Zynga 2014 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2014 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Factors Affecting Our Performance

Platform agreements. Our games are primarily distributed, marketed and promoted through third parties, primarily Facebook, Apple’

s App

store for iOS and the Google Play App Store for Android devices. Virtual goods for our games purchased through the payment processing

systems of these platform providers. To date, we have generated a significant portion of our bookings, revenue and players through the Facebook

platform and expect to continue to do so for the foreseeable future. We are generating an increasing portion of our bookings, revenue and players

through the Apple App store and Google Play App Store and expect that this trend will continue as we launch more games for mobile devices.

Facebook, Apple and Google generally have the discretion to change their platforms’ terms of service and other policies with respect to us or

other developers in their sole discretion, and those changes may be unfavorable to us.

Launch of new games and release of enhancements. Our bookings and revenue results have been driven by the launch of new mobile and

web games and the release of fresh content and new features in existing games. Our future success depends on our ability to launch and monetize

successful new hit titles on various platforms. Although the amount of revenue and bookings we generate from a new game or an enhancement

to an existing game can vary significantly, we expect our revenue and bookings to be correlated to the success and timely launch of our new

games and our success in releasing engaging content and features. In addition, revenue and bookings from many of our games tend to decline

over time after reaching a peak of popularity and player usage. We often refer to the speed of this decline as the decay rate of a game. As a result

of this decline in the revenue and bookings of our games, our business depends on our ability to consistently and timely launch new games that

achieve significant popularity and have the potential to become franchise games.

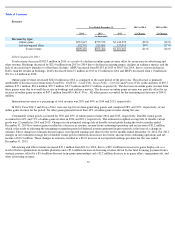

Game monetization . We generate most of our bookings and revenue from the sale of virtual goods in our games. The degree to which our

players choose to pay for virtual goods in our games is driven by our ability to create content and virtual goods that enhance the game-play

experience. Our bookings, revenue and overall financial performance are affected by the number of players and the effectiveness of our

monetization of players through the sale of virtual goods and advertising. For example ABPU increased from $0.053 in the twelve months ended

December 31, 2013 to $0.071 in the twelve months ended December 31, 2014 due to a higher decline in DAU of non-paying players (compared

to paying players) who do not contribute to online game bookings, coupled with an increase in advertising and other revenue. In addition, mobile

and international players have historically monetized at a lower level than web and U.S. players, respectively. The percentage of paying mobile

and international players may increase or decrease based on a number of factors, including growth in mobile games as a percentage of total game

audience and our overall international players, localization of content and the availability of payment options.

Investment in game development . In order to develop new games and enhance the content and features in our existing games, we must

continue to invest in a significant amount of engineering and creative resources. These expenditures generally occur months in advance of the

launch of a new game or the release of new content, and the resulting revenue may not equal or exceed our development costs.

Player acquisition costs. We utilize advertising and other forms of player acquisition and retention to grow and retain our player audience.

These expenditures generally relate to the promotion of new game launches and ongoing performance-based programs to drive new player

acquisition and lapsed player reactivation. Over time, these acquisition and retention-related programs may become either less effective or more

costly, negatively impacting our operating results. Additionally, as our player base becomes more heavily concentrated on mobile platforms, our

ability to drive traffic to our games through unpaid channels may become diminished, and the overall cost of marketing our games may increase.

55

•

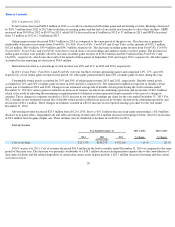

2014 Restructuring.

In the first quarter of 2014, we implemented a restructuring plan that included a reduction in work force and the

closure of certain office and datacenter facilities as part of an overall plan to reduce our long term cost structure. In total, we recorded

restructuring charges of $27.4 million as December 31, 2014 related to the 2014 plan.