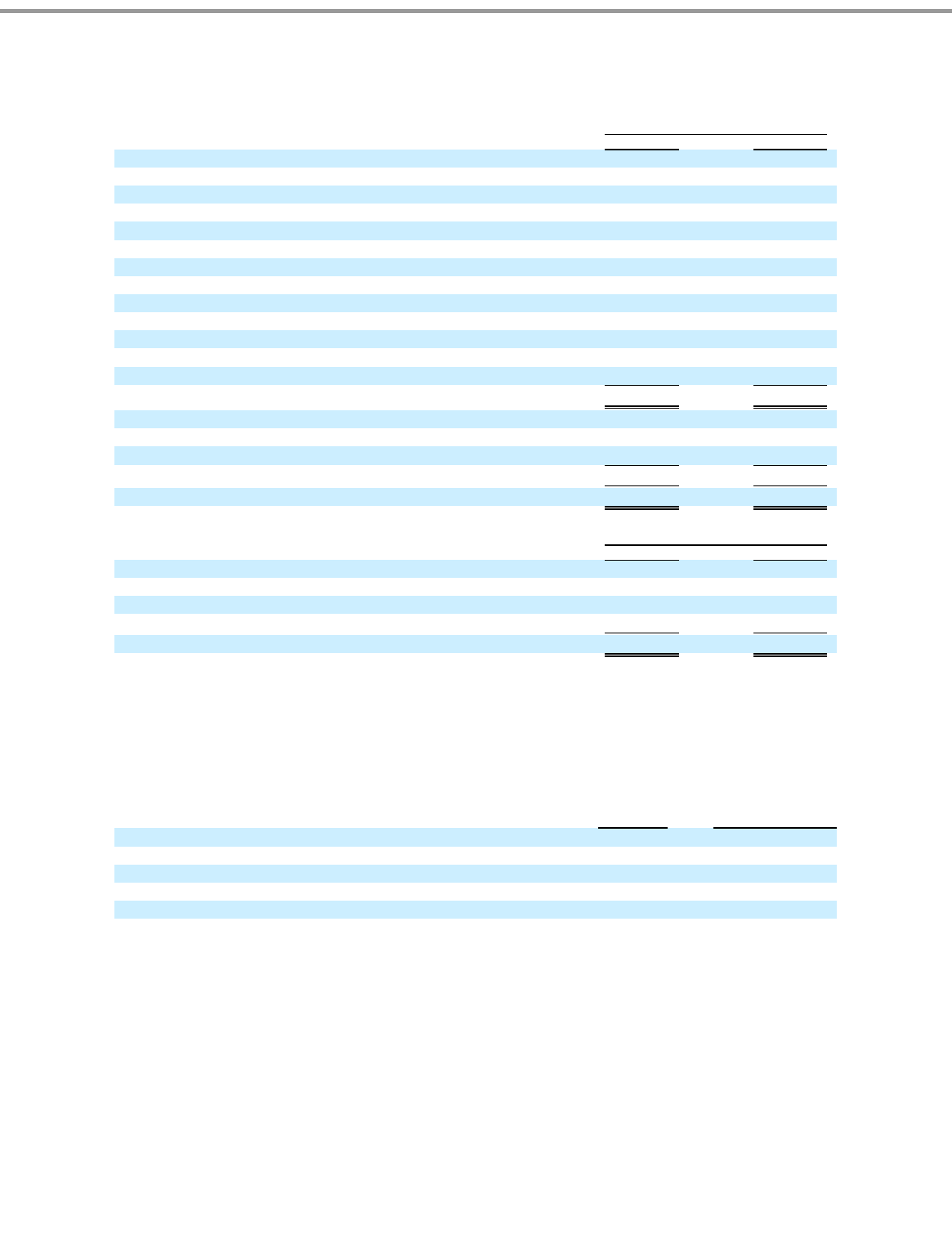

Deferred tax assets and liabilities consist of the following (in thousands):

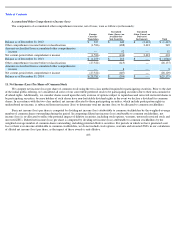

Realization of deferred tax assets is dependent upon the generation of future taxable income, if any, the timing and amount of which are

uncertain. Due to our history of losses in certain jurisdictions, we believe it is more likely than not that certain federal, state, and foreign deferred

tax assets will not be realized as of December 31, 2014. Accordingly, as of December 31, 2014 and December 31, 2013, the Company recorded a

valuation allowance of $127.9 million and $92.1 million, respectively, against its net deferred tax assets. The increase in valuation allowance for

2014 is primarily related to current year net operating losses generated and the partial reversal of the deferred tax liability related to fixed assets.

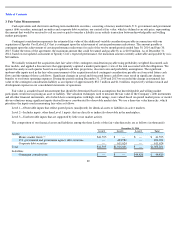

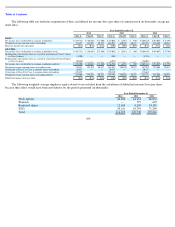

Net operating loss and tax credit carryforwards as of December 31, 2014 are as follows (in thousands):

96

Year Ended December 31,

2014

2013

Deferred tax assets:

Tax credit carryforwards

$

40,501

$

60,745

Net operating loss carryforwards

30,381

14,892

Equity based compensation

28,263

28,164

Accrued expenses

19,406

6,856

Other accrued compensation

6,664

190

State taxes

2,933

2,725

Deferred Rent

2,186

4,620

Charitable contributions

2,047

5,130

Other

1,956

679

Deferred revenue

1,129

5,984

Acquired intangible assets

—

7,183

Valuation allowance

(127,917

)

(92,095

)

Net deferred tax assets

7,549

45,073

Deferred tax liabilities:

Depreciation

(8,453

)

(21,356

)

Acquired intangible assets

(1,654

)

—

Net deferred tax liabilities

(10,107

)

(21,356

)

Net deferred taxes

$

(2,558

)

$

23,717

Year Ended December 31,

2014

2013

Recorded as:

Current deferred tax assets

$

2,765

$

16,293

Non

-

current deferred tax assets

—

7,424

Non

-

current deferred tax liabilities

(5,323

)

—

Net deferred tax assets

$

(2,558

)

$

23,717

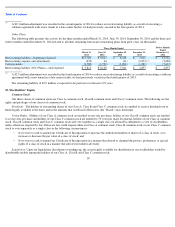

Amount

Expiration years

Net operating losses, federal

$

316,931

2028

-

2034

Net operating losses, state

$

306,100

2017

-

2034

Tax credit, federal

$

78,603

2031

-

2034

Tax credits, state

$

66,113

2020

-

indefinite

Net operating losses, foreign

$

59,513

2030

-

indefinite

Tax credits, foreign

$

55

indefinite