Zynga 2014 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2014 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

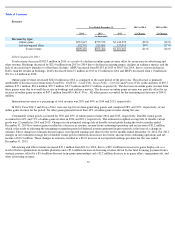

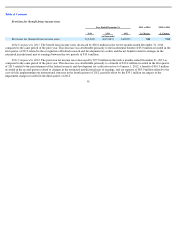

Table of Contents

data usage, an $11.7 million decrease in third party customer service expense which is in line with the discontinuance of certain games and a

$5.1 million decrease in headcount-related expense, offset by a $36.8 million increase in payment processing fees from mobile payment

processors due to an increase in mobile bookings and a $6.3 million increase in royalty expense for licensed intellectual property.

2013 Compared to 2012. Cost of revenue decreased $103.8 million in the twelve months ended December 31, 2013 as compared to the

same period of the prior year. The decrease was primarily attributable to a decrease of $47.0 million in third party hosting expense due to

increased usage of our own datacenters, a decrease of $24.6 million in third party customer service expense which is in line with the decline in

DAUs and the discontinuance of certain games, a decrease of $11.6 million in stock-based expense primarily due to forfeiture credits resulting

from employee attrition, a decrease of $9.3 million in depreciation and amortization expense and a decrease of $7.9 million in payment

processing fees.

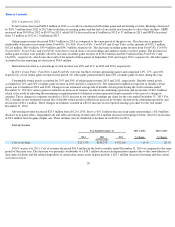

Research and development

2014 Compared to 2013. Research and development expenses decreased $16.4 million in the twelve months ended December 31, 2014 as

compared to the same period of the prior year. The decrease was primarily attributable to a $46.4 million decrease in headcount-related

expenses, $13.7 million decrease in restructuring expense and a $13.7 million decrease in allocated facilities and overhead costs, offset by $32.7

million of expense recorded in 2014 to reflect the change in estimated fair value of the contingent consideration liability for Spooky Cool Labs

and a $21.7 million increase in stock-based expense primarily due to higher forfeiture credits in the prior year and additional grants in 2014 as a

result of the NaturalMotion acquisition in February 2014.

2013 Compared to 2012.

Research and development expenses decreased $232.6 million in the twelve months ended December 31, 2013 as

compared to the same period of the prior year. The decrease was primarily attributable to a $138.7 million decrease in stock-based expense

primarily due to forfeiture credits resulting from employee attrition and an $87.0 million decrease in headcount-related expenses.

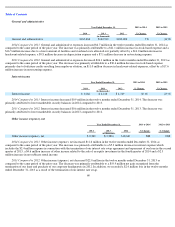

Sales and marketing

2014 Compared to 2013. Sales and marketing expenses increased $53.0 million in the twelve months ended December 31, 2014 as

compared to the same period of the prior year. The increase was primarily attributable to a $57.8 million increase in marketing expense due to

higher mobile player acquisition costs and consumer marketing costs from the launch of FarmVille 2: Country Escape and Hit it Rich! Slots ,

offset by a $3.1 million decrease in headcount-related expenses and a $2.2 million decrease in stock-based expense primarily due to forfeiture

credits resulting from employee attrition.

2013 Compared to 2012. Sales and marketing expenses decreased $77.5 million in the twelve months ended December 31, 2013 as

compared to the same period of the prior year. The decrease was primarily attributable to a $41.6 million decrease in player acquisition costs

which declined along with our overall spending during 2013 due to declines in bookings and DAUs, a $16.6 million decrease in stock-based

expense primarily due to forfeiture credits resulting from employee attrition, a $9.0 million decrease in headcount related expenses, and $4.3

million decrease in third party consulting service expense.

59

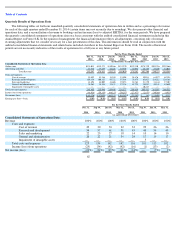

Year Ended December 31,

2013 to 2014

% Change

2012 to 2013

% Change

2014

2013

2012

(in thousands)

Research and development

$

396,553

$

413,001

$

645,648

(4

)%

(36

)%

Year Ended December 31,

2013 to 2014

% Change

2012 to 2013

% Change

2014

2013

2012

(in thousands)

Sales and marketing

$

157,364

$

104,403

$

181,924

51

%

(43

)%