Zynga 2014 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2014 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

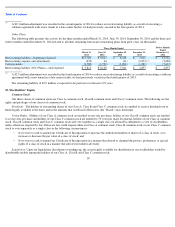

Pursuant to authoritative guidance, the benefit of stock options will only be recorded to stockholders’ equity when cash taxes payable is

reduced. When realized, the amount of net operating loss carryforward that will be recognized as a benefit to additional paid in capital is

approximately $470.3 million. The federal and state net operating loss carryforwards are subject to various annual limitations under Section 382

of the Internal Revenue Code.

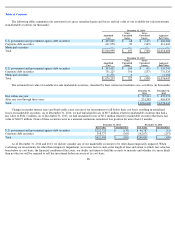

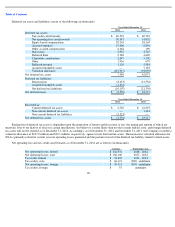

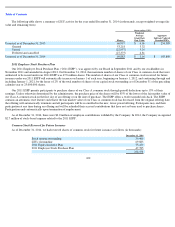

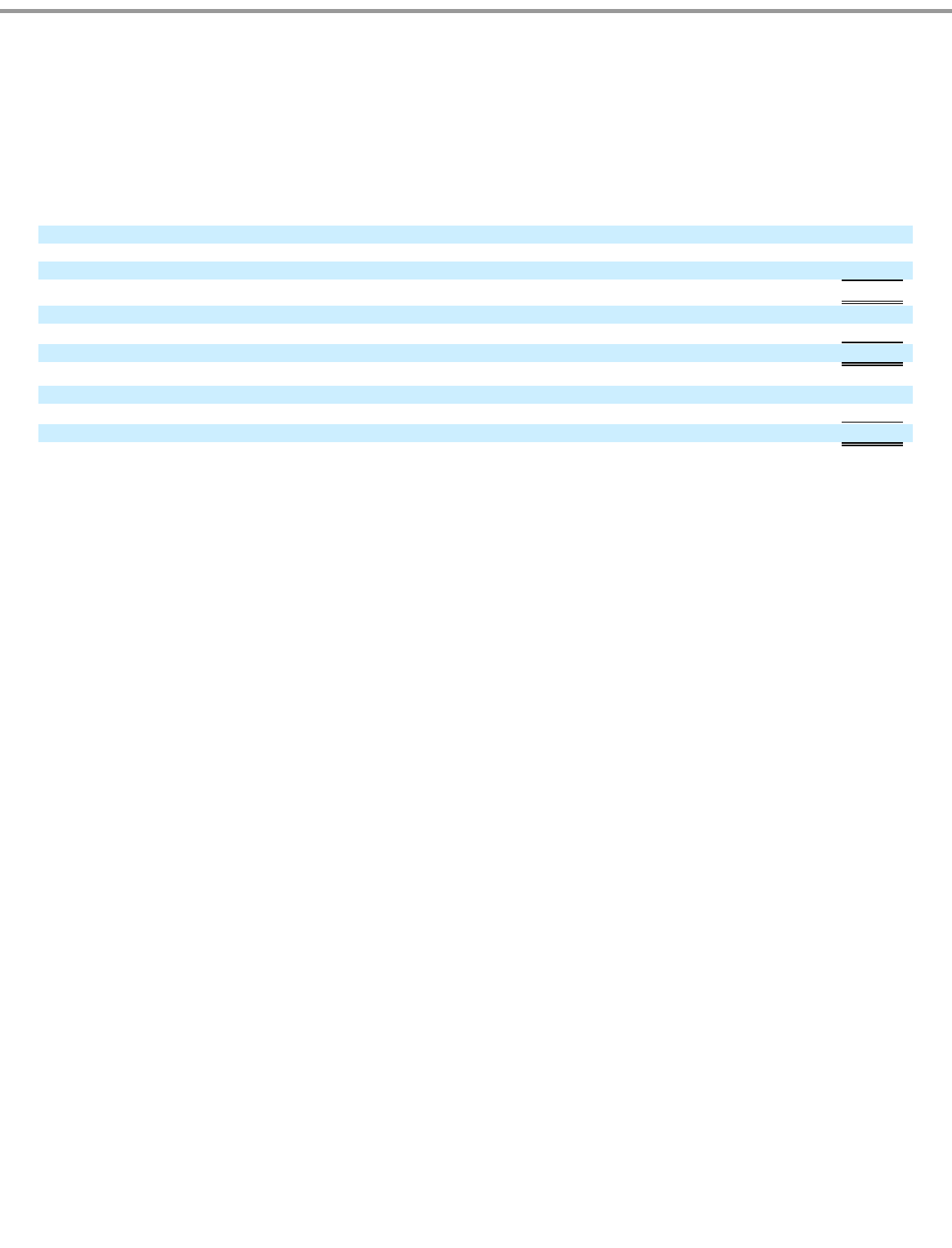

As of December 31, 2014, the Company had approximately $140.9 million in total unrecognized tax benefits. A reconciliation of the

beginning and ending amount of unrecognized tax benefits is as follows (in thousands):

If the $140.9 million of unrecognized tax benefits as of December 31, 2014 is recognized, approximately $10.2 million would impact the

effective tax rate in the period in which the benefits are recognized. The remaining amount would be offset by the reversal of related deferred tax

assets on which a valuation allowance is placed. The Company does not expect any material changes to its unrecognized tax benefits within the

next twelve months.

We classify uncertain tax positions as non-current income tax liabilities unless expected to be paid within one year or otherwise directly

related to an existing deferred tax asset, in which case the uncertain tax position is recorded net of the asset on the balance sheet. We recognize

interest and penalties in income tax expense. As of December 31, 2014 and December 31, 2013, the total balance of accrued interest and

penalties related to uncertain tax positions was $0.7 million and $0.5 million, respectively.

We file income tax returns in the U.S. federal jurisdiction as well as many U.S. states and certain foreign jurisdictions. The material

jurisdictions in which we are subject to potential examination include the United States, United Kingdom, and Ireland. We are subject to

examination in these jurisdictions for all years since our inception in 2007. Fiscal years outside the normal statute of limitation remain open to

audit by tax authorities due to tax attributes generated in those early years which have been carried forward and may be audited in subsequent

years when utilized.

97

December 31, 2011

$

48,334

Additions based on tax positions related to 2012

51,222

Reductions for tax positions of prior years

(835

)

December 31, 2012

98,721

Additions based on tax positions related to 2013

16,414

Additions for tax positions of prior years

18,356

December 31, 2013

133,491

Additions based on tax positions related to 2014

7,738

Additions for tax positions of prior years

171

Reductions for tax positions of prior years

(511

)

December 31, 2014

$

140,889