Zynga 2014 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2014 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

New market development. We are investing in new distribution channels, mobile platforms and international markets to expand our reach

and grow our business. For example, we have continued to hire additional employees and acquire companies with experience developing mobile

applications. Our ability to be successful will depend on our ability to develop a successful mobile network, obtain new players and retain

existing players on new and existing social networks and attract advertisers.

In the first quarter of 2014, we completed the acquisition of NaturalMotion, the maker of Clumsy Ninja and CSR Racing . This allowed us

to enter into two new consumer categories—People Simulation and Racing—

and our future success is dependent upon our ability to leverage the

games, workforce, and technology we acquired.

As we expand into new markets and distribution channels, we expect to incur headcount, marketing and other operating costs in advance of

the associated bookings and revenue. Our financial performance will be impacted by our investment in these initiatives and their success.

Hiring and retaining key personnel. Our ability to compete and grow depends in large part on the efforts and talents of our employees. In

2014, in addition to employee attrition, we have also implemented, and continue to implement, certain cost reduction initiatives to better align

our operating expenses with our revenue, including reducing our headcount and consolidating certain facilities. For example, in the first quarter

of 2014, we implemented a restructuring plan that included a work force reduction. These cost reduction initiatives could negatively impact our

ability to attract, hire and retain key employees which is critical to our ability to grow our business and execute on our business strategy.

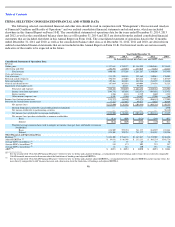

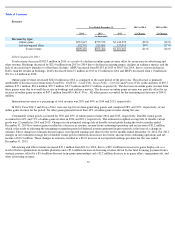

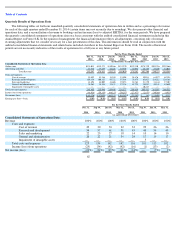

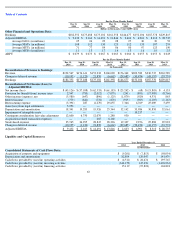

Results of Operations

The following table sets forth our results of operations for the periods presented as a percentage of revenue for those periods:

56

For the Year Ended December 31,

2014

2013

2012

Consolidated Statements of Operations Data

:

Revenue

100

%

100

%

100

%

Costs and expenses:

Cost of revenue

31

28

27

Research and development

57

48

50

Sales and marketing

23

12

14

General and administrative

24

19

15

Impairment of intangible assets

—

1

7

Total costs and expenses

135

108

113

Income (loss) from operations

(35

)

(8

)

(13

)

Interest income

—

—

—

Other income (expense), net

1

—

1

Income (loss) before income taxes

(34

)

(8

)

(12

)

Provision for (benefit from) income taxes

(1

)

(3

)

4

Net income (loss)

(33

)%

(5

)%

(16

)%