Zynga 2014 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2014 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

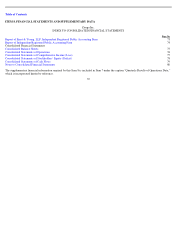

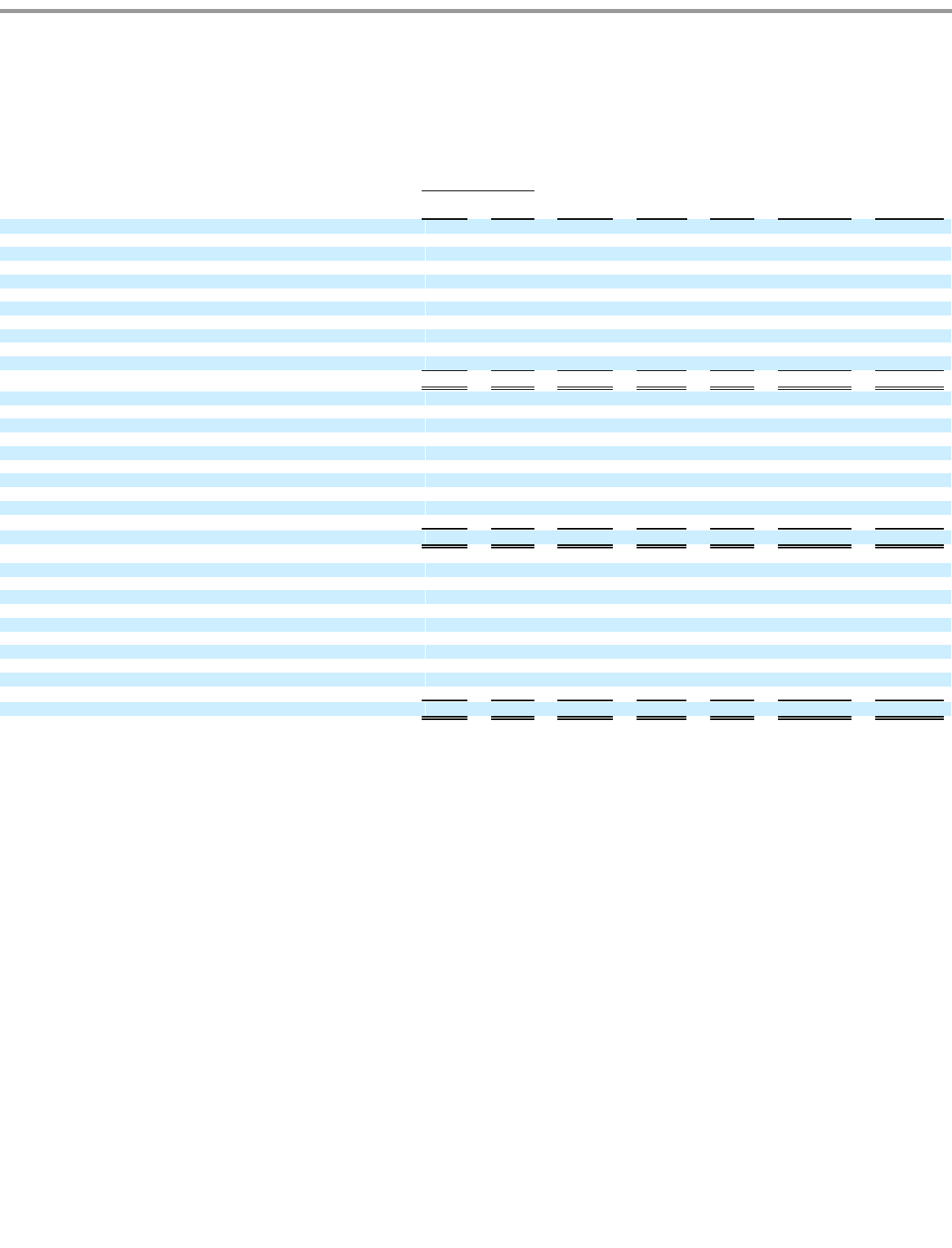

Table of Contents

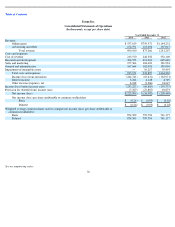

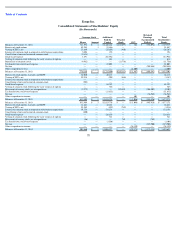

Zynga Inc.

