Zynga 2014 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2014 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

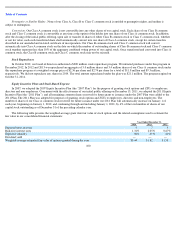

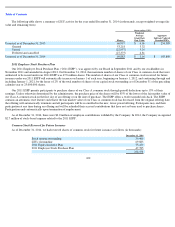

Table of Contents

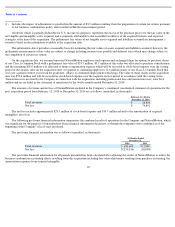

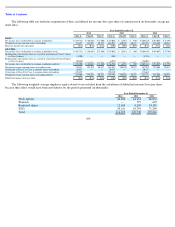

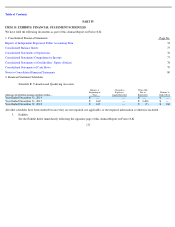

We recorded stock-

based expense related to grants of employee and consultant stock options, restricted stock and ZSUs in our consolidated

statements of operations as follows (in thousands):

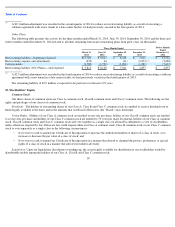

As of December 31, 2014, total unamortized stock-based compensation relating to ZSUs amounted to $202.4 million over a weighted-

average recognition period of 2.7 years.

Shares granted in 2014 included 1.1 million performance-based ZSUs granted as part of our executive compensation plan with vesting that

was dependent on the achievement of certain 2014 annual performance metrics in addition to the passage of time. We recorded $2.2 million of

stock-based expense related to this plan in the twelve months ended December 31, 2014.

In connection with the 2014 employee bonus program, the company recognized $2.4 million of stock based compensation expense during

the 12-month period ending December 31, 2014. This amount was accrued based on certain performance criteria and the passage of time and

recognized as a liability based on the estimated fair value as of the reporting date. Upon settlement, according to the conditions specified in the

agreement, approximately 1.1 million shares would be issued for an estimated total liability of $2.9 million based upon Company’

s closing stock

price as of December 31, 2014 of $2.66.

As of December 31, 2014, total unrecognized stock-

based expense of $41.0 million and $45.0 million related to unvested stock options and

restricted shares of common stock, respectively, is expected to be recognized over a weighted-average recognition period of approximately 2.37

and 2.01 years, respectively.

