Zynga 2014 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2014 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

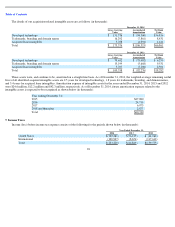

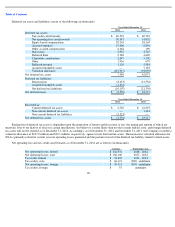

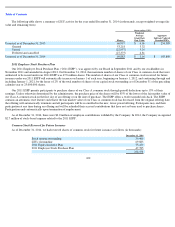

Table of Contents

Goodwill, which is partially deductible for U.S. income tax purposes, represents the excess of the purchase price over the fair value of the

net tangible and intangible assets acquired, and is primarily attributable to the assembled workforce of the acquired business and expected

synergies at the time of the acquisition. The preliminary fair values of net tangible assets acquired and liabilities assumed are management’s

estimates based on the information available at the acquisition date.

The information above provides a reasonable basis for estimating the fair values of assets acquired and liabilities assumed, however, the

preliminary measurements of fair value are subject to change including income taxes payable and deferred taxes which may change subject to

the completion of certain tax returns.

On the acquisition date, we assumed unvested NaturalMotion employee stock options and exchanged them for options to purchase shares

of our Class A Common Stock with a preliminary fair value of $29.7 million. $0.7 million of this value was allocated to purchase consideration

and the remaining $29.0 million was allocated to future compensation expense which will be recorded as stock-based expense over the vesting

period of the awards. Also on the acquisition date, we granted to continuing employees 11.6 million shares of our Class A Common Stock that

vest over a period of three years from the grant date, subject to continued employment with Zynga. The value of these shares on the acquisition

date was $53.6 million and will be recorded as stock-based expense over the requisite service period in accordance with the vesting terms.

Transaction costs incurred by the Company in connection with the acquisition, including professional fees and transaction taxes, were $6.4

million and are included in our statement of operations for the twelve months ended December 31, 2014.

