Zynga 2014 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2014 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

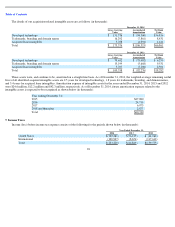

Table of Contents

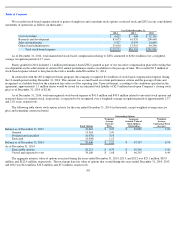

2012 Acquisition of Corporate Headquarters Building

In April, 2012, we purchased our corporate headquarters building located in San Francisco, California from 650 Townsend Associates,

LLC to support the overall growth of our business.

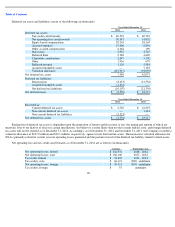

In conjunction with the transaction we recorded a gain of $41.1 million. The gain on the termination of the below-market lease represents

the difference between the contractual minimum rental payments owed under our previously-existing leases and the market rates of those same

leases. In addition to the gain recognized on the termination of the below-market lease, we recognized a gain of $25.1 million from the write-off

of deferred rent liability and we recognized a loss of $46.2 million resulting from the write-off of leasehold improvements, as any value ascribed

to these leasehold improvements were reflected in the fair value of the net tangible and intangible assets acquired. These amounts have been

included in other income (expense), net in our consolidated statements of operations for the period ending December 31, 2012.

Pursuant to the agreement, we also acquired existing third-party leases and other intangible property and terminated our existing office

leases with the seller. We have included the rental income from third party leases with other tenants in the building, and the proportionate share

of building expenses for those leases, in other income (expense), net in our consolidated results of operations from the date of acquisition. These

amounts were not material for the periods presented. The estimated useful life for the building is 39 years and is being amortized on a straight-

line basis.

5. Acquisitions

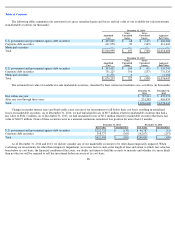

On February 11, 2014, we acquired 100% of the outstanding stock of NaturalMotion, a provider of games for mobile phones and tablets

domiciled in the U.K. We acquired NaturalMotion to leverage their strong portfolio of technology, assembled workforce and existing mobile

games in order to expand and enhance our game offerings particularly on mobile platforms. The acquisition date fair value of the purchase

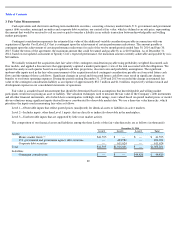

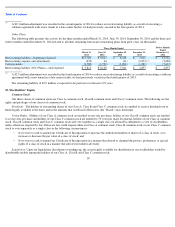

consideration was $522.2 million, which included the following (in thousands):

The value of the purchase consideration attributed to the 28.2 million common shares issued was based on a $4.63 closing price of the

Company’s Class A Common Stock on the date of the closing of the acquisition.

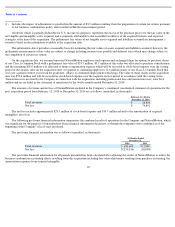

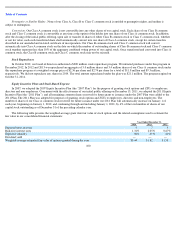

The following table summarizes the preliminary acquisition date fair value of net tangible assets acquired and liabilities assumed from

NaturalMotion (in thousands, unaudited):

91

Fair Value of

Purchase

Consideration

Cash

$

391,000

Common stock (28,178,201 shares)

130,465

Fair value of stock options assumed

693

Total

$

522,158

Preliminary

Estimated

Fair Value

Preliminary

Estimated

Weighted

Average

Useful Life

Tangible net assets (liabilities) assumed(1)

$

1,259

N/A

Intangible assets

Developed technology

59,900

3 years

Branding and trade names

15,000

4.6 years

Goodwill(1)

445,999

N/A

Total

$

522,158