Zynga 2014 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2014 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

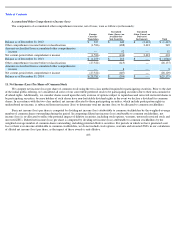

Table of Contents

Preemptive or Similar Rights . None of our Class A, Class B or Class C common stock is entitled to preemptive rights, and neither is

subject to redemption.

Conversion. Our Class A common stock is not convertible into any other shares of our capital stock. Each share of our Class B common

stock and Class C common stock is convertible at any time at the option of the holder into one share of our Class A common stock. In addition,

after the closing of the initial public offering, upon sale or transfer of shares of either Class B common stock or Class C common stock, whether

or not for value, each such transferred share shall automatically convert into one share of Class A common stock, except for certain transfers

described in our amended and restated certificate of incorporation. Our Class B common stock and Class C common stock will convert

automatically into Class A common stock on the date on which the number of outstanding shares of Class B common stock and Class C common

stock together represent less than 10% of the aggregate combined voting power of our capital stock. Once transferred and converted into Class A

common stock, the Class B common stock and Class C common stock may not be reissued.

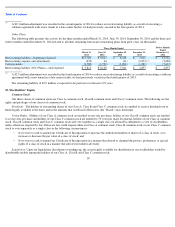

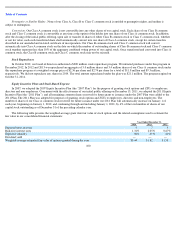

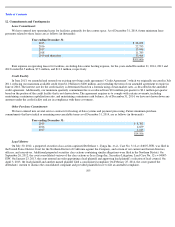

Stock Repurchases

In October 2012, our board of directors authorized a $200 million stock repurchase program. We initiated purchases under this program in

December 2012. In 2012 and 2013 we repurchased an aggregate of 5.0 million shares and 3.4 million shares of our Class A common stock under

this repurchase program at a weighted average price of $2.36 per share and $2.74 per share for a total of $11.8 million and $9.3 million,

respectively. We did not repurchase any shares in 2014. The total amount repurchased under the plan was $21.1 million. The program expired on

October 31, 2014.

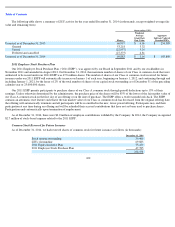

Equity Incentive Plans and Stock-Based Expense

In 2007, we adopted the 2007 Equity Incentive Plan (the “2007 Plan”) for the purpose of granting stock options and ZSUs to employees,

directors and non-

employees. Concurrent with the effectiveness of our initial public offering on December 15, 2011, we adopted the 2011 Equity

Incentive Plan (the “2011 Plan”), and all remaining common shares reserved for future grant or issuance under the 2007 Plan were added to the

2011 Plan. The 2011 Plan was adopted for purposes of granting stock options and ZSUs to employees, directors and non-employees. The

number of shares of our Class A common stock reserved for future issuance under our 2011 Plan will automatically increase on January 1 of

each year, beginning on January 1, 2012, and continuing through and including January 1, 2021, by 4% of the total number of shares of our

capital stock outstanding as of December 31 of the preceding calendar year.