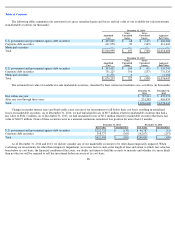

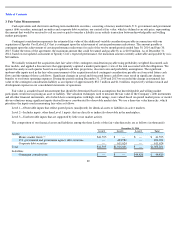

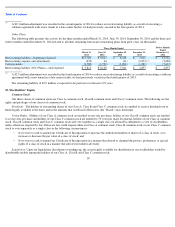

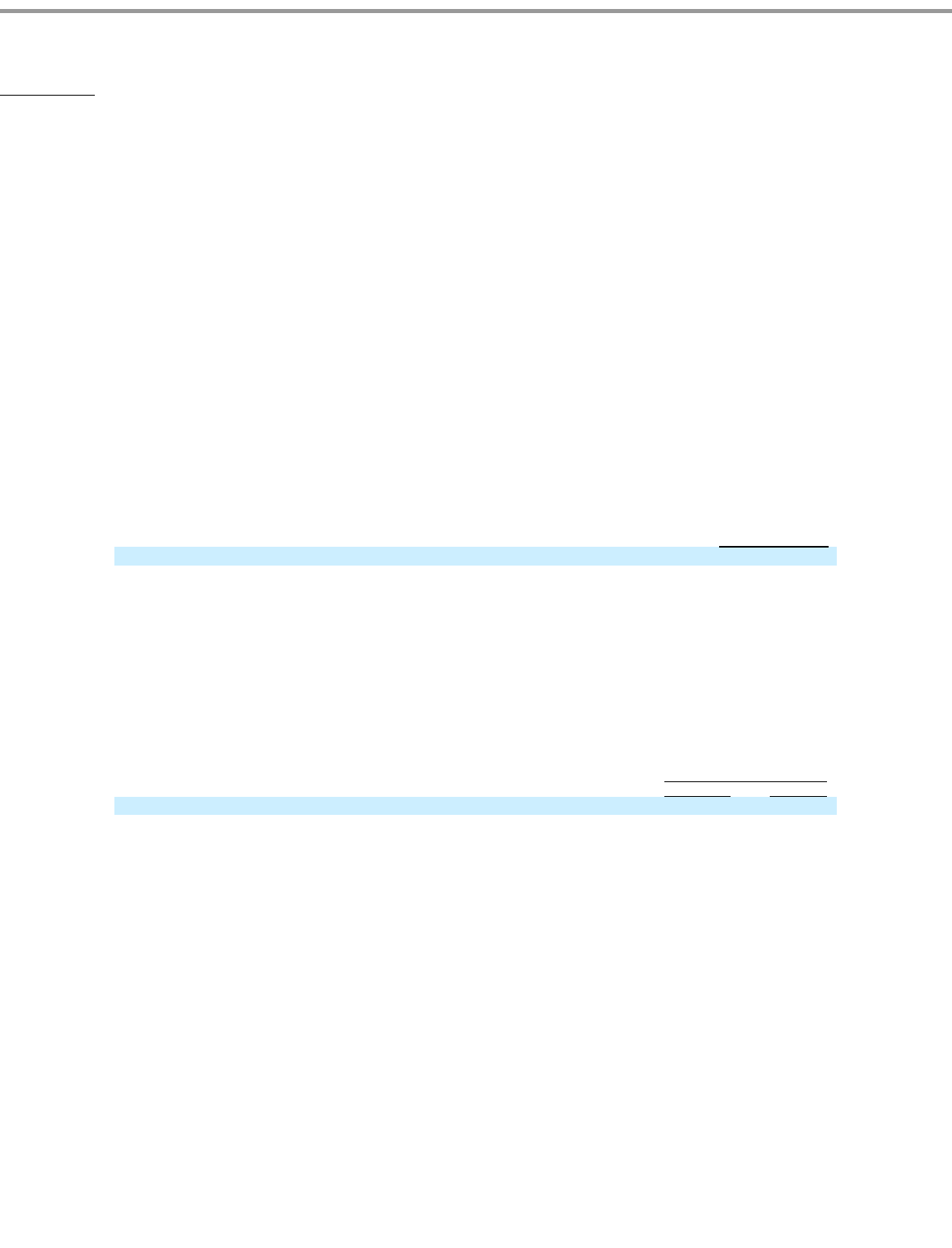

The amounts of revenue and net loss of NaturalMotion included in the Company’s condensed consolidated statement of operations for the

post acquisition period from February 12, 2014 to December 31, 2014 are as follows (unaudited, in thousands):

The net loss includes approximately $29.5 million of stock-based expense and $19.7 million related to the amortization of acquired

intangibles, net of tax.

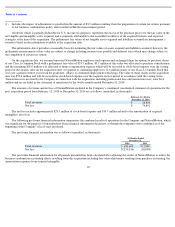

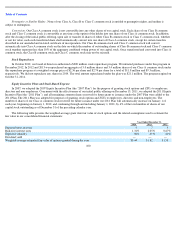

The following pro forma financial information summarizes the combined results of operations for the Company and NaturalMotion, which

was significant for the purposes of unaudited pro forma financial information disclosure, as though the companies were combined as of the

beginning of the Company’s fiscal years presented.

The pro forma financial information was as follows (unaudited, in thousands):

The pro forma financial information for all periods presented has been calculated after adjusting the results of NaturalMotion to reflect the

business combination accounting effects resulting from this acquisition including fair value adjustments resulting from purchase accounting, the

amortization expenses from acquired intangible

92

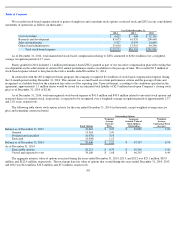

(1) Includes the impact of adjustments to goodwill in the amount of $3.9 million resulting from the preparation of certain tax returns pursuant

to our business combinations policy and recorded within the measurement period.

February 12, 2014 to

December 31, 2014

Total revenues

$

26,800

Net loss

$

74,891

12 Months Ended

December 31,

2014

2013

Total revenues

$

698,608

912,880

Net loss

$

(233,036

)

(96,048

)