Zynga 2014 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2014 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

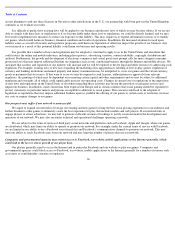

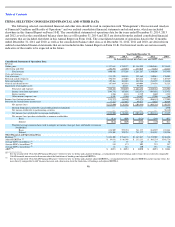

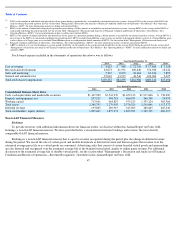

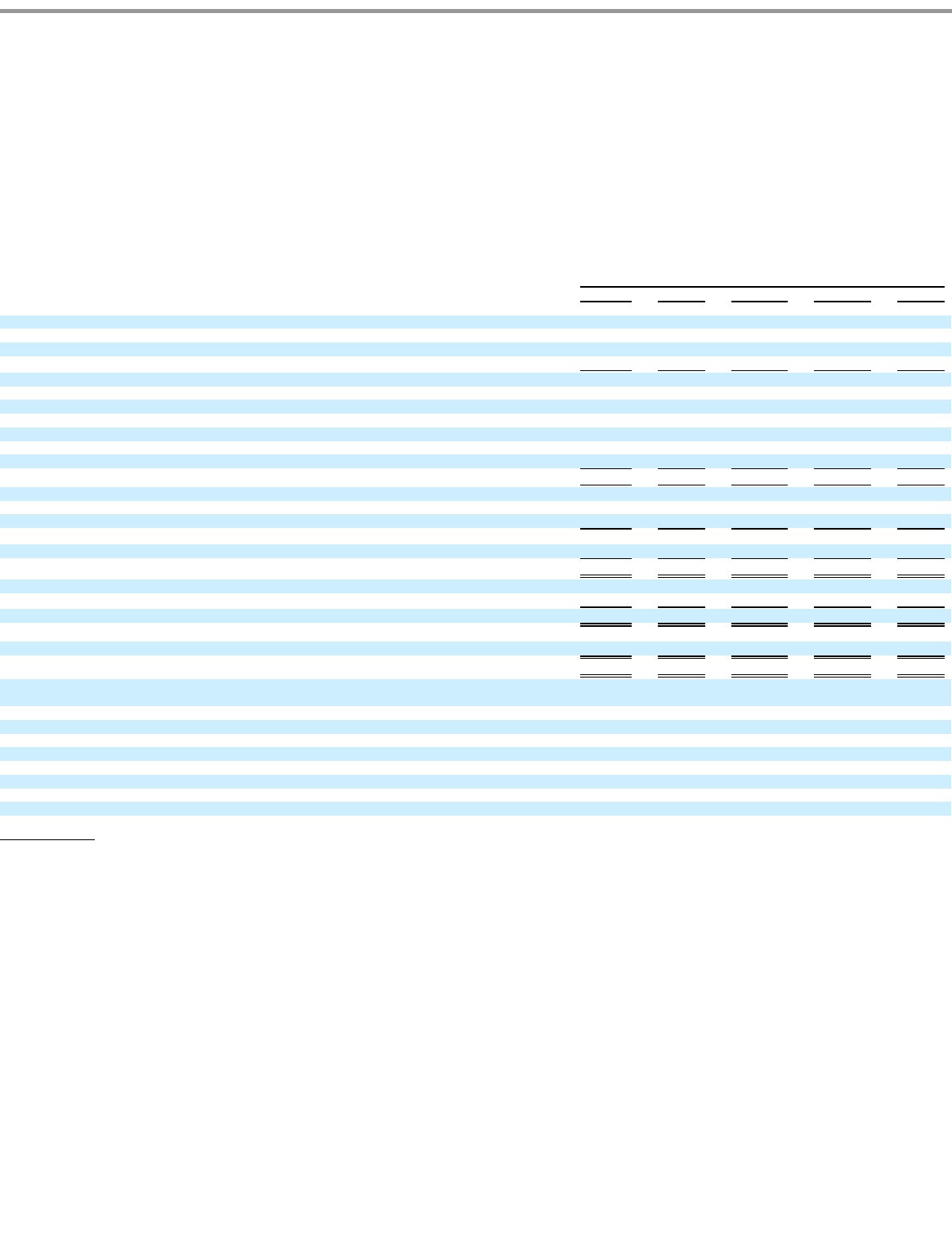

ITEM 6. SELECTED CONSOLIDATED FINANCIAL AND OTHER DATA

The following selected consolidated financial and other data should be read in conjunction with “Management’s Discussion and Analysis