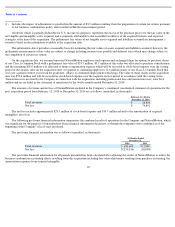

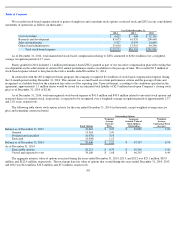

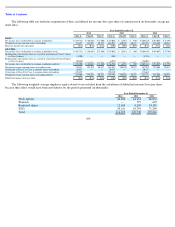

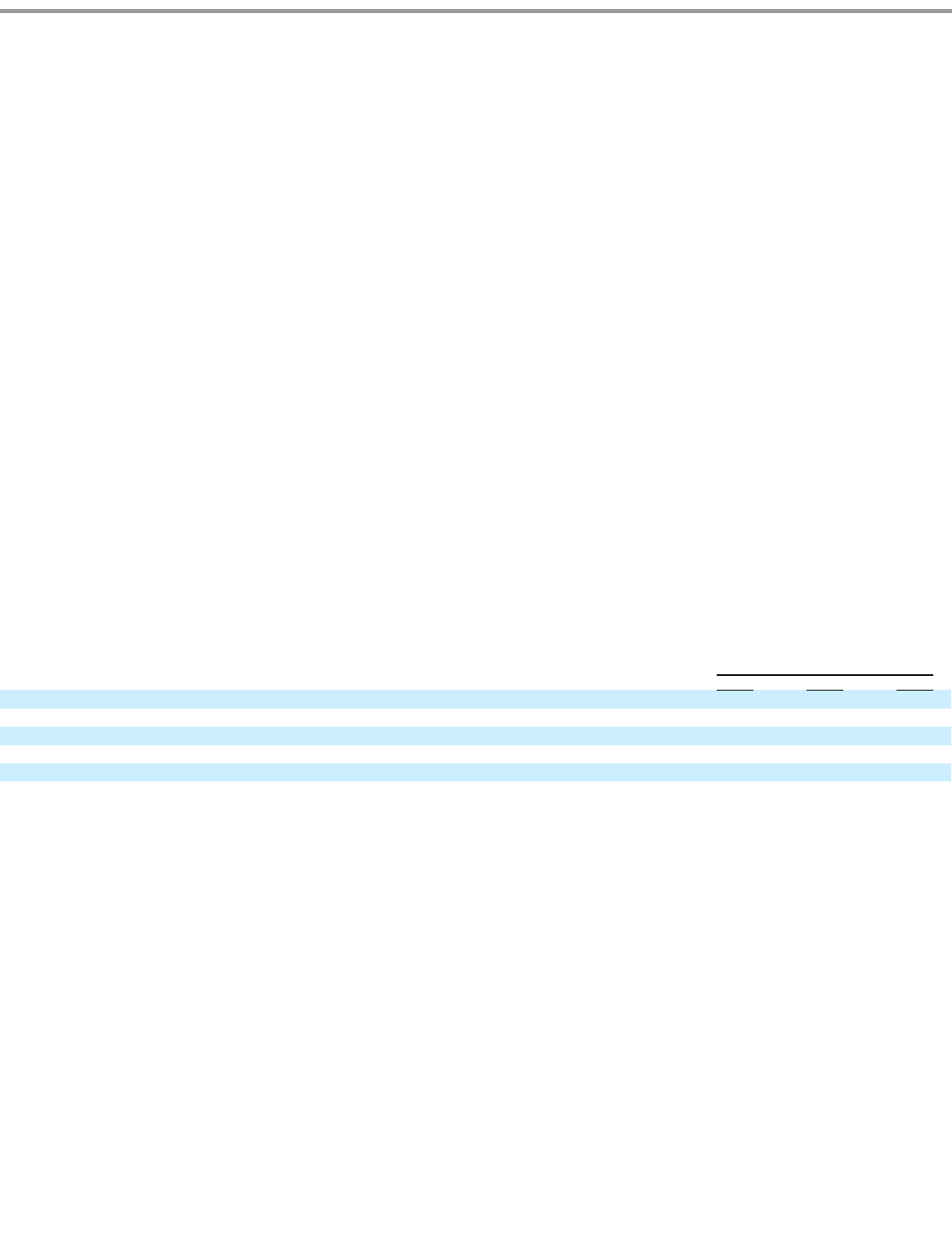

The following table presents the weighted-average grant date fair value of stock options and the related assumptions used to estimate the

fair value in our consolidated financial statements:

100

Year Ended December 31,

2014

2013

2012

Expected term, in years

5

7

6

Risk

-

free interest rates

1.31

%

2.05

%

0.67

%

Expected volatility

56

%

49

%

62

%

Dividend yield

—

—

—

Weighted

-

average estimated fair value of options granted during the year

$

3.44

$

1.82

$

1.58