Zynga 2014 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2014 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Online game. We provide our players with the opportunity to purchase virtual goods that enhance their game-playing experience. We

believe players choose to pay for virtual goods for the same reasons they are willing to pay for other forms of entertainment—they enjoy the

additional playing time or added convenience, the ability to personalize their own game boards, the satisfaction of leveling up and the

opportunity for sharing creative expressions. We believe players are more likely to purchase virtual goods when they are connected to and

playing with their friends, whether those friends play for free or also purchase virtual goods. Players may also elect to pay a one-time download

fee to obtain certain mobile games free of third-party advertisements.

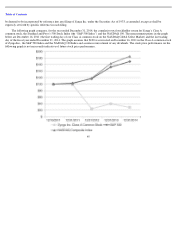

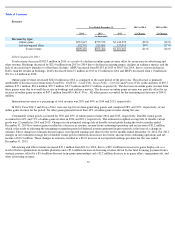

2014 was the first year in which our business generated a higher percentage of bookings through mobile platforms than through the

Facebook platform. For the twelve months ended December 31, 2014 and 2013 we estimate that we generated 51% and 27% of our bookings,

respectively, from mobile platforms while 43% and 69% of our bookings, respectively, were generated from the Facebook platform. Facebook is

still the largest single distribution, marketing, promotion and payment platform for our games and we generate a significant portion of our

revenue through the Facebook platform. For the twelve months ended December 31, 2014 and 2013, we estimate that 51% and 75% of our

revenue, respectively, was generated through the Facebook platform, while 44% and 24% of our revenue, respectively, was generated through

mobile platforms. We have had to estimate this information because certain payment methods we accept and certain advertising networks do not

allow us to determine the platform used.

For all payment transactions in our games under Facebook’s local currency-

based payments model, Facebook remits to us an amount equal

to 70% of the price we requested to be charged to our players.

On platforms other than Facebook, players purchase our virtual goods through various widely accepted payment methods offered in the

games, including PayPal, Apple iTunes accounts, Google Wallet, credit cards and direct wires.

Advertising and other. Advertising revenue primarily includes branded virtual goods and sponsorships, engagement ads and offers, mobile

ads and display ads and other. We generally report our advertising revenue net of amounts due to advertising agencies and brokers. Other

revenue includes software licensing and maintenance related to technology acquired in our acquisition of NaturalMotion as well as licensing of

our brands.

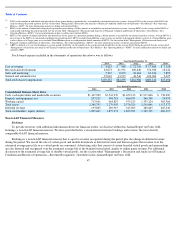

Key Metrics

We regularly review a number of metrics, including the following key financial and operating metrics, to evaluate our business, measure

our performance, identify trends in our business, prepare financial projections and make strategic decisions.

Key Financial Metrics

Bookings. Bookings (as defined in the section titled “—Non-GAAP Financial Measures” included in “Item 6. Selected Consolidated

Financial and Other Data” of this Annual Report on Form 10-K) is the fundamental top-

line metric we use to manage our business, as we believe

it is a useful indicator of the sales activity in a given period. Over the long term, the factors impacting our bookings and revenue are the same.

However, in the short term, there are factors that may cause revenue to exceed or be less than bookings in any period.

We use bookings to evaluate the results of our operations, generate future operating plans and assess the performance of our company.

While we believe that this non-GAAP financial measure is useful in evaluating our business, this information should be considered as

supplemental in nature and is not meant as a substitute for revenue recognized in accordance with U.S. GAAP. In addition, other companies,

including companies in our industry, may calculate bookings differently or not at all, which reduces its usefulness as a comparative measure.

51