Zynga 2014 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2014 Zynga annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

For non-marketable securities in which we exercise significant influence on the equity to which these non-marketable securities relate, we

apply the equity method of accounting. Our non-marketable securities are subject to periodic impairment reviews.

Restricted Cash

Restricted cash consists of collateral for facility operating lease agreements and funds held in escrow in accordance with the terms of

certain of our business acquisition agreements.

Accounts Receivable and Allowance for Doubtful Accounts

Accounts receivable are recorded and carried at the original invoiced amount less an allowance for any potential uncollectible amounts.

We review accounts receivable regularly and make estimates for the allowance for doubtful accounts when there is doubt as to our ability to

collect individual balances. In evaluating our ability to collect outstanding receivable balances, we consider many factors, including the age of

the balance, the customer’s payment history and current creditworthiness, and current economic trends. Bad debts are written off after all

collection efforts have ceased. We do not require collateral from our customers.

Property and Equipment

Property and equipment are stated at cost less accumulated depreciation. Depreciation is recorded using the straight-line method over the

estimated useful lives of the assets. Leasehold improvements are amortized over the shorter of the estimated useful lives of the improvements or

the lease term.

Business Combinations

We account for acquisitions of entities that include inputs and processes and have the ability to create outputs as business combinations.

We allocate the purchase price of the acquisition, which includes the estimated acquisition date fair value of contingent consideration to the

tangible assets, liabilities, and identifiable intangible assets acquired based on their estimated fair values. The excess of the purchase price over

those fair values is recorded as goodwill. Acquisition-

related expenses and restructuring costs are expensed as incurred. During the measurement

period, we record adjustments to the assets acquired and liabilities assumed with the corresponding offset to goodwill. After the measurement

period, which could be up to one year after the transaction date, subsequent adjustments are recorded to our consolidated statements of

operations. We record changes in the fair value of contingent consideration liabilities within operating expenses in our consolidated statement of

operations each reporting period.

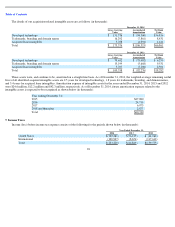

Goodwill and Indefinite-Lived Intangible Assets

Goodwill and indefinite-lived intangible assets are carried at cost and are evaluated annually for impairment, or more frequently if

circumstances exist that indicate that impairment may exist. When conducting our annual goodwill impairment assessment, we perform a

quantitative evaluation of whether goodwill is impaired using the two-step impairment test. The first step is comparing the fair value of our

reporting unit to its carrying value. We consider the enterprise to be the reporting unit for this analysis. If step one indicates that impairment

potentially exists, the second step is performed to measure the amount of impairment, if any. We record the amount by which the carrying value

of the goodwill exceeds its implied fair value, if any, as impairment.

We test recoverability of indefinite-lived intangible assets using a qualitative approach on whether it is more likely than not that the fair

value of the intangible asset exceeds its carrying value. If the asset is considered to be impaired, the amount of any impairment is measured as

the difference between the carrying value and the fair value of the impaired asset.

84