Zynga 2014 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2014 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

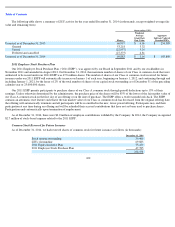

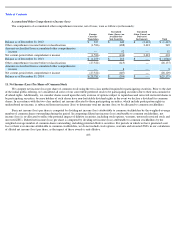

Table of Contents

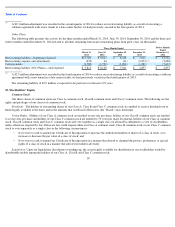

assets, the stock-based compensation expense for unvested stock options assumed and restricted stock awards granted and the related tax effects

as though the acquisition occurred as of the beginning of the periods presented. The pro forma financial information is for informational

purposes only and is not indicative of the results of operations that would have been achieved based on these assumptions.

2013 Acquisitions

On June 19, 2013, we acquired Spooky Cool Labs LLC (“Spooky Cool Labs”), a developer of social casino games, for purchase

consideration of approximately $30.6 million, which consisted of cash paid of $19.8 million and contingent consideration with an acquisition

date fair value of $10.8 million (see Note 3 for changes in this estimate). The contingent consideration may be payable based on the achievement

of certain future performance targets during the two year period following the acquisition date and could be up to $100 million.

For further details on our fair value methodology with respect to contingent consideration liabilities, see Note 3—Fair Value.

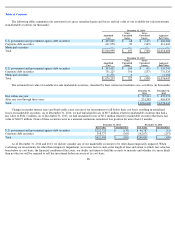

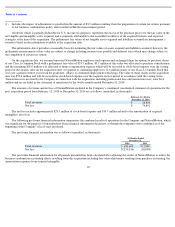

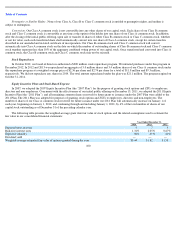

The following table summarizes the purchase date fair value of net tangible and intangible assets acquired from Spooky Cool Labs (in

thousands, unaudited):

Goodwill, which is deductible for tax purposes, represents the excess of the purchase price over the fair value of the net tangible and

intangible assets acquired, and is primarily attributable to the assembled workforce of the acquired business and expected synergies at the time of

the acquisition.

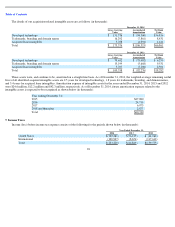

6. Goodwill and Other Intangible Assets

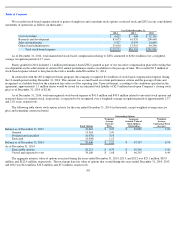

Changes in the carrying value of goodwill from December 31, 2012 to December 31, 2014 are as follows (in thousands):

93

Total

Developed technology

$

7,500

Net tangible assets acquired (liabilities assumed)

2,612

Goodwill

20,441

Total

$

30,553

Goodwill

—

December 31, 2012

$

208,955

Additions

20,441

Foreign currency translation adjustments

(1,407

)

Goodwill

—

December 31, 2013

227,989

Additions

450,582

Foreign currency translation adjustments

(23,994

)

Goodwill adjustments

(3,799

)

Goodwill

—

December 31, 2014

$

650,778

The decrease is primarily related to translation losses on goodwill associated with the acquisition of NaturalMotion denominated in British

pounds.

Includes the impact of adjustments to goodwill resulting from changes in net assets (liabilities) acquired and other adjustments, pursuant to

our business combinations policy.

(1)

(2)

(1)

(2)