Zynga 2014 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2014 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

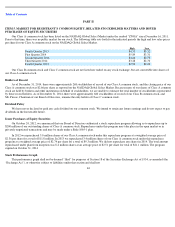

Table of Contents

Accordingly, we may be restricted from taking actions that management believes would be desirable and in the best interests of us and our

stockholders. Our Credit Agreement also requires us to maintain compliance with a capitalization ratio and maintain a minimum cash balance. A

breach of any of the covenants contained in our Credit Agreement could result in an event of default under the agreement and would allow our

lenders to pursue various remedies, including accelerating the repayment of any outstanding indebtedness.

We may require additional capital to meet our financial obligations and support business growth, and this capital might not be available on

acceptable terms or at all.

We intend to continue to make significant investments to support our business growth and may require additional funds to respond to

business challenges, including the need to develop new games and features or enhance our existing games, improve our operating infrastructure

or acquire complementary businesses, personnel and technologies. Accordingly, we may need to engage in equity or debt financings to secure

additional funds. If we raise additional funds through future issuances of equity or convertible debt securities, our existing stockholders could

suffer significant dilution, and any new equity securities we issue could have rights, preferences and privileges superior to those of holders of our

Class A common stock. Any debt financing that we secure in the future could involve restrictive covenants relating to our capital raising

activities and other financial and operational matters, which may make it more difficult for us to obtain additional capital and to pursue business

opportunities, including potential acquisitions. We may not be able to obtain additional financing on terms favorable to us, if at all. If we are

unable to obtain adequate financing or financing on terms satisfactory to us when we require it, our ability to continue to support our business

growth and to respond to business challenges could be significantly impaired, and our business may be harmed.

Risks Related to Our Class A Common Stock

The three class structure of our common stock has the effect of concentrating voting control with those stockholders who held our stock prior

to our initial public offering, including our founder and our other executive officers, employees and directors and their affiliates; this limits

our other stockholders’ ability to influence corporate matters.

Our Class C common stock has 70 votes per share, our Class B common stock has seven votes per share and our Class A common stock

has one vote per share. Mark Pincus, our Chairman, beneficially owned approximately 63% of the total voting power of our outstanding capital

stock as of December 31, 2014. As a result, Mr. Pincus has significant influence over the management and affairs of the company and control

over matters requiring stockholder approval, including the election of directors and significant corporate transactions, such as a merger or other

sale of our company or our assets. Mr. Pincus may hold this voting power for the foreseeable future, subject to additional issuances of stock by

the company or sales by Mr. Pincus. This concentrated voting control limits the ability of our other stockholders to influence corporate matters

and could adversely affect the market price of our Class A common stock.

Future transfers or sales by holders of Class B common stock or Class C common stock will result in those shares converting to Class A

common stock, which will have the effect, over time, of increasing the relative voting power of those stockholders who retain their existing

shares of Class B or Class C common stock. In addition, as shares of Class B common stock are transferred or sold and converted to Class A

common stock, the sole holder of Class C common stock, Mark Pincus, will have greater relative voting control to the extent he retains his

existing shares of Class C common stock, and as a result he could in the future control a majority of our total voting power. Mark Pincus is

entitled to vote his shares in his own interests and may do so.

39