Zynga 2014 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2014 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

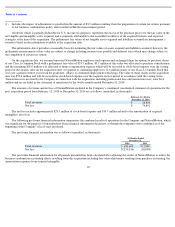

We recognize advertising revenue for branded virtual goods and sponsorships, engagement advertisements and offers, mobile

advertisements and other advertisements as advertisements are delivered to customers as long as evidence of the arrangement exists (executed

contract), the price is fixed or determinable, and we have assessed collectability as reasonably assured. Certain branded in-game sponsorships

that involve virtual goods are deferred and recognized over the estimated life of the branded virtual good or as consumed, similar to online game

revenue. Price is determined to be fixed and determinable when there is a fixed price in the applicable evidence of the arrangement, which may

include a master contract, insertion order, or a third party statement of activity. For branded virtual goods and sponsorships, we determine the

delivery criteria has been met based on delivery information primarily from third parties. For engagement advertisements and offers, mobile

advertisements, and other advertisements, delivery occurs when the advertisement has been displayed or the offer has been completed by the

customer, as evidenced by third party verification reports supporting the number of advertisements displayed or offers completed.

Multiple-element Arrangements

We allocate arrangement consideration in multiple-deliverable revenue arrangements at the inception of an arrangement to all deliverables

based on the relative selling price method, generally based on our best estimate of selling price. We offer certain promotions to customers from

time to time that include the sale of in-game virtual currency via the sale of a game card and also other deliverables such as a limited edition in-

game virtual good.

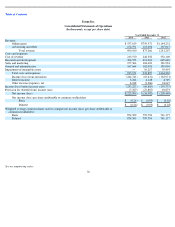

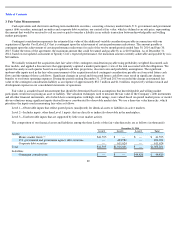

Cost of Revenue

Amounts recorded as cost of revenue relate to direct expenses incurred in order to generate online game revenue. Such costs are recorded

as incurred. Our cost of revenue consists primarily of hosting and data center costs related to operating our games, including depreciation,

consulting costs primarily related to third-party provisioning of customer support services, payment processing fees, licensing fees, salaries,

benefits and stock-based expense for our customer support and infrastructure teams. Cost of revenue also includes amortization expense related

to purchased technology of $21.4 million, $11.3 million and $38.5 million for the years ended December 31, 2014, 2013 and 2012, respectively.

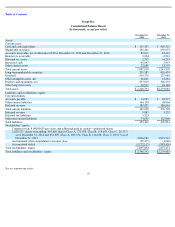

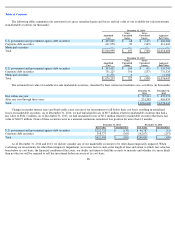

Cash and Cash Equivalents

Cash equivalents consist of cash on hand, money market funds, commercial paper, corporate bonds, municipal securities, and U.S.

government-issued obligations with maturities of 90 days or less from the date of purchase.

Marketable Securities and Non-Marketable Securities

Marketable securities consist of U.S. government-issued obligations, municipal securities and corporate debt securities. Management

determines the appropriate classification of marketable securities at the time of purchase and evaluates such determination at each balance sheet

date. The fair value of marketable securities is determined as the exit price in the principal market in which we would transact. Based on our

intentions regarding our marketable securities, all marketable securities are classified as available-for-sale and are carried at fair value with

unrealized gains and losses recorded as a separate component of other comprehensive income, net of income taxes. Realized gains and losses are

determined using the specific-identification method and are reflected as a component of other income (expense), net in the consolidated

statements of operations when they are realized. When we determine that a decline in fair value is other than temporary, the cost basis of the

individual security is written down to the fair value as a new cost basis and the amount of the write-down is accounted for as a realized loss in

other income (expense), net. The new cost basis will not be adjusted for subsequent recoveries in fair value. Determination of whether declines

in fair value are other than temporary requires judgment regarding the amount and timing of recovery. No such impairments of marketable

securities have been recorded in 2014.

83