Zynga 2014 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2014 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

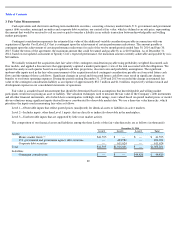

Other Intangible Assets

Other intangible assets are carried at cost less accumulated amortization. Amortization is recorded over the estimated useful lives of the

assets, generally 12 to 60 months.

Impairment of Long-Lived Assets

Long-lived assets, including other intangible assets (excluding indefinite-lived intangible assets), are reviewed for impairment whenever

events or changes in circumstances indicate an asset’s carrying value may not be recoverable. If such circumstances are present, we assess the

recoverability of the long-

lived assets by comparing the carrying value to the undiscounted future cash flows associated with the related assets. If

the future net undiscounted cash flows are less than the carrying value of the assets, the assets are considered impaired and an expense, equal to

the amount required to reduce the carrying value of the assets to the estimated fair value, is recorded as impairment of intangible assets in the

consolidated statements of operations. Significant judgment is required to estimate the amount and timing of future cash flows and the relative

risk of achieving those cash flows.

Assumptions and estimates about future values and remaining useful lives are complex and often subjective. They can be affected by a

variety of factors, including external factors such as industry and economic trends, and internal factors such as changes in our business strategy

and our internal forecasts. For example, if our future operating results do not meet current forecasts, we may be required to record future

impairment charges for acquired intangible assets. Impairment charges could materially decrease our future net income and result in lower asset

values on our balance sheet. There were no impairment charges in 2014. In 2013, we recorded a $10.2 million impairment charge related to

certain games associated with intangible assets previously acquired through various business combinations. In 2012, we recorded a $95.5 million

impairment charge related to OMGPOP intangibles.

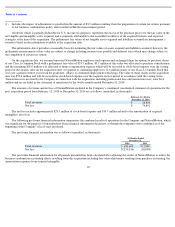

Stock-Based Expense

Prior to our IPO in December 2011, we granted ZSUs to our employees that generally vest upon the satisfaction of both a service-based

condition of up to four years and a liquidity condition, the latter of which was satisfied in connection with our IPO in December 2011. Because

the liquidity condition was not satisfied until our IPO, in prior periods, we had not recorded any expense relating to the granting of our ZSUs. In

the fourth quarter of 2011, after the IPO, we recognized $510 million of stock-based expense associated with ZSUs that vested in connection

with our IPO. This expense is in addition to the stock-based expense we recognize related to outstanding equity awards other than ZSUs as well

as expenses related to ZSUs or other equity awards that may be granted in the future.

For ZSUs granted prior to the IPO, and for awards subject to performance conditions, we recognize stock-based expense based on grant

date fair value using the accelerated attribution method in which compensation cost for each vesting tranche in an award is recognized ratably

from the service inception date to the vesting date for that tranche. For ZSUs granted after the IPO, which are only subject to a service condition,

we recognize stock-based expense based on grant date fair value on a ratable basis over the requisite service period for the entire award.

We estimate the fair value of stock options using the Black-Scholes option-pricing model. This model requires the use of the following

assumptions: expected volatility of our Class A common stock, which is based on our peer group in the industry in which we do business;

expected life of the option award, which we elected to calculate using the simplified method; expected dividend yield, which is 0%, as we have

not paid and do not anticipate paying dividends on our common stock; and the risk-free interest rate, which is based on the U.S. Treasury yield

curve in effect at the time of grant with maturities equal to the grant’s expected life. Option grants generally vest over four years, with 25%

vesting after one year and the remainder vesting monthly thereafter over

85