Zynga 2014 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2014 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

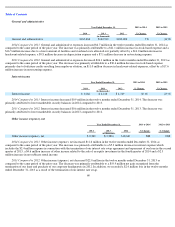

Provision for (benefit from) income taxes

2014 Compared to 2013. The benefit from income taxes decreased by $20.6 million in the twelve months ended December 31, 2014

compared to the same period of the prior year. This decrease was attributable primarily to the incremental benefit of $5.0 million recorded in the

first quarter of 2013 related to the recognition of Federal research and development tax credits and the net benefit related to changes in the

estimated jurisdictional mix of earnings between the two periods of $15.6 million.

2013 Compared to 2012. The provision for income taxes decreased by $77.8 million in the twelve months ended December 31, 2013 as

compared to the same period of the prior year. This decrease was attributable primarily to a benefit of $12.4 million recorded in the first quarter

of 2013 related to the reinstatement of the federal research and development tax credit retroactive to January 1, 2012, a benefit of $16.3 million

recorded in the second quarter related to changes in the estimated jurisdictional mix of earnings, and tax expense of $85.0 million related to the

cost of fully implementing our international structure in the fourth quarter of 2012, partially offset by the $39.1 million tax impact of the

impairment charges recorded in the third quarter of 2012.

61

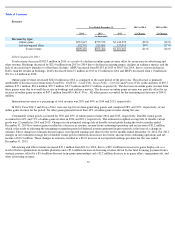

Year Ended December 31,

2013 to 2014

% Change

2012 to 2013

% Change

2014

2013

2012

(in thousands)

Provision for (benefit from) income taxes

$

(7,327

)

$

(27,887

)

$

49,873

NM

NM