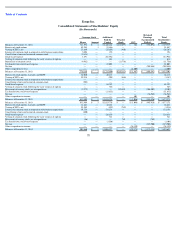

Zynga 2014 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2014 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

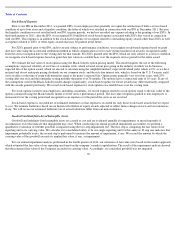

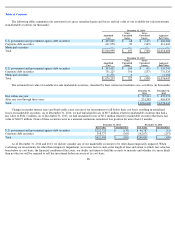

Table of Contents

Zynga Inc.

Consolidated Statements of Cash Flows

(In thousands)

See accompanying notes.

79

Year Ended December 31,

2014

2013

2012

Operating activities:

Net income (loss)

$

(225,900

)

$

(36,982

)

$

(209,448

)

Adjustments to reconcile net income (loss) to net cash provided by operating activities:

Depreciation and amortization

82,894

129,047

141,479

Stock

-

based expense

129,233

84,393

281,986

(Gain) loss from sales of investments, assets and other, net

(1,610

)

8,147

563

Net gain on termination of lease and purchase of building

—

—

(

19,886

)

Tax benefits (costs) from stock

-

based awards

(86

)

(11,244

)

21,652

Excess tax benefits (costs) from stock

-

based awards

86

11,244

(21,652

)

Accretion and amortization on marketable securities

10,061

17,575

17,223

Deferred income taxes

(10,982

)

(18,766

)

(43,841

)

Impairment of intangible assets

—

10,217

95,493

Changes in operating assets and liabilities:

Accounts receivable, net

(16,489

)

40,806

34,338

Income tax receivable

5,433

(1,336

)

12,976

Other assets

971

3,932

19,908

Accounts payable

(6,393

)

(2,325

)

(21,312

)

Deferred revenue

3,643

(157,090

)

(133,640

)

Other liabilities

24,628

(48,944

)

19,928

Net cash provided by (used in) operating activities

(4,511

)

28,674

195,767

Investing activities:

Purchases of marketable securities

(758,509

)

(1,074,919

)

(1,826,137

)

Sales and maturities of marketable securities

806,232

1,244,841

871,744

Purchase of corporate headquarters building

—

—

(

233,700

)

Acquisition of property and equipment

(9,201

)

(7,813

)

(98,054

)

Business acquisition, net of cash acquired

(392,411

)

(18,054

)

(205,510

)

Proceeds from sale of property and equipment

5,059

3,057

—

Equity method investment

—

—

(

10,000

)

Restricted cash

—

227

6,979

Other investing activities, net

4,671

137

(2,256

)

Net cash provided by (used in) investing activities

(344,159

)

147,476

(1,496,934

)

Financing activities:

Proceeds from debt, net of issuance costs

—

—

99,780

Taxes paid related to net share settlement of equity awards

(1,216

)

(1,387

)

(26,307

)

Repurchases of common stock

—

(

9,302

)

(11,756

)

Proceeds from employee stock purchase plan and exercise of stock options

16,421

26,115

21,449

Excess tax benefits from stock

-

based awards

(86

)

(11,244

)

21,652

Repayment of debt

—

(

100,000

)

—

Net cash provided by (used in) financing activities

15,119

(95,818

)

104,818

Effect of exchange rate changes on cash and cash equivalents

(669

)

(758

)

(45

)

Net increase (decrease) in cash and cash equivalents

(334,220

)

79,574

(1,196,394

)

Cash and cash equivalents, beginning of period

465,523

385,949

1,582,343

Cash and cash equivalents, end of period

$

131,303

$

465,523

$

385,949