Consolidated Statements of Stockholders’ Equity

(In thousands)

78

Common Stock

Additional

Paid-In

Capital

Treasury

Stock

OCI

Retained

Earnings

(Accumulated

Deficit)

Total

Stockholders

Equity

Shares

Amount

Balances at December 31, 2011

721,592

$

4

$

2,426,164

$

(282,897

)

$

362

$

(394,094

)

$

1,749,539

Exercise of stock options

42,285

1

21,446

—

—

—

21,447

Vesting of ZSUs, net

25,649

—

(

25,807

)

(460

)

—

—

(

26,267

)

Issuance of common stock in connection with business acquisitions

3,208

—

194

—

—

—

194

Cancellation of unvested restricted common stock

(9,814

)

—

—

—

—

—

—

Stock

-

based expense

1,291

—

281,986

—

—

—

281,986

Vesting of common stock following the early exercise of options

—

—

614

—

—

—

614

Repurchase of common stock

(4,962

)

—

—

(

11,756

)

—

—

(

11,756

)

Tax benefit from stock

-

based expense

—

—

21,003

—

—

—

21,003

Net loss

—

—

—

—

—

(

209,448

)

(209,448

)

Other comprehensive loss

—

—

—

—

(

1,809

)

—

(

1,809

)

Balances at December 31, 2012

779,249

$

5

$

2,725,600

$

(295,113

)

$

(1,447

)

$

(603,542

)

$

1,825,503

Exercise of stock options, warrants, and ESPP

34,020

—

26,115

—

—

—

26,115

Vesting of ZSUs, net

22,914

—

(

901

)

(486

)

—

—

(

1,387

)

Issuance of common stock in connection with business acquisitions

—

—

—

—

—

—

—

Cancellation of unvested restricted common stock

(502

)

—

—

—

—

—

—

Stock

-

based expense

—

—

84,393

—

—

—

84,393

Vesting of common stock following the early exercise of options

—

—

363

—

—

—

363

Retirement of treasury stock, net of repurchases

(3,372

)

—

—

295,599

—

(

304,902

)

(9,303

)

Tax benefit from stock

-

based expense

—

—

(

11,832

)

—

—

—

(

11,832

)

Net loss

—

—

—

—

—

(

36,982

)

(36,982

)

Other comprehensive income

—

—

—

—

401

—

401

Balances at December 31, 2013

832,309

$

5

$

2,823,738

$

—

$

(

1,046

)

$

(945,426

)

$

1,877,271

Balances at December 31, 2013

832,309

$

5

$

2,823,738

$

—

$

(

1,046

)

$

(945,426

)

$

1,877,271

Exercise of stock options, warrants, and ESPP

11,461

—

16,421

—

—

—

16,421

Vesting of ZSUs, net

22,582

—

(

429

)

(789

)

—

—

(

1,218

)

Issuance of common stock in connection with business acquisitions

39,754

—

131,158

—

—

—

131,158

Cancellation of unvested restricted common stock

(200

)

—

—

—

—

—

—

Stock

-

based expense

—

—

126,856

—

—

—

126,856

Vesting of common stock following the early exercise of options

—

—

341

—

—

—

341

Retirement of treasury stock, net of repurchases

(46

)

—

—

789

—

(

789

)

—

Tax benefit from stock

-

based expense

—

—

(

1,108

)

—

—

—

(

1,108

)

Net loss

—

—

—

—

—

(

225,900

)

(225,900

)

Other comprehensive income

—

—

—

—

(

28,129

)

—

(

28,129

)

Balances at December 31, 2014

905,860

$

5

$

3,096,977

$

—

$

(

29,175

)

$

(1,172,115

)

$

1,895,692