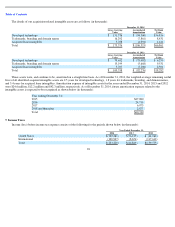

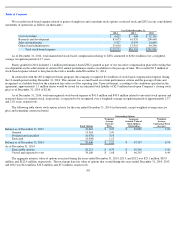

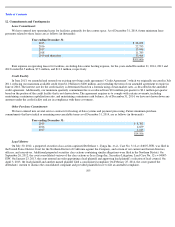

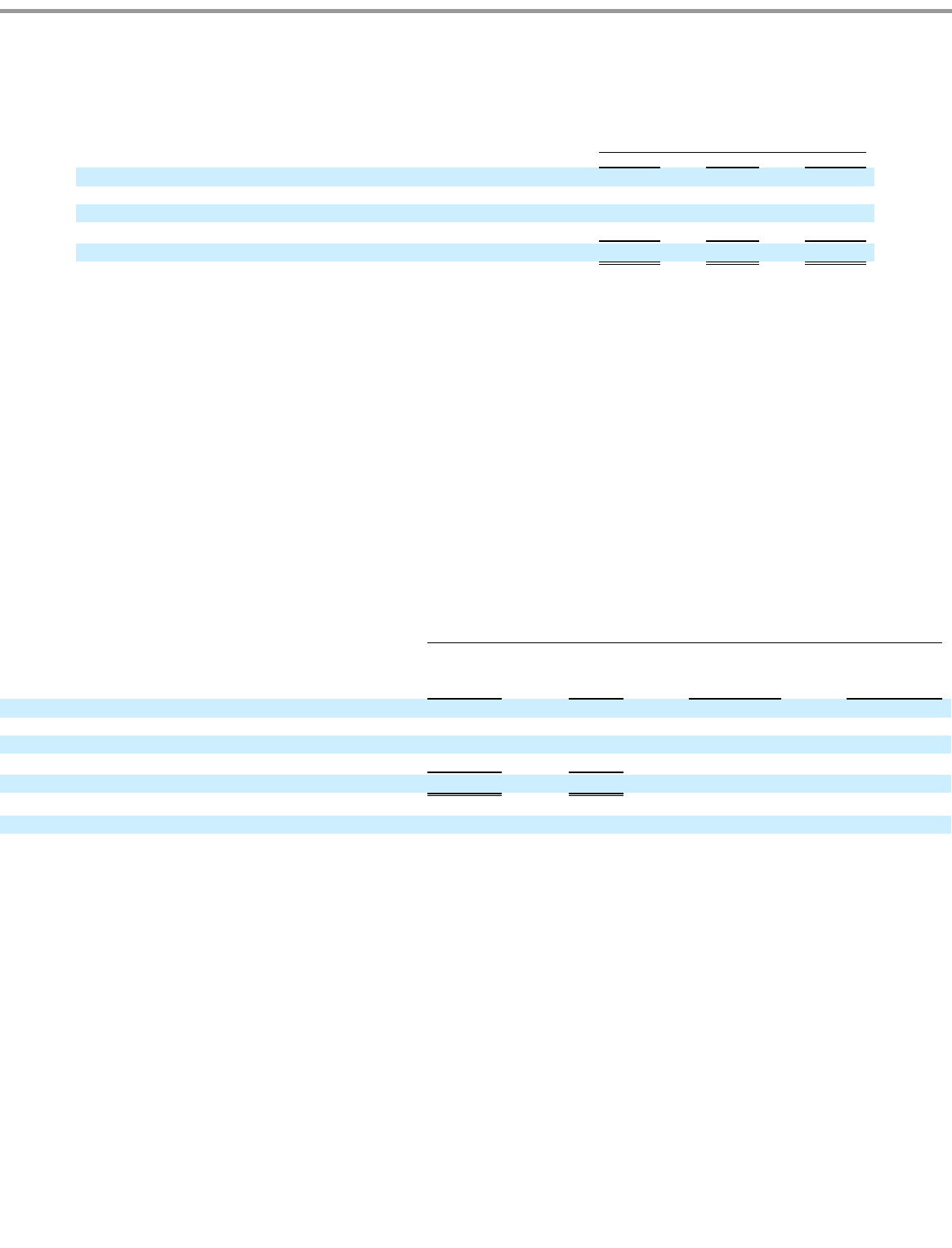

The following table shows stock option activity for the year ended December 31, 2014 (in thousands, except weighted-average exercise

price and remaining contractual term):

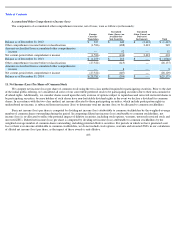

The aggregate intrinsic value of options exercised during the years ended December 31, 2014, 2013, and 2012 was $25.1 million, $85.9

million, and $222.4 million, respectively. The total grant date fair value of options that vested during the years ended December 31, 2014, 2013,

and 2012 was $6.6 million, $12.8 million, and $7.6 million, respectively.

101

Year Ended December 31,

2014

2013

2012

Cost of revenue

$

4,623

$

468

$

12,116

Research and development

83,673

61,931

200,640

Sales and marketing

5,927

8,079

24,684

General and administrative

35,010

13,915

44,546

Total stock

-

based expense

$

129,233

$

84,393

$

281,986

Outstanding Options

Stock Options

Weighted

-

Average

Exercise

Price

Aggregate

Intrinsic Value of

Stock Options

Outstanding

Weighted

-

Average

Contractual Term

(in years)

Balance as of December 31, 2013

41,081

$

2.07

$

83,089

7.02

Granted

13,363

2.41

Forfeited and cancelled

(6,076

)

3.19

Exercised

(8,908

)

1.13

Balance as of December 31, 2014

39,460

$

2.22

$

47,347

6.74

As of December 31, 2014

Exercisable options

20,213

$

0.79

$

39,349

5.10

Vested and expected to vest

34,160

$

1.68

$

46,367

6.44