Zynga 2014 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2014 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER

PURCHASES OF EQUITY SECURITIES

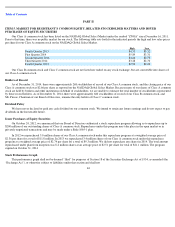

Our Class A common stock has been listed on the NASDAQ Global Select Market under the symbol “ZNGA” since December 16, 2011.

Prior to that time, there was no public market for our stock. The following table sets forth for the indicated periods the high and low sales prices

per share for our Class A common stock on the NASDAQ Global Select Market.

Our Class B common stock and Class C common stock are not listed nor traded on any stock exchange, but are convertible into shares of

our Class A common stock.

Holders of Record

As of December 31, 2014, there were approximately 268 stockholders of record of our Class A common stock, and the closing price of our

Class A common stock was $2.66 per share as reported on the NASDAQ Global Select Market. Because many of our shares of Class A common

stock are held by brokers and other institutions on behalf of stockholders, we are unable to estimate the total number of stockholders represented

by these record holders. As of December 31, 2014, there were approximately 660 stockholders of record of our Class B common stock, and

Mr. Pincus, Chairman of our Board of Directors, remains the only holder of Class C common stock.

Dividend Policy

We have never declared or paid any cash dividend on our common stock. We intend to retain any future earnings and do not expect to pay

dividends in the foreseeable future.

Issuer Purchases of Equity Securities

On October 24, 2012, we announced that our Board of Directors authorized a stock repurchase program allowing us to repurchase up to

$200 million of our outstanding shares of Class A common stock. Repurchases under this program may take place in the open market or in

privately negotiated transactions and may be made under a Rule 10b5-1 plan.

In 2012 we repurchased 5.0 million shares of our Class A common stock under this repurchase program at a weighted average price of

$2.36 per share for a total of $11.8 million. In 2013 we repurchased 3.4 million shares of our Class A common stock under this repurchase

program at a weighted average price of $2.74 per share for a total of $9.3 million. We did not repurchase any shares in 2014. The total amount

repurchased under plan from inception was 8.4 million shares at an average price of $2.51 per share for total of $21.1 million. The program

expired on October 31, 2014

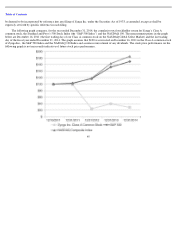

Stock Performance Graph

This performance graph shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the

“Exchange Act”), or otherwise subject to liabilities under that section and shall not

44

High

Low

Fourth Quarter 2013

$

4.55

$

3.32

First Quarter 2014

$

5.89

$

3.31

Second Quarter 2014

$

4.66

$

2.73

Third Quarter 2014

$

3.28

$

2.70

Fourth Quarter 2014

$

2.92

$

2.20