Zynga 2014 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2014 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

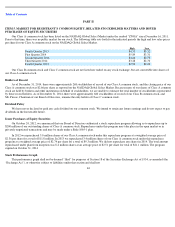

We use bookings to evaluate the results of our operations, generate future operating plans and assess the performance of our company.

While we believe that this non-GAAP financial measure is useful in evaluating our business, this information should be considered as

supplemental in nature and is not meant as a substitute for revenue recognized in accordance with GAAP. In addition, other companies,

including companies in our industry, may calculate bookings differently or not at all, which reduces its usefulness as a comparative measure.

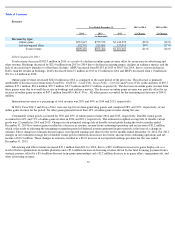

The following table is a reconciliation of revenue to bookings for each of the periods presented:

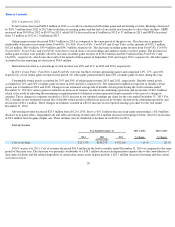

Adjusted EBITDA

To provide investors with additional information about our financial results, we disclose within this Annual Report on Form 10-K adjusted

EBITDA, a non-GAAP financial measure. We have provided below a reconciliation between adjusted EBITDA and net income (loss), the most

directly comparable GAAP financial measure.

We have included adjusted EBITDA in this Annual Report on Form 10-K because it is a key measure we use to evaluate our financial and

operating performance, generate future operating plans and make strategic decisions for the allocation of capital. Accordingly, we believe that

adjusted EBITDA provides useful information to investors and others in understanding and evaluating our operating results in the same manner

as our management and board of directors. While we believe that this non-GAAP financial measure is useful in evaluating our business, this

information should be considered as supplemental in nature and is not meant as a substitute for the related financial information prepared in

accordance with U.S. GAAP.

The following table presents a reconciliation of net income (loss) to adjusted EBITDA for each of the periods indicated:

48

Year Ended December 31,

2014

2013

2012

2011

2010

(in thousands)

Reconciliation of Revenue to Bookings:

Revenue

$

690,410

$

873,266

$

1,281,267

$

1,140,100

$

597,459

Change in deferred revenue

3,890

(157,090

)

(133,640

)

15,409

241,437

Bookings

$

694,300

$

716,176

$

1,147,627

$

1,155,509

$

838,896

Year Ended December 31,

2014

2013

2012

2011

2010

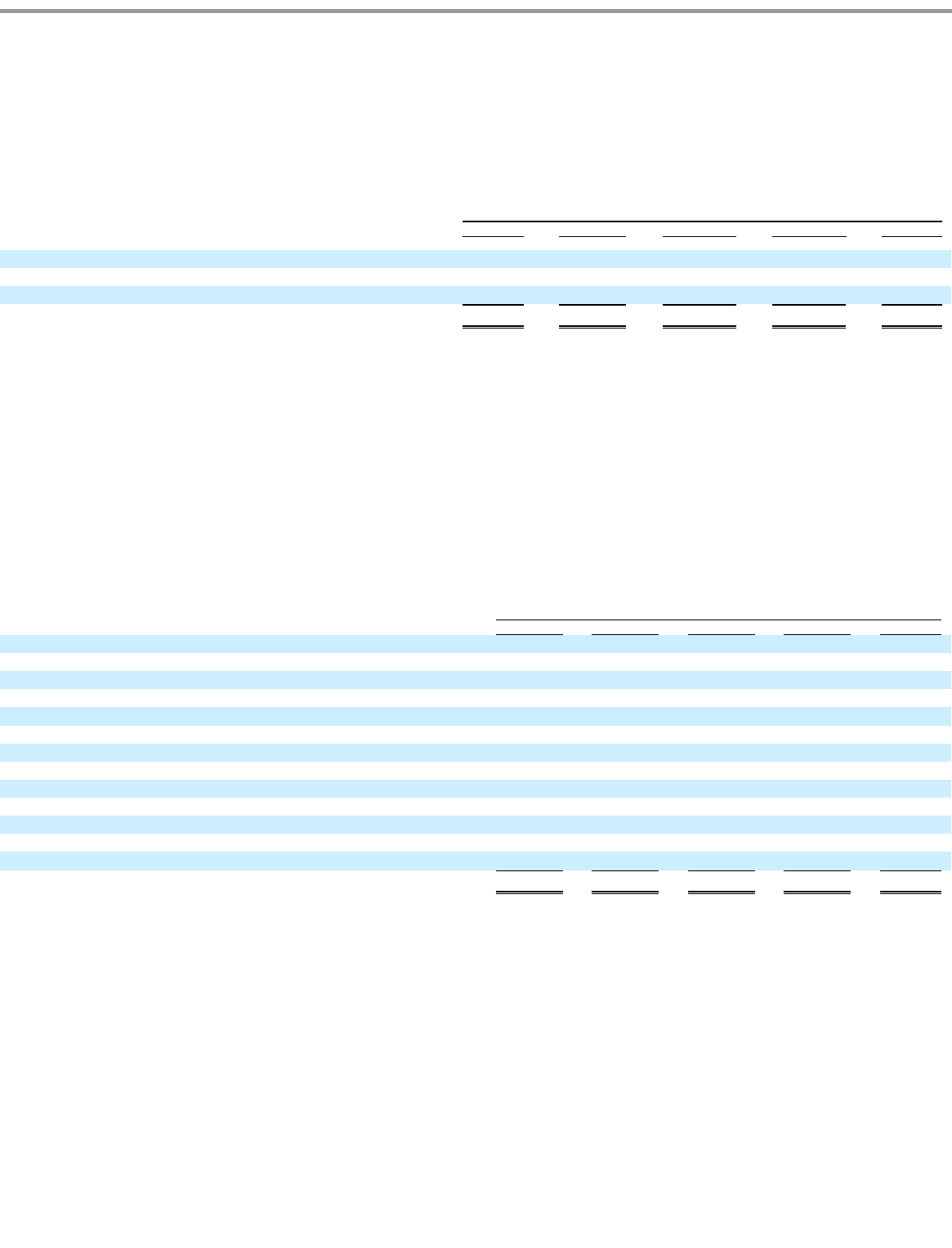

Reconciliation of Net Income (Loss) to Adjusted EBITDA:

Net income (loss)

$

(225,900

)

$

(36,982

)

$

(209,448

)

$

(404,316

)

$

90,595

Provision for (benefit from) income taxes

(7,327

)

(27,887

)

49,873

(1,826

)

36,464

Other income (expense), net

(8,248

)

3,386

(18,647

)

2,206

(365

)

Interest income (expense), net

(3,266

)

(4,148

)

(4,749

)

(1,680

)

(1,222

)

Gain (loss) from legal settlements

5,250

—

3,024

(2,145

)

(39,346

)

Depreciation and amortization

82,894

129,047

141,479

95,414

39,481

Stock

-

based expense

129,233

84,393

281,986

600,212

25,694

Impairment of intangible assets

—

10,217

95,493

—

—

Contingent consideration fair value adjustment

32,700

—

—

—

—

Acquisition

-

related transaction expenses

6,425

930

—

—

—

Restructuring expense, net

24,281

44,683

7,862

—

—

Change in deferred revenue

3,890

(157,090

)

(133,640

)

15,409

241,437

Adjusted EBITDA

$

39,932

$

46,549

$

213,233

$

303,274

$

392,738