of Financial Condition and Results of Operations” and our audited consolidated financial statements and related notes, which are included

elsewhere in this Annual Report on Form 10-K. The consolidated statements of operations data for the years ended December 31, 2014, 2013

and 2012 as well as the consolidated balance sheet data as of December 31, 2014 and 2013 are derived from the audited consolidated financial

statements that are included elsewhere in this Annual Report on Form 10-K. The consolidated statement of operations data for the 12 months

ended December 31, 2011 and 2010, as well as the consolidated balance sheet data as of December 31, 2012, 2011 and 2010, are derived from

audited consolidated financial statements that are not included in this Annual Report on Form 10-K. Our historical results are not necessarily

indicative of the results to be expected in the future.

46

Year Ended December 31,

2014

2013

2012

2011

2010

(in thousands, except per share, user and ABPU data)

Consolidated Statements of Operations Data:

Revenue:

Online game

$

537,619

$

759,572

$

1,144,252

$

1,065,648

$

574,632

Advertising and other

152,791

113,694

137,015

74,452

22,827

Total revenue

690,410

873,266

1,281,267

1,140,100

597,459

Costs and expenses:

Cost of revenue

213,570

248,358

352,169

330,043

176,052

Research and development

396,553

413,001

645,648

727,018

149,519

Sales and marketing

157,364

104,403

181,924

234,199

114,165

General and administrative

167,664

162,918

189,004

254,456

32,251

Impairment of intangible assets

—

10,217

95,493

—

—

Total costs and expenses

935,151

938,897

1,464,238

1,545,716

471,987

Income (loss) from operations

(244,741

)

(65,631

)

(182,971

)

(405,616

)

125,472

Interest income

3,266

4,148

4,749

1,680

1,222

Other income (expense), net

8,248

(3,386

)

18,647

(2,206

)

365

Income (loss) before income taxes

(233,227

)

(64,869

)

(159,575

)

(406,142

)

127,059

Provision for (benefit from) income taxes

(7,327

)

(27,887

)

49,873

(1,826

)

36,464

Net income (loss)

$

(225,900

)

$

(36,982

)

$

(209,448

)

$

(404,316

)

$

90,595

Deemed dividend to a Series B

-

2 convertible preferred stockholder

—

—

—

—

4,590

Net income attributable to participating securities

—

—

—

—

58,110

Net income (loss) attributable to common stockholders

$

(225,900

)

$

(36,982

)

$

(209,448

)

$

(404,316

)

$

27,895

Net income (loss) per share attributable to common stockholders

Basic

$

(0.26

)

$

(0.05

)

$

(0.28

)

$

(1.40

)

$

0.12

Diluted

$

(0.26

)

$

(0.05

)

$

(0.28

)

$

(1.40

)

$

0.11

Weighted average common shares used to compute net income (loss) per share attributable to common

stockholders:

Basic

874,509

799,794

741,177

288,599

223,881

Diluted

874,509

799,794

741,177

288,599

329,256

Other Financial and Operational Data:

Bookings

$

694,300

$

716,176

$

1,147,627

$

1,155,509

$

838,896

Adjusted EBITDA

$

39,932

$

46,549

$

213,233

$

303,274

$

392,738

Average DAUs (in millions)

27

37

63

57

56

Average MAUs (in millions)

118

171

302

233

217

Average MUUs (in millions)

81

112

180

151

116

ABPU

$

0.071

$

0.053

$

0.050

$

0.055

$

0.041

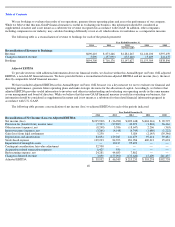

See the section titled “Non-GAAP Financial Measures” below for how we define and calculate bookings, a reconciliation between bookings and revenue, the most directly comparable

GAAP financial measure and a discussion about the limitations of bookings and adjusted EBITDA.

See the section titled “Non-GAAP Financial Measures” below for how we define and calculate adjusted EBITDA, a reconciliation between adjusted EBITDA and net income (loss), the

most directly comparable GAAP financial measure and a discussion about the limitations of bookings and adjusted EBITDA.

(1)

(2)

(3)

(4)

(5)

(6)

(1)

